- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Hello @alta-tax1,

I think your explanation on not using GA NOL carryover this year might make sense.

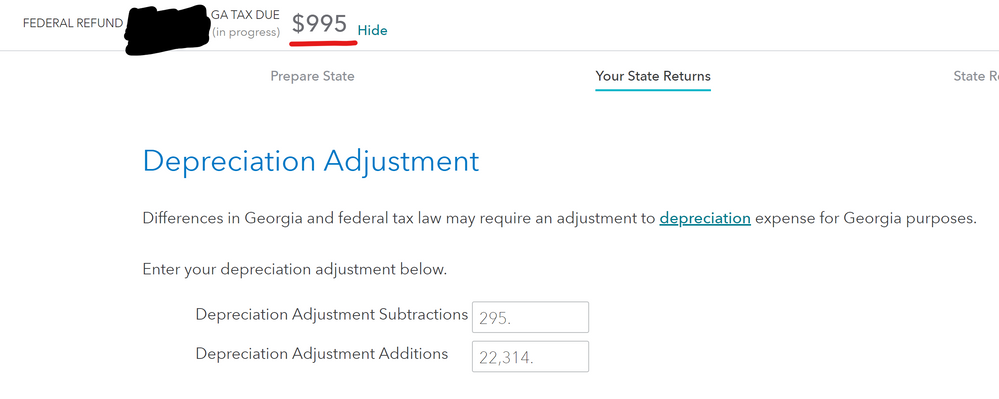

Where did you enter your loss from K1, and how did you remove the bonus depreciation and add back the state depreciation? Tried back the depreciation adjustments of $22,314 and subtracting $295 but it increased my amount due to GA.

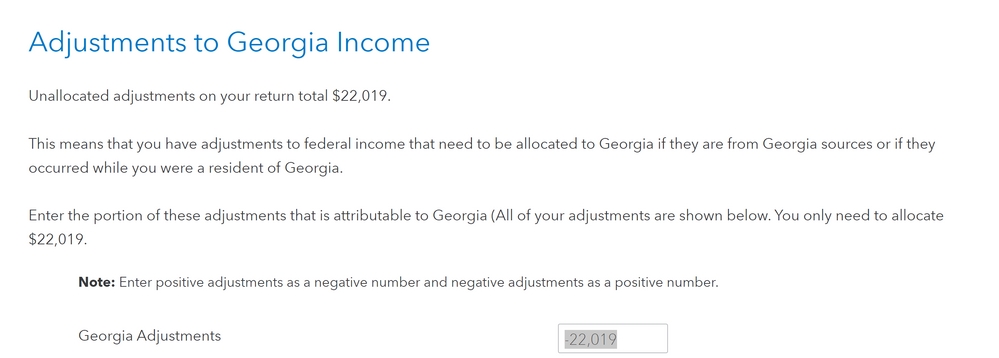

Also, TT is telling me that I have $22,019 unallocated adjustments. It seems the state return is not pulling the info from my federal K1 loss of $22,455.

March 30, 2022

2:35 PM