- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Where’s My Tax Refund? How to Check Your Refund Status

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s My Tax Refund? How to Check Your Refund Status

With refund season well underway and the average direct deposit tax refund being over $3,000 last tax season, we are hearing the common tax season question: “Where’s My Refund?”

We know that you work hard for your money and often a tax refund may be the biggest check you get all year, so we’re here to let you know what happens after you hit the e-file button and how to check the status of your tax refund.

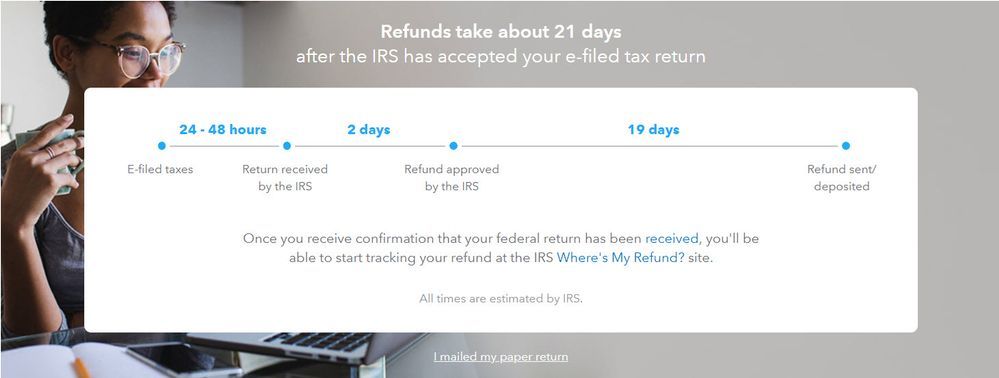

Here is a breakdown of IRS processing times, how your tax return will progress through 3 stages with the IRS (“Return Received,” “Return Approved,” and “Refund Sent” once you e-file), and where you can go to check your refund status.

Refund Processing Time

- E-filed tax returns with direct deposit – E-file with direct deposit is the fastest way to get your federal tax refund. The IRS states that nine out of 10 e-filed tax returns with direct deposit will be processed within 21 days of IRS e-file acceptance.

- Mailed paper returns – Refund processing time is 6 to 8 weeks from the date the IRS receives your tax return.

Refund Process

- Start checking status 24 – 48 hours after e-file – Once you have e-filed your tax return, you can check status using IRS Where’s My Refund? You will not be able to start checking the status of your tax refund for 4 weeks if you mail a paper tax return.

- Return Received Notice within 24 – 48 hours after e-file – The IRS Where’s My Refund tool will show “Return Received” status once they begin processing your tax return. You will not see a refund date until the IRS finishes processing your tax return and approves your tax refund.

- Status change from “Return Received” to “Refund Approved” – Once the IRS finishes processing your tax return and confirms your tax refund is approved, your status will change from “Return Received” to “Refund Approved.” Sometimes the change in status can take a few days, but it could take longer and a date will not be provided in Where’s My Refund? until your tax return is processed and your tax refund is approved.

- Where’s My Refund? tool shows refund date – The IRS will provide a personalized refund date once your status moves to “Refund Approved”. The IRS issues nine out of 10 refunds within 21 days of acceptance if you e-file with direct deposit.

- Where’s My Refund? shows “Refund Sent” – If the status in Where’s My Refund? shows “Refund Sent”, the IRS has sent your tax refund to your financial institution for direct deposit. It can take 1 to 5 days for your financial institution to deposit funds into your account. If you requested that your tax refund be mailed, it could take several weeks for your check to arrive.

Here are more answers to your common tax refund questions:

Will I see a date right away when I check status in “Where’s My Refund”?

Where’s My Refund tool will not give you a date until your tax return is received, processed, and your tax refund is approved by the IRS.

It’s been longer than 21 days since the IRS has received my tax return and I have not received my tax refund. What’s happening?

Some tax returns take longer than others to process depending on your tax situation. Some of the reasons it may take longer are incomplete information, an error, or the IRS needs to review it further.

The Protecting Americans from Tax Hikes (PATH) Act, signed into law in December 2015, requires the IRS to hold tax refunds that include Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC) until February 15, 2017 regardless of what method you used to file your taxes. The IRS began accepting and processing tax returns when they opened for the season on January 29, 2018. Tax refunds for those who claim Earned Income Tax Credit or Additional Child Tax Credit will begin to be issued on February 15, 2018, so there’s no need to wait! The sooner you e-file your return, the sooner you’ll get your tax refund. The IRS expects the earliest that taxpayers claiming the EITC or ACTC will start seeing tax refunds is February 27 if taxpayers chose e-file with direct deposit and there are no other issues with their tax return.

I requested my money be automatically deposited into my bank account, but I was mailed a check. What happened?

The IRS is limiting the number of direct deposits that go into a single bank account or prepaid debit card to three tax refunds per year. Your limit may have been exceeded.

Haven’t filed your taxes yet? Get that much closer to your tax refund and file today. You may even be able to e-file your federal and state tax returns for absolutely nothing and have your federal tax refund in your pocket within 21 days.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s My Tax Refund? How to Check Your Refund Status

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s My Tax Refund? How to Check Your Refund Status

The IRS says no 2019 and 2016 tax file. Where's my refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s My Tax Refund? How to Check Your Refund Status

Tax return- 2151.00

owe- 1955.30

bal. 206.87

I have a posted amt. of in my bank as: 4/17 SBTPG LLC TAX PRODUCTS PE1 $102.93

I spoke with IRS and they said the deposit was made in the amt. of 206.87.

I went to bank and it never went through. They told me that you probably took amt. out of balance. So where is my total amt. at.

Margaret Leal

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s My Tax Refund? How to Check Your Refund Status

You said you have a deposit from SBTPG for $102.93. The difference would be the Turbo Tax fees. What version did you use? There is a separate $44.99 charge for state and an Extra 39.99 Refund Processing Service charge.

I bet you used Deluxe. Deluxe is 59.99 plus the 39.99 Pay with Refund charge. So 99.98 plus any Sales tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s My Tax Refund? How to Check Your Refund Status

I filed my taxes on April 9th and when I check it on where's my refund it says "still processing". I think I'm being audited, so if I am, how long does that take?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s My Tax Refund? How to Check Your Refund Status

@tebenn wrote:I filed my taxes on April 9th and when I check it on where's my refund it says "still processing". I think I'm being audited, so if I am, how long does that take?

Only the IRS can tell you why they have not yet released your Federal refund. I'll tell you how to reach a live IRS agent below. If you can't get good answers from the IRS, I'll also be telling you below how to contact the IRS Taxpayer Advocate Service.

Here's how to reach a live agent at the IRS:

800-829-1040 (7AM-7 PM local time) Monday-Friday

When calling the IRS do not choose the first choice re: "Refund", or it will send you to an automated phone line.

- First choose your language. Then listen to each menu before making the selection.

- Then press 2 for "personal income tax".

- Then press 1 for "form, tax history, or payment".

- Then press 3 "for all other questions."

- Then press 2 "for all other questions."

- It might transfer you to an agent at that point. If it doesn't it may ask for your SSN, but do not enter it. Just wait. If it asks for SSN a second time, still do not enter it.

- Then you'll get another menu. Choose 2 for "personal" then you should be transferred.

I usually use a speakerphone so I can work on something else while waiting.

If you don't get good info/results from the IRS, you can contact the IRS Taxpayer Advocate for your area. They are especially prone to help if you have a hardship, or if there have been continued delays with lack of info from the IRS. At the following IRS website, find the USA map and click on your state, and it will give you the number of your IRS Taxpayer Advocate.

http://www.irs.gov/uac/Contact-a-Local-Taxpayer-Advocate

Also see this article for more info on how the IRS Taxpayer Advocate Service works::

http://www.irs.gov/taxtopics/tc104.html

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s My Tax Refund? How to Check Your Refund Status

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s My Tax Refund? How to Check Your Refund Status

dgordon76 wrote:

I filed my tax refund for 2018 in Jan. 2019, was accepted in the same month. I have Amended my return on June 5, 2019, and I still have not recieved my refund yet. What's the hold up?

It can take the IRS up to 16 weeks to process an amended return. An amended return cannot be efiled. I will presume you mailed your amended return to the IRS. TurboTax does not mail it for you.

It should show up in this IRS tool. Do you see info on your amended return there?

https://www.irs.gov/filing/wheres-my-amended-return

Were you due a Federal refund with the original return you filed in January? If so, did you ever receive it prior to amending the return, or did you amend the return before you got the original refund?

Only the IRS will know what all they are doing with your return. In my comment above, you will see the steps to phone them, if necessary, but it's too soon to phone about an amended return. They might be able to tell you something about the original return if you never received an original refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s My Tax Refund? How to Check Your Refund Status

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s My Tax Refund? How to Check Your Refund Status

@Anabella wrote:

I file my taxes on June 29th and get accept and approve on July 2nd. But receive my refund jet.

I assume you efiled your return. "Accepted" refers to the efile status only. If your efile return was accepted on July 2, that is the date that the IRS started processing it. Approval of the entries in your return can only occur after the IRS has finished processing it. So acceptance and approval cannot happen on the same day.

The IRS says 9 out of 10 filers who efile and choose direct deposit will get their refunds within 21 days. That still leaves a considerable number of people who do not. Some returns take longer for additional processing due to specific items in the return. Some are pulled at random for more thorough investigation.

You can use this tool to double-check and be sure the efiled return was accepted on July 2:

https://shop.turbotax.intuit.com/efile/efile_status_lookup.jsp

If that confirmed it was accepted, then what do you see at the IRS website below for the status of your Federal refund?

https://www.irs.gov/Refunds

NOTE: Be sure you enter only the Federal refund amount and not any total amount that includes a state refund. The figure to enter appears on your Federal Form 1040, Line 20a.

If that IRS tool shows that the refund has been sent, report back for more info.

If the IRS tool says it is still "being processed", we can tell you how to speak to a live agent at the IRS to see if they can tell you anything about the delay.

To track a state refund:

https://ttlc.intuit.com/questions/1899433-how-do-i-track-my-state-refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s My Tax Refund? How to Check Your Refund Status

What address will

you send the refund? Or is the refund ready?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s My Tax Refund? How to Check Your Refund Status

If you selected to have a check mailed for your refund or the bank rejected the Direct Deposit then the IRS will mail a check to the address on your return.

Has the IRS sent your refund?

You can check your Federal refund status at Where's My Refund.

https://www.irs.gov/refunds

Make sure you are using the refund amount from your actual federal tax return and not the combined amount Turbo Tax showed you at the end. That was for federal and state combined.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s My Tax Refund? How to Check Your Refund Status

I got a letter telling me i owe the irs instead of a refund when i contacted them they told me my taxes was filled twice for the same job so turbo tax messed up on my taxes now i am haveing a hard time getting them straightened out now i fell behind on my bills that i had planed on paying off thanks alot

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where’s My Tax Refund? How to Check Your Refund Status

@ hardship5000 wrote:

I got a letter telling me i owe the irs instead of a refund when i contacted them they told me my taxes was filled twice for the same job so turbo tax messed up on my taxes now i am haveing a hard time getting them straightened out now i fell behind on my bills that i had planed on paying off thanks alot

You're posting in an old thread with multiple users and multiple issues. If you need assistance in this community forum, you should start your own new thread. To do so, go to the page at the link below, click the blue "Ask a question" button.

https://ttlc.intuit.com/community/after-you-file/discussion/02/203

Also, since you received an IRS Letter, you can speak by telephone to the free TurboTax Audit Support Center (assuming you did not purchase the optional Audit Defense). They may be able to offer you some guidance on this issue. To get the phone number, go to the page at the link below, click the blue "Get Help..." button and follow the prompts.

https://support.turbotax.intuit.com/irs-notice/audit-support/

Hours are 5AM-5PM Pacific (8AM-8PM Eastern) Monday-Friday.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

melaniefett

New Member

lorenzovilla34

New Member

ninny401

New Member

mixmail

New Member

Pegcabral

Level 1