- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Thanks, @DavidD66! I really appreciate your explanation. I do have follow-up questions.

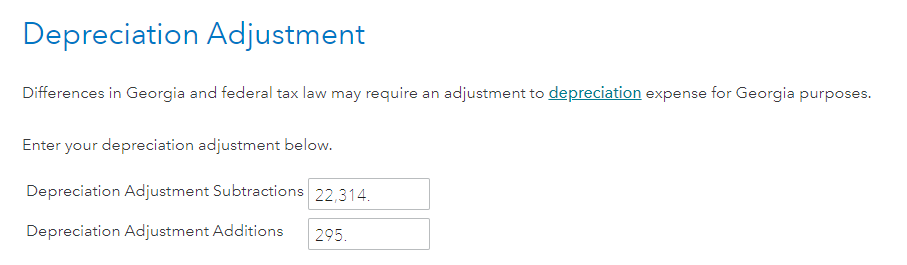

1. Am I adjusting the depreciation from the GA-700 correctly on Turbotax? The way I am understanding it, I need to make depreciation adjustments on my GA state return so Turbotax won't use the entire federal loss (due to bonus depreciation $22,455).

- I entered $22,314 under Depreciation Adjustment Subtractions (to deduct from the federal bonus depreciation of $22,455)

- Then, I entered $295 under Depreciation Adjustment Additions (for the GA state depreciation).

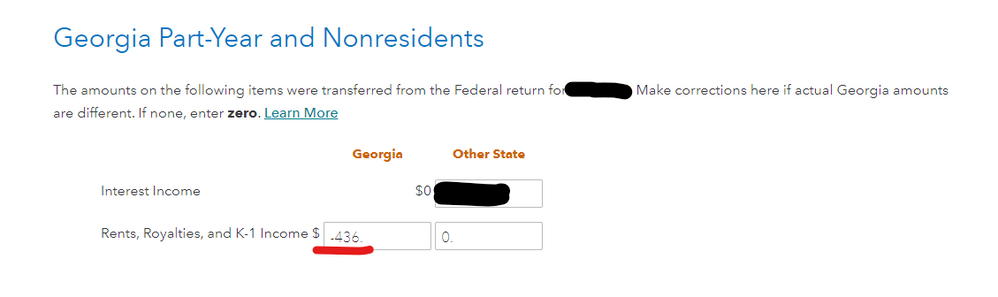

2. Where do I enter the -$436 of Total Income/Loss for Georgia Purposes? I assume I need to enter it under the Rents, Royalties and K-1 Income. I just need to track this passive loss manually moving forward.

Is Step1 above (depreciation adjustment) necessary? Or can I just enter the -$436 of Total Income/Loss for Georgia Purposes?

Appreciate your guidance.

Thanks.

March 15, 2022

4:44 AM