- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

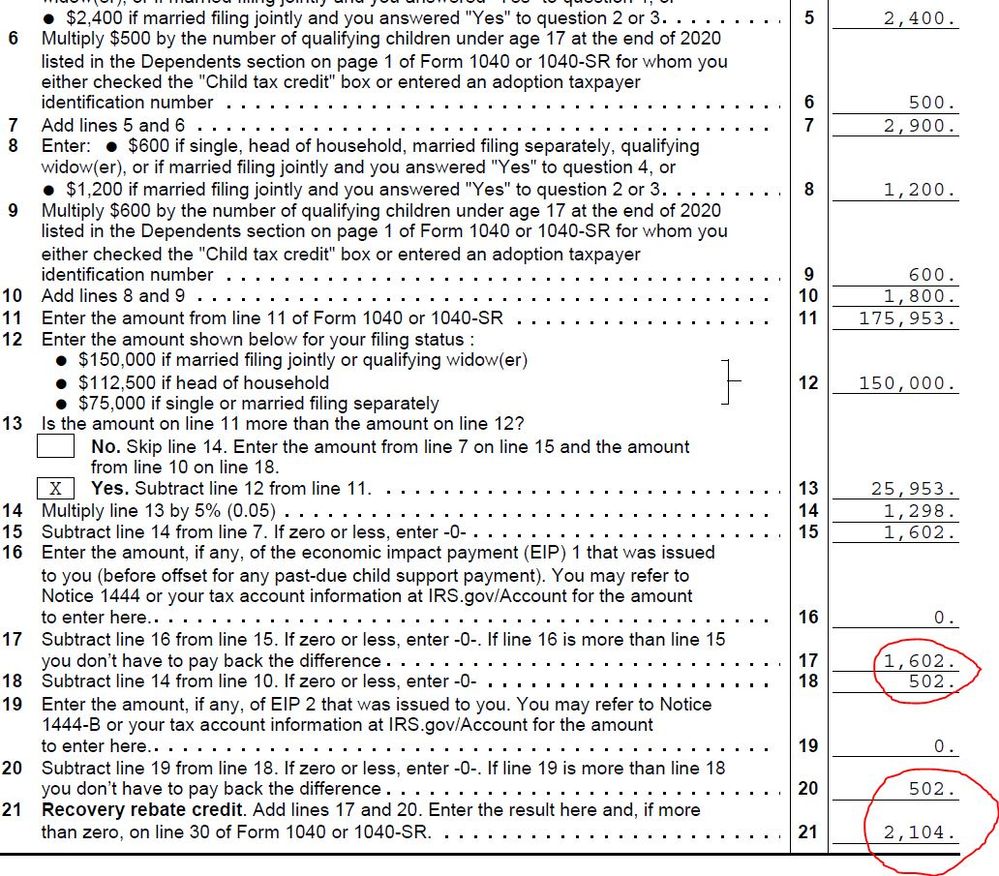

They just received their paper notice from the IRS . The puzzle deepens! Seems the IRS actually allowed $502 for the EIP. According to T-Tax the total should be $2,104, but I have no idea how they came up with that. Every way I checked the math manually the total should be $1,602. Is it a coincidence that the difference between what I think the payment should have been, and what T-Tax calculated, is exactly $502? Is it possible there is an error in the program resulting in an inaccurate upload? I attached a photo of the T-Tax "Recovery Rebate Credit Worksheet" with no personal identifiable info, just numbers. Help me make sense of this please. 🤔

June 29, 2021

3:21 PM