- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- IRS Denied Economic Impact Payment on 2020 Return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Denied Economic Impact Payment on 2020 Return

My Daughter, and son-in-law, had a combined AGI of approximately $175k for 2020. They filed a joint return with one young child as dependent. TurboTax calculated the EIP adjustment for the excess over &175k, which I have since manually confirmed was correct. After electronically filing it took 3 1/2 months to receive a refund but they excluded the entire EIP. When checking online it shows a long list of possible reasons but none seemed to apply. Has anyone else experienced this. BTW, their 2019 income exceeded $200k so they didn't receive any direct Economic Impact payments. It is my understanding that they should re-qualify if their 2020 income was within the threshold, which it was. Any thoughts. Call the IRS? That sounds like a long day on hold!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Denied Economic Impact Payment on 2020 Return

You see that their income exceeded the threshold for the full stimulus amounts, but they should have qualified for a reduced amount of the stimulus payment. Have they received a detailed letter from the IRS that explains the reduced refund? When the IRS reduces a refund, it takes several weeks for the letter of explanation to arrive.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Denied Economic Impact Payment on 2020 Return

@JohnASmith Going through your worksheet the calculations are correct as entered.

Based on the AGI shown the amount for EIP1 would be $1,602 and the amount for EIP2 would be $502 for a total of $2,104.

In the TurboTax program you must have indicated that you did not receive either EIP1 or EIP2 since on the worksheet Line 16 is 0 for EIP1 and Line 19 is 0 for EIP2.

If the IRS allowed $502 for the Recovery Rebate Credit then they believe EIP1 was sent to you which would eliminate the $1,602. But allowed $502 for EIP2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Denied Economic Impact Payment on 2020 Return

First of all you are confused about EIC. EIC is earned income credit ----and with an income of more than $175K they definitely do not qualify to receive earned income credit. So you might be referring to the child tax credit, which is a different credit. Or are you referring to the stimulus payments?

So ....some information about Earned Income Credit and the Child Tax Credit---so that you know what they are, who qualifies, and where to look for it on a Form 1040:

https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/use-the-eitc-assistant

https://ttlc.intuit.com/questions/1900923-what-is-the-child-tax-credit

Look at your 2020 Form 1040 to see the child-related credits you received

PREVIEW 1040

https://ttlc.intuit.com/questions/1901539-how-do-i-preview-my-turbotax-online-return-before-filing

Child Tax Credit line 19

Credit for Other Dependents line 19

Earned Income Credit line 27

Additional Child Tax Credit line 28

Child and Dependent Care Credit line 31 (from line 13 of Schedule 3)

Were you really trying to ask about EIP payments---Economic Impact Payments--- also called stimulus payments? The criteria for receiving the 1st and 2nd EIP payments are below:

A1. Generally, if you are a U.S. citizen or U.S. resident alien, you will receive an Economic Impact Payment of $1,200 ($2,400 for a joint return) if you (and your spouse if filing a joint return) are not a dependent of another taxpayer and have a Social Security number valid for employment and your adjusted gross income (AGI) does not exceed:

- $150,000 if married and filing a joint return

- $112,500 if filing as head of household or

- $75,000 for eligible individuals using any other filing status

Your payment will be reduced by 5% of the amount by which your AGI exceeds the applicable threshold above.

You are not eligible for a payment if any of the following apply to you:

- You may be claimed as a dependent on another taxpayer’s return (for example, a child or student who may be claimed on a parent’s return or a dependent parent who may be claimed on an adult child’s return).

- You do not have a Social Security number that is valid for employment.

- You are a nonresident alien.

The following are also not eligible: a deceased individual or an estate or trust.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Denied Economic Impact Payment on 2020 Return

Thanks for the reply. I wasn't confused, I just got the acronym wrong, but now fixed. I have read, and reread, the qualifications for the payment. Nothing I have seen disqualifies them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Denied Economic Impact Payment on 2020 Return

You see that their income exceeded the threshold for the full stimulus amounts, but they should have qualified for a reduced amount of the stimulus payment. Have they received a detailed letter from the IRS that explains the reduced refund? When the IRS reduces a refund, it takes several weeks for the letter of explanation to arrive.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Denied Economic Impact Payment on 2020 Return

Thank you. The only information I have gotten was on the "Where's My Refund" IRS site. The refund was direct deposited just a few days ago. I will advise my kids to wait for the detailed letter you mentioned could take a few weeks. Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Denied Economic Impact Payment on 2020 Return

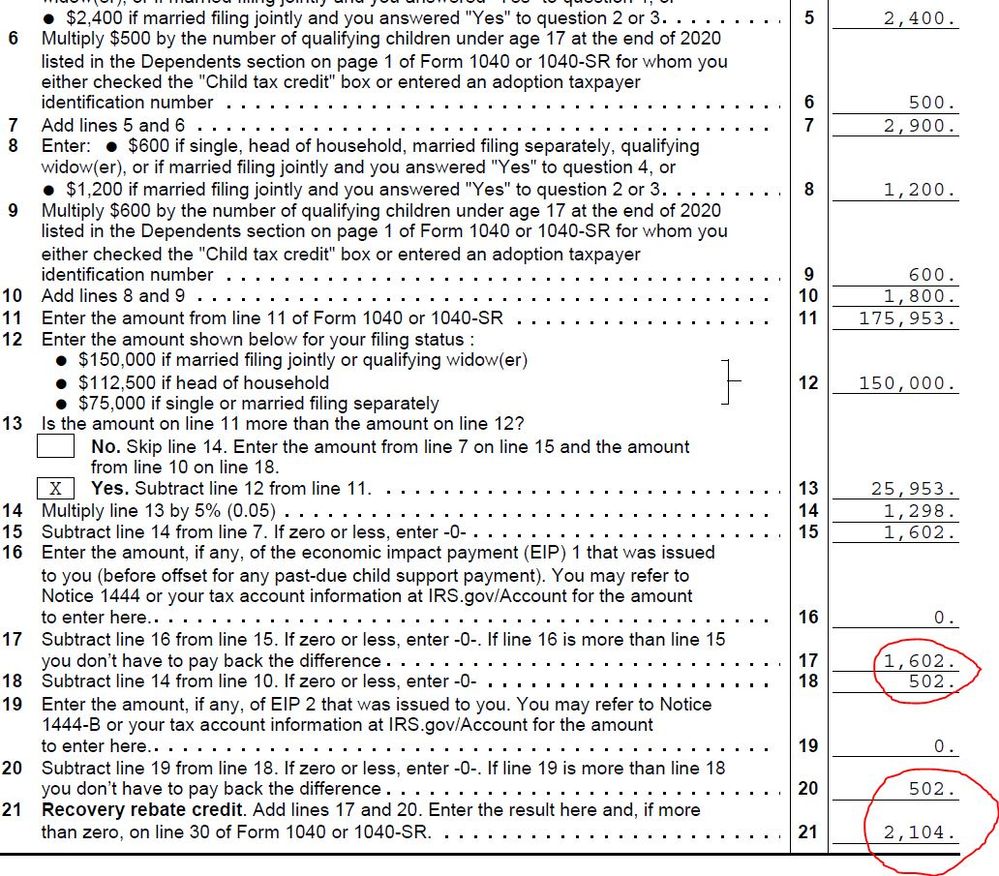

They just received their paper notice from the IRS . The puzzle deepens! Seems the IRS actually allowed $502 for the EIP. According to T-Tax the total should be $2,104, but I have no idea how they came up with that. Every way I checked the math manually the total should be $1,602. Is it a coincidence that the difference between what I think the payment should have been, and what T-Tax calculated, is exactly $502? Is it possible there is an error in the program resulting in an inaccurate upload? I attached a photo of the T-Tax "Recovery Rebate Credit Worksheet" with no personal identifiable info, just numbers. Help me make sense of this please. 🤔

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Denied Economic Impact Payment on 2020 Return

@JohnASmith Going through your worksheet the calculations are correct as entered.

Based on the AGI shown the amount for EIP1 would be $1,602 and the amount for EIP2 would be $502 for a total of $2,104.

In the TurboTax program you must have indicated that you did not receive either EIP1 or EIP2 since on the worksheet Line 16 is 0 for EIP1 and Line 19 is 0 for EIP2.

If the IRS allowed $502 for the Recovery Rebate Credit then they believe EIP1 was sent to you which would eliminate the $1,602. But allowed $502 for EIP2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Denied Economic Impact Payment on 2020 Return

Thank you for that clarification. They did not receive EIP1 or EIP2. Since they didn't qualify for EIP1 based on 2019 AGI, but requalified based on 2020 AGI, why would IRS have made such a payment before 2020 was filed? Very confusing! Anyway, at lease we now know exactly what the issue is and again I thank you for that.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kathryn1659

New Member

bertkesj

New Member

rltkbirnbaum

New Member

TroutVision

Level 1

Matt034

Level 1