- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Will *ANY* version of TurboTax Deluxe CD do 2020 New York State tax return free or do I need the "with state" version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will *ANY* version of TurboTax Deluxe CD do 2020 New York State tax return free or do I need the "with state" version?

For Windows CD...

Will TurboTax Deluxe CD without state version for 2020 do New York State income tax returns free or does it HAVE to be the version of Deluxe that comes with state to do that?

Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will *ANY* version of TurboTax Deluxe CD do 2020 New York State tax return free or do I need the "with state" version?

@TurboLover2 wrote:

This part of TT is so confusing.

Let me see if I can state a clear question.

I want to prepare and efile a 2020 federal and New York State income tax return.

Can I do this with ANY 2020 TurboTax Deluxe Desktop version and still efile the NY State return free?

If I can get a yes or a no to that question I think it will be clear.

Thank you.

Yes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will *ANY* version of TurboTax Deluxe CD do 2020 New York State tax return free or do I need the "with state" version?

No actually you’ve gotten a little lost in the other direction.

For state preparation, using the desktop program, you need to have a version that is marked “plus free state”. All desktop versions sold directly from Intuit as downloads include the free state, but some boxed versions sold at other retailers such as Amazon, Costco, or office supply stores, come in a “federal only” and a “federal plus state” box. The logic supposedly is that some states don’t have income tax and so a cheaper version is offered. In practical matters, the federal-only version is usually only a few dollars less, and it leads to accidents where people in states with income tax buy the wrong box, if the store stocks both versions, and then they have to buy the state module which is I believe $40.

For state e-filing, if you have a desktop copy that was sold as “includes one free state”, then state e-filing is still an extra $20 E-filing fee, although you can print your return and file for free by mail. In New York only, that state file e-filing free is not charged because of a provision in New York State law.

In addition, if you purchase the “includes one free state“ version and then have to buy additional state modules because you need to file in more than one state, then I believe the state e-filing fee is included in the cost of the second and third state modules. Although even I am not sure about that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will *ANY* version of TurboTax Deluxe CD do 2020 New York State tax return free or do I need the "with state" version?

The New York state income tax return can be e-filed at no charge using the desktop editions.

The TurboTax software for a state return has to purchased if your TurboTax edition does not have one free state program download included in the purchase price.

State program using the TurboTax desktop editions - $40 (increasing to $45 on 03/01/2021)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will *ANY* version of TurboTax Deluxe CD do 2020 New York State tax return free or do I need the "with state" version?

Sorry but I am not clear on your answer. Are you saying that the 2020 TurboTax Deluxe CD version that does not come with one free state will NOT allow preparing and efiling of the New York State return?

I know that New York is an exception to the rule about free efiling. Please be sure that any answer given takes that into account.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will *ANY* version of TurboTax Deluxe CD do 2020 New York State tax return free or do I need the "with state" version?

This part of TT is so confusing.

Let me see if I can state a clear question.

I want to prepare and efile a 2020 federal and New York State income tax return.

Can I do this with ANY 2020 TurboTax Deluxe Desktop version and still efile the NY State return free?

If I can get a yes or a no to that question I think it will be clear.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will *ANY* version of TurboTax Deluxe CD do 2020 New York State tax return free or do I need the "with state" version?

@TurboLover2 wrote:

This part of TT is so confusing.

Let me see if I can state a clear question.

I want to prepare and efile a 2020 federal and New York State income tax return.

Can I do this with ANY 2020 TurboTax Deluxe Desktop version and still efile the NY State return free?

If I can get a yes or a no to that question I think it will be clear.

Thank you.

Yes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will *ANY* version of TurboTax Deluxe CD do 2020 New York State tax return free or do I need the "with state" version?

Thank you!

What I think I now understand is that I can PREPARE both the federal and New York State 2020 tax returns with ANY desktop version of TT Deluxe. But if I want to efile in any state EXCEPT New York, I would have to also pay for the state efile. I can efile New York without paying the extra efile fee.

Hope I got it now.

Thanks for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will *ANY* version of TurboTax Deluxe CD do 2020 New York State tax return free or do I need the "with state" version?

No actually you’ve gotten a little lost in the other direction.

For state preparation, using the desktop program, you need to have a version that is marked “plus free state”. All desktop versions sold directly from Intuit as downloads include the free state, but some boxed versions sold at other retailers such as Amazon, Costco, or office supply stores, come in a “federal only” and a “federal plus state” box. The logic supposedly is that some states don’t have income tax and so a cheaper version is offered. In practical matters, the federal-only version is usually only a few dollars less, and it leads to accidents where people in states with income tax buy the wrong box, if the store stocks both versions, and then they have to buy the state module which is I believe $40.

For state e-filing, if you have a desktop copy that was sold as “includes one free state”, then state e-filing is still an extra $20 E-filing fee, although you can print your return and file for free by mail. In New York only, that state file e-filing free is not charged because of a provision in New York State law.

In addition, if you purchase the “includes one free state“ version and then have to buy additional state modules because you need to file in more than one state, then I believe the state e-filing fee is included in the cost of the second and third state modules. Although even I am not sure about that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will *ANY* version of TurboTax Deluxe CD do 2020 New York State tax return free or do I need the "with state" version?

Thank you Opus 17!

After looking at Amazon I came back to check the answer again because I noticed exactly what you stated. You already answered the question I came back to ask.

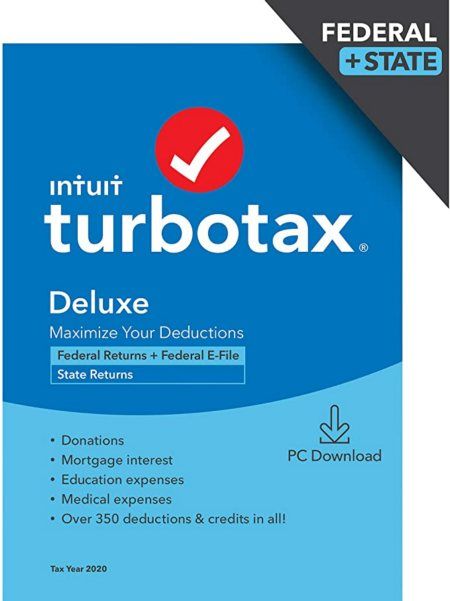

There are two different boxes. One says "Federal Returns + Federal E-file," and the other one adds the words "State Returns" underneath those words.

So the answer to my previous question is no, not ALL Deluxe desktop versions will allow me either prepare OR efile a 2020 New York State tax return. I must buy the one that has the words "State Returns" on it. Then I will be able to both prepare the NY return and efile it free.

Thank you for your thorough response and to others who helped.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will *ANY* version of TurboTax Deluxe CD do 2020 New York State tax return free or do I need the "with state" version?

Okay here we go again! This one will take a real expert...please don't guess if you aren't certain.

I think the 2020 Deluxe CD version that says "State Returns" on it (I posted a picture of it) allows up to 5 federal returns to be prepared AND efiled.

But for a 2020 New York state return, how many can you prepare and how many can you efile free with it?

Can it also prepare and efile 5 New York State returns free in addition to 5 federal returns?

It says "PC Download" but I plan to buy the CD which I am assuming is subject to the same answer (I hope).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will *ANY* version of TurboTax Deluxe CD do 2020 New York State tax return free or do I need the "with state" version?

I have a feeling only one NY State return is included with the purchase.

So the question becomes, does that mean if you need to prepare more than one NY State return you have to pay for the additional ones, but NOT to efile them?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will *ANY* version of TurboTax Deluxe CD do 2020 New York State tax return free or do I need the "with state" version?

The CD is the same as the download. Except the CD has both the Windows and Mac programs on it. If you buy the download you have to be sure to get the right one.

Yes you can prepare and efile a state return for each federal return. If you have more than 5 federal/state you can print and mail the rest.

FYI - if you are doing returns for family and someone has the same name initial as you or your spouse. There is a problem saving returns if 2 returns use the same initials, one will overwrite the other. So you have to be sure to save the returns with names completely different to keep them apart. Don't use the default name given by the program. Go up to File-Save As and give it a unique name.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will *ANY* version of TurboTax Deluxe CD do 2020 New York State tax return free or do I need the "with state" version?

For your other question. What you get is one free state PROGRAM download. You can prepare unlimited state returns in that state and efile a state with each federal. New York is free to efile but other states are $20/25 to efile or print and mail for free.

Hope that clears it up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will *ANY* version of TurboTax Deluxe CD do 2020 New York State tax return free or do I need the "with state" version?

Thank you VolvoGirl...

To nail it down, if I buy the Deluxe with state version in either the download or CD, and I download New York State to do the first return, I can file up to four additional New York State returns with that download without paying any extra fees for either the returns or the efile?

Is that accurate?

So if I download a New York State return to do the first set of Federal and NY returns, when I start the second return how can I access the NY return? As I recall it asks if you want to download a state, and you have already downloaded it once for the first return. It says "Includes 5 free federal e-files and one download of a TurboTax state product."

How do you reuse that download for the second set of returns you prepare?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will *ANY* version of TurboTax Deluxe CD do 2020 New York State tax return free or do I need the "with state" version?

Right. Once you download and install the state Program it is there to use for all returns. Your return is not kept in the program. Each return (federal & state) are in a data file ending in .tax2020. You will save the ,tax2020 file for each person's return. Federal and state returns are in the same data file. So be sure to save each federal return with a name you can tell apart from other people. Read my post above about saving returns for people with similar names.

Just do the first return and you will see how it is. Save frequently. Your returns are only stored and saved on that computer. When you are done save your return as both a tax2020 file and a PDF file and back them up to a flash drive or burn a CD, etc. You will need the file ending in .tax2020 to transfer into next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will *ANY* version of TurboTax Deluxe CD do 2020 New York State tax return free or do I need the "with state" version?

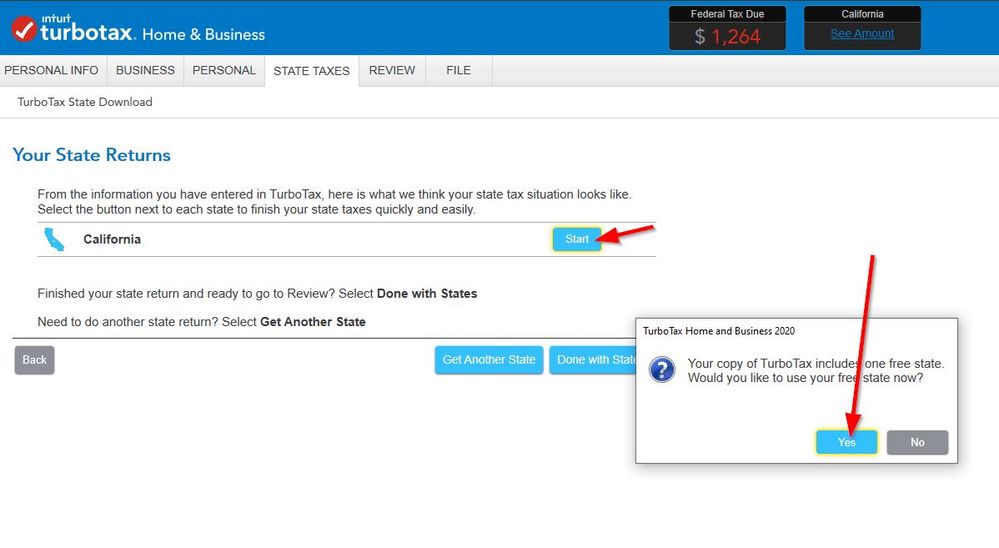

I can make you screen shots. Here is one. I hadn't downloaded the state yet. I started a federal return and when I click on the state tab to do state it shows me California (based on my address) and a Start button. When I click on Start it pops up and asks me if I want to use my free state. Then the next return I do it will already be installed and I will just click Start.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

TaxesForGetSmart

New Member

user17552925565

New Member

spunky_twist

New Member

sonia-yu

New Member

hung05

Level 2