- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- How am I to know if I’m one of those with an issue with the stimulus?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I to know if I’m one of those with an issue with the stimulus?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I to know if I’m one of those with an issue with the stimulus?

You can confirm the status of your stimulus payment at Get My Payment.

-

If it shows a direct deposit date and partial account information, then your payment is deposited there.

-

If it shows a date your payment was mailed, it may take up to 3 – 4 weeks for you to receive the payment. Watch your mail carefully for a check or debit card.

-

If it shows "Payment Status #2 – Not Available," then you will not receive a second Economic Impact Payment and instead you need to claim the Recovery Rebate Credit on your 2020 Tax Return.

If you paid for TurboTax with your refund last year, we have given the IRS your correct account information and you can expect the IRS to make a second attempt within the next few days.

You can find the most up to date information at IRS Updates on the Second Stimulus and TurboTax Updates on the Second Stimulus.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I to know if I’m one of those with an issue with the stimulus?

Can someone do my taxes and I'll pay him I need a somebody to call me back

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I to know if I’m one of those with an issue with the stimulus?

Yes, we would be glad to do your taxes for you. You will need to input your forms and upload documents and then we can take over. Please see this link on a Line by Line Review for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I to know if I’m one of those with an issue with the stimulus?

Why would I have to wait and receive a credit on my refund instead of getting a stimulus check now when I desperately need it? I qualify for it and got check #1 without any problem. This seems to just be a Turbo Tax customer issue right now. I will be rethinking how I file taxes going forward.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I to know if I’m one of those with an issue with the stimulus?

The IRS recently began issuing a second round of stimulus payments to those eligible. Unfortunately, because of an IRS error, millions of payments were sent to the wrong accounts and some may not have received their stimulus payment. If your second stimulus payment was delivered to a card that you no longer have, you may be able to get a replacement card. See this TurboTax Help.

If you were entitled to a stimulus payment but did not receive one, and you didn’t pay for TurboTax with your refund last year, you may need to claim the Recovery Rebate Credit on your 2020 tax return to get your money.

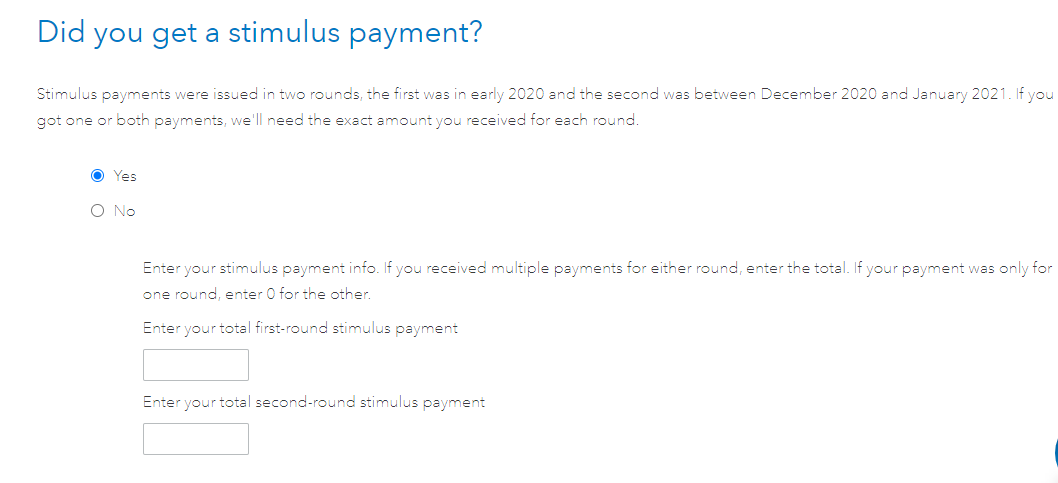

In TurboTax Online, you are prompted to input stimulus check 1 and stimulus check 2 information under Review down the left hand side of the screen.

You can access your stimulus check choices by following these steps:

- Down the left side of the screen, click on Federal.

- Across the top of the screen, click on Other Tax Situations.

- At the screen Let’s keep going to wrap up. Click on Let’s keep going.

- At the screen Let’s make sure you got the right stimulus amount, click Continue.

- At the screen Did you get a stimulus payment? you can update your stimulus check entries.

TurboTax will compare your two payment amounts to the computation within TurboTax. The computations within TurboTax are based upon the information that has been entered into the tax software. If you are due an additional amount, it will be issued as a Rebate Recovery Credit (RRC) on line 30 of the 2020 1040 tax return.

See also this TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I to know if I’m one of those with an issue with the stimulus?

How long before I get my money

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I to know if I’m one of those with an issue with the stimulus?

To check the status of your stimulus payment go the IRS Get My Payment website. When you put your information in, it will tell you if a payment has been processed for you and the date when you can expect to receive it.

If there is no payment processed for you, then you claim the payment on your 2020 income tax return.

If you qualify, you can use the TurboTax Free File site to file with no charge for federal or state returns.

When you file your return complete these steps to claim your stimulus payment:

This year your stimulus is added to your tax refund amount. But if you already received the stimulus, then you have to tell TurboTax and it will be removed from the refund amount.

At the top of your tax return select Federal Review

That will take you to this screen where it asks if you have already received your stimulus payments. If you received the first or second payment already, then select Yes and fill in the information.

When that page is correct, you refund will be adjusted correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I to know if I’m one of those with an issue with the stimulus?

When I went to the get my payment app. It said unavailable for my second stimulus. So I filed on my taxes that I never got it. When I finally was able to get on my bank app my second stimulus had been in there since January 8th. I don't know what to do because I had a child in 2020 and didn't get nothing on any of the three stimulus for her. I had finally my taxes before the third stimulus was passed. Can someone please reach out and email or call me to help.

[email address removed]

[phone number removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I to know if I’m one of those with an issue with the stimulus?

The IRS has said it will fix tax returns with the wrong stimulus amounts. If a correction is needed, there may be a slight delay in processing your return and the IRS will send you a notice explaining any change made.

The IRS will probably deduct your second stimulus payment from your refund amount because it's in your bank account.

The amount for your newborn should be part of your Recovery Rebate Credit. The payment would be $500 plus $600. The third payment is not part of the tax return. Since you had your baby in 2020, that payment made be delayed. You may get a third payment without the $1,400 for the baby. It depends on how quickly the IRS processes your information.

The IRS has not said how it will deal with catch-up payments. However by filing now, your baby will be registered for the $3,600 credit for child under age 6 coming this summer.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I to know if I’m one of those with an issue with the stimulus?

[image removed due to SSN]

This is what it has been saying since the week after February 13 I have no info I can't get ahold of no one at the irs and I have no idea what is going on with my tax refund can someone please help me or shed some light on this because I do not know what to do and it's going on two months now I'm feeling like I won't get one even though it said it was accepted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I to know if I’m one of those with an issue with the stimulus?

The only thing that can be done is to check once a day to see if the IRS has any update.

Topic 152 means your return is under the typical review before any refund will be direct deposited.

See: Topic No. 152 Refund Information.

My return is accepted but still not approved. Is there a problem? Should I be worried?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I to know if I’m one of those with an issue with the stimulus?

So I filed with TurboTax and was getting 2136.00 and later got a letter saying my refund was deducted to 336. Then they sent my money on my Venmo and TurboTax took 190 from my 336 and I used the free sight! This year is the last time me or my husband files with TurboTax. Guess We’ll be filing with H&R Block next year!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I to know if I’m one of those with an issue with the stimulus?

How do I add my 1099-G to my IRS electronic file taxes. and do I qualify for stimulus?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I to know if I’m one of those with an issue with the stimulus?

It depends. First, we need to know what the Form 1099-G was received for. There are various income items that are reported on this form. The following article will provide greater detail for so that you can clarify exactly what you need to know. We have many experts here anxious to help you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

margueritearden

New Member

K-REALTOR

New Member

johnplowe1974

New Member

thedustinmartin

New Member

ericbeauchesne

New Member

in Education