- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

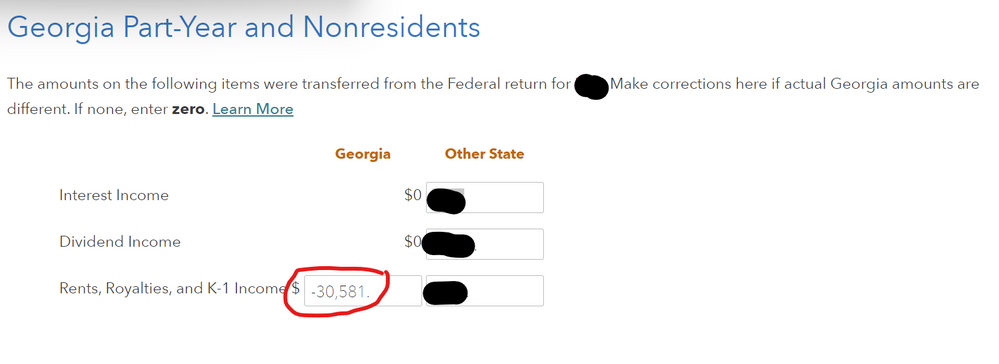

That is correct, my state return did not pull in the correct info from my K1 entered on my federal return. What I had to do was manually enter the loss myself as below circled in red:

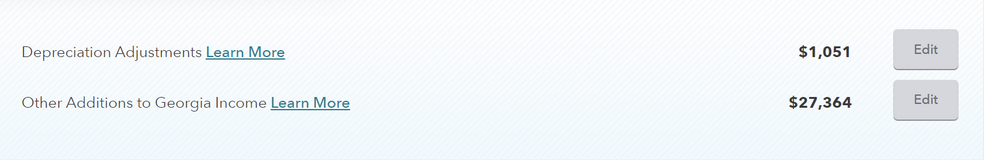

On my form 700, the additions to GA income is bonus depreciation (i.e. $27364). It is not called bonus depreciation I just figured that is what it was. The Depreciation adjustment is what GA will allows you to take (i.e. $1051). I entered those amounts in the screen titled: "Here's the income that GA handles differently"

I after I did all of this everything matched my form 700.

Hope this helps!

March 31, 2022

6:46 AM