- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Yes, you can combine your 72 Form W-2G forms to report th...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to enter 72 different W2-G.? Also how do I enter my Win/ Loss Statement?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to enter 72 different W2-G.? Also how do I enter my Win/ Loss Statement?

Yes, you can combine your 72 Form W-2G forms to report them in TurboTax. However, it is recommended that you:

- Only combine W-2G's from the same casino (so the Casino's EIN matches).

- Also, have a spreadsheet for documentation (if requested by the IRS) of calculation totals.

Your win/loss statement does not get entered into TurboTax. Add your winnings from Form W-2g and if you itemize

To add Form W-2G (gambling winnings)

To add a W-2g

1. Sign In or Open TurboTax.

2. Select "Take me to my return"

3. Select "Search" or "Help" icon.

4. Type "W-2g" and select "Jump to W-2g"

5. Answer "Yes" on the Gambling Winnings screen and follow the instructions to enter your W-2g.

6. Add your gambling Losses on the "Let us know if you had any gambling losses in 2017" screen.

The IRS limits gambling losses up to the extent of gambling winnings included on your tax return. Gambling losses become a tax deduction if you used itemized versus standard deductions. See FAQ below for more on claiming gambling losses and record keeping.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to enter 72 different W2-G.? Also how do I enter my Win/ Loss Statement?

Yes, you can combine your 72 Form W-2G forms to report them in TurboTax. However, it is recommended that you:

- Only combine W-2G's from the same casino (so the Casino's EIN matches).

- Also, have a spreadsheet for documentation (if requested by the IRS) of calculation totals.

Your win/loss statement does not get entered into TurboTax. Add your winnings from Form W-2g and if you itemize

To add Form W-2G (gambling winnings)

To add a W-2g

1. Sign In or Open TurboTax.

2. Select "Take me to my return"

3. Select "Search" or "Help" icon.

4. Type "W-2g" and select "Jump to W-2g"

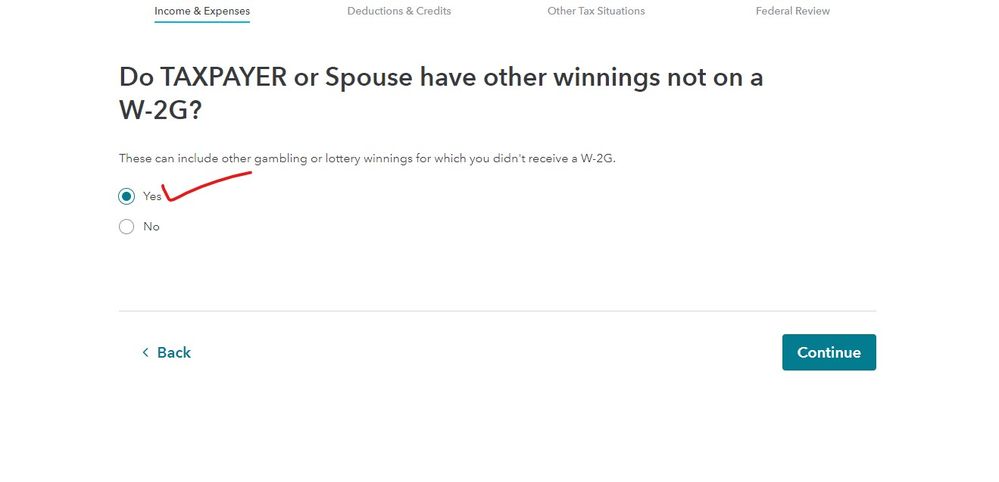

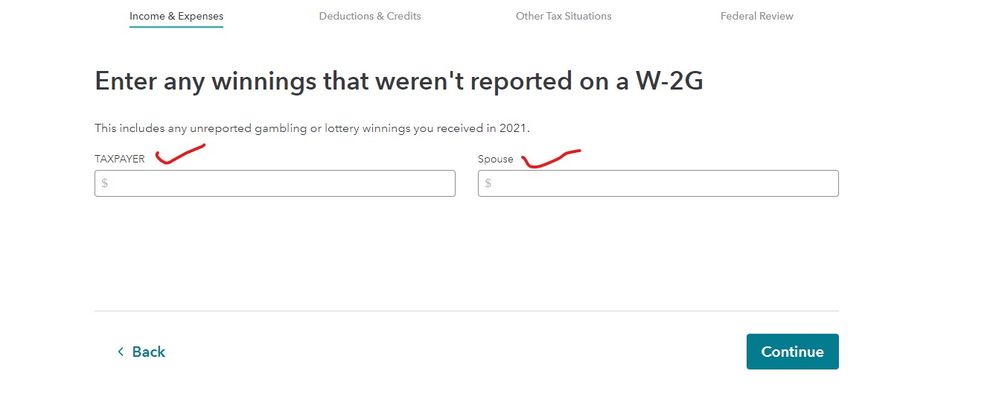

5. Answer "Yes" on the Gambling Winnings screen and follow the instructions to enter your W-2g.

6. Add your gambling Losses on the "Let us know if you had any gambling losses in 2017" screen.

The IRS limits gambling losses up to the extent of gambling winnings included on your tax return. Gambling losses become a tax deduction if you used itemized versus standard deductions. See FAQ below for more on claiming gambling losses and record keeping.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to enter 72 different W2-G.? Also how do I enter my Win/ Loss Statement?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to enter 72 different W2-G.? Also how do I enter my Win/ Loss Statement?

I just want to confirm I have this information correct.

Example if I have 68 W2-G from the Peppermill Casino and they total 65,500.00 I can enter it as one (1) W-2G for the full amount?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to enter 72 different W2-G.? Also how do I enter my Win/ Loss Statement?

Yes please do and save yourself a lot of unneeded entering.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to enter 72 different W2-G.? Also how do I enter my Win/ Loss Statement?

I understand that I can enter as a combined W2-G as long as they are from the same Casino. What would I enter as the winning date and casher?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to enter 72 different W2-G.? Also how do I enter my Win/ Loss Statement?

Leave the date and cashier blank.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to enter 72 different W2-G.? Also how do I enter my Win/ Loss Statement?

So long as the EIN of the payor is the same on all W-2G's, you can combine them and make a single entry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to enter 72 different W2-G.? Also how do I enter my Win/ Loss Statement?

Understand this ... the IRS only gets the total of the winnings on the tax return. All those entries in the program is for your use only and are not sent with the return at all. The program just acts like a calculator adding up all those amounts. You can skip the W-G entries all together and simply enter the total if you wish. The IRS will match your total with the forms they get from the issuer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to enter 72 different W2-G.? Also how do I enter my Win/ Loss Statement?

Don't combine by EIN! I did this in 2019, and the IRS just reached out and rejected it. I sent a response and showed exactly what I did, and they still rejected it. My only recourse was to amend my return and enter every w2g separately. I recently did this and am waiting on their response.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to enter 72 different W2-G.? Also how do I enter my Win/ Loss Statement?

30 years in the business and I have yet to enter one single W-2G form in any tax program ... simply put the total winnings on the appropriate line with zero IRS issues.

Now if you have any withholdings on any of the forms, to get that in the program you will either need to make one W-2g entry OR put that in the other tax situations section next to the estimated payments.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to enter 72 different W2-G.? Also how do I enter my Win/ Loss Statement?

Same here, tried to find an easier way to input the hundreds of W2-G’s and now are under an audit for 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to enter 72 different W2-G.? Also how do I enter my Win/ Loss Statement?

I just spoke to a Turbo Tax expert and she told me that you can only combine them if the EIN, date, cashier, and window number are the same. Is this true?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to enter 72 different W2-G.? Also how do I enter my Win/ Loss Statement?

NOT true ... only need the EIN to be the same.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to enter 72 different W2-G.? Also how do I enter my Win/ Loss Statement?

That is correct. You cannot combine them if they have different Federal EIN numbers or different state EIN numbers. The IRS get's copies of these too, so everything needs to match what they received.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Idealsol

New Member

ed 49

Returning Member

chinyoung

New Member

dinesh_grad

New Member

user17552925565

Level 1