- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I interpret and enter my Georgia Form 700 Schedule K-1 (nonresident state tax return)

Hello Turbotax Community,

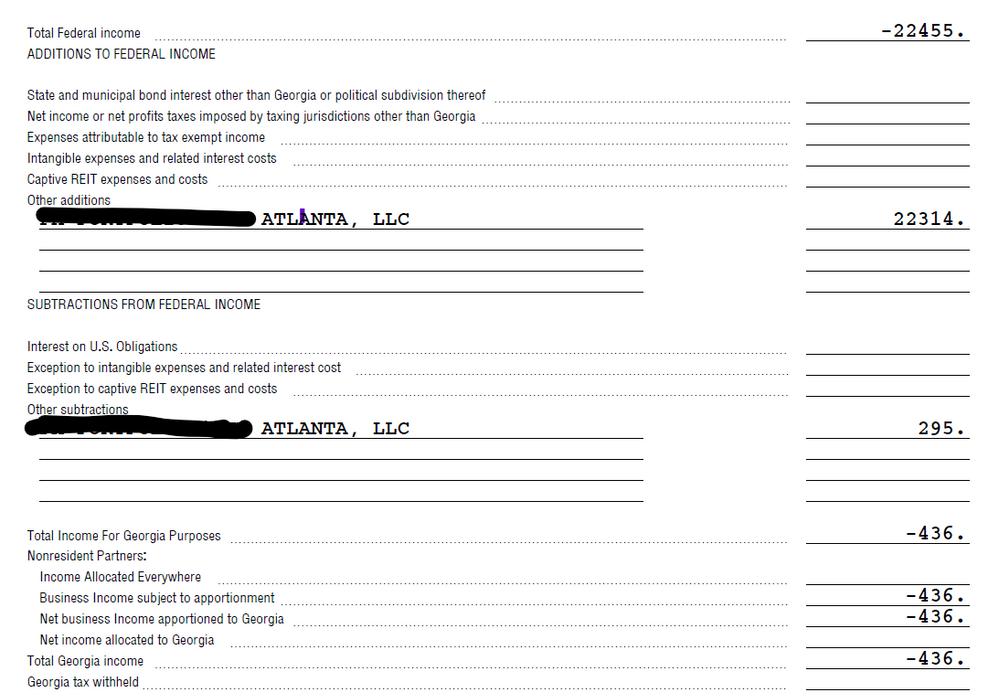

I am a resident of NJ. I invested in a real estate syndication fund back in Dec 2021 which has apartments in GA. I did not receive any distributions/income during 2021. I got my 1065 K1 over the weekend with a GA 700 form attached to it. As expected, it was a net loss due to the depreciation (-$22,455). See the GA 700 screenshot below. I was able to properly file the Federal K1. But I don't know if I am doing it correctly for the GA nonresident state tax return.

Questions:

1. What does the $22,314 additions, $295 subtraction, and -$436 Total George Income mean? How do I enter these on the Georgia state tax return?

2. Where can I track the unallowed passive loss at the state level? I can only see it on the federal level through form 8582. Is there a similar form in Georgia?

Appreciate any insights you can share.