- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Tax estimator shows federal tax due as rather low. Does it include self-employment taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax estimator shows federal tax due as rather low. Does it include self-employment taxes?

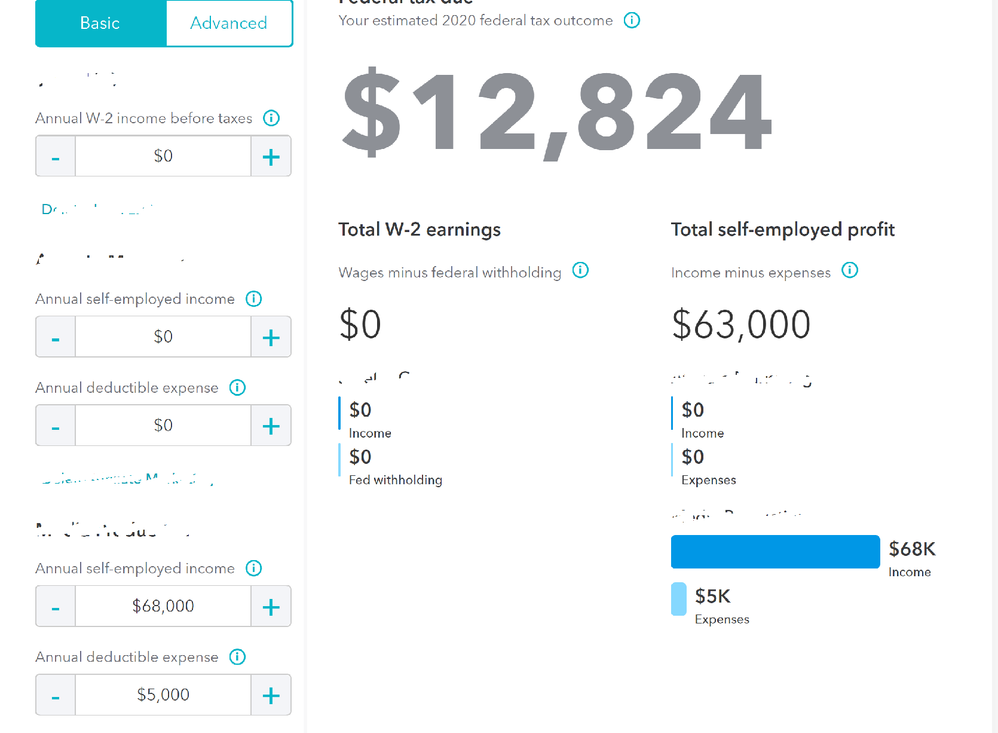

I used the turbo tax estimator to estimate my taxes for 2020. No W2 income this year. Only self employment income ...

I put in income as $68,000 (just an estimate, it could be more at the end of the year)

Expenses $5,000

It put my estimated federal tax due as $12,824 .... my question is, does this include my self employment taxes which are at 15%? I am single and my standard deduction is $12,400 I believe.

At that tax bracket, income taxes are at 22% and estimated taxes at 15%... why does it say estimated federal tax due as 12k?

if my math is correct, $63,000 (income minus 5k expenses) - $12,400 = 50,600

22% tax + 15% SE tax is 37%. 37% of $56,000 is $20,720 ? Why does the estimator say 12k?

Also, do you have an estimator for state taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax estimator shows federal tax due as rather low. Does it include self-employment taxes?

At that tax bracket, income taxes are at 22% and estimated taxes at 15%... why does it say estimated federal tax due as 12k? You are forgetting we have a graduated tax bracket system so although your income may have hit the 22% bracket it is not all taxed at 22%.

if my math is correct ... it is not ... here is an educated guess ...

SE tax ... 63K x 15.3% = 9639

Fed tax ... 63K - 4820 (1/2 se tax ) = 58,180 - 12,400= 45,780 - QBI deduction (approximate) $12,600 = $33,180 ... tax from 2019 table (could not find a 2020 table ... see tax brackets below) is $3,787

Total estimated tax 3787 + 9639 = 13,426 ( may be other things I didn't consider).

Also, do you have an estimator for state taxes? No ... your state may have one... check their website.

Why are you not using the program's estimator instead ( FYI ... in the future use the downloaded version if you can ... use the Deluxe and save a few bucks ... then you can what if all year long) ...

What are estimated taxes?

https://ttlc.intuit.com/replies/3301588

Do I need to make estimated tax payments to the IRS?

PAYING ESTIMATES

For SE self employment tax - if you have a net profit (after expenses) of $400 or more you will pay 15.3% for 2015 SE Tax on 92.35% of your net profit in addition to your regular income tax on it. So if you have other income like W2 income your extra business income might put you into a higher tax bracket.

You must make quarterly estimated tax payments for the current tax year (or next year) if both of the following apply:

- 1. You expect to owe at least $1,000 in tax for the current tax year, after subtracting your withholding and credits.

- 2. You expect your withholding and credits to be less than the smaller of:

90% of the tax to be shown on your current year’s tax return, or

100% of the tax shown on your prior year’s tax return. (Your prior year tax return must cover all 12 months.)

https://ttlc.intuit.com/replies/3301891

How do I make estimated tax payments?

https://ttlc.intuit.com/replies/3301258

Can TurboTax calculate next year's federal estimated taxes?

https://ttlc.intuit.com/replies/4242911

Can TurboTax calculate the estimated payments for next year's state taxes?

https://ttlc.intuit.com/replies/3301735

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax estimator shows federal tax due as rather low. Does it include self-employment taxes?

To open the 2019 program after filing ... scroll down and click on ADD A STATE ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax estimator shows federal tax due as rather low. Does it include self-employment taxes?

Thanks for helping me with the math. That helps clear up a lot. I am actually using the Turbo Tax estimator and but it was the online version. I'll try the deluxe version next time. I just wanted to make sure that the amount was correct. I chose not to use my Estimated Tax Payments that Turbotax gave me as my income increased dramatically this year compared to 2019 so it wouldn't be accurate. I've been making ES payments online and it looks like I'm right on target as I've paid over 12k so far so I won't end up owing too much. Thank again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax estimator shows federal tax due as rather low. Does it include self-employment taxes?

Had a quick question about Fed tax ... 63K - 4820 (1/2 se tax )

Why did you use one half of SE tax... as someone who is self employed I am supposed to pay 15% or all of it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax estimator shows federal tax due as rather low. Does it include self-employment taxes?

You get a deduction of 1/2 SE tax as an adjustment to gross income which lowers you SE tax ... note the minus sign.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax estimator shows federal tax due as rather low. Does it include self-employment taxes?

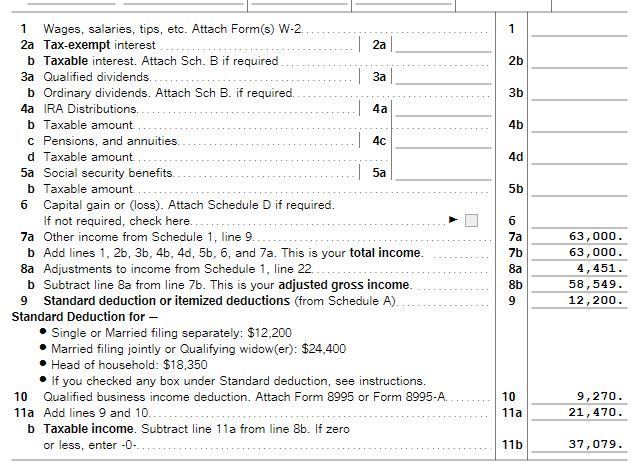

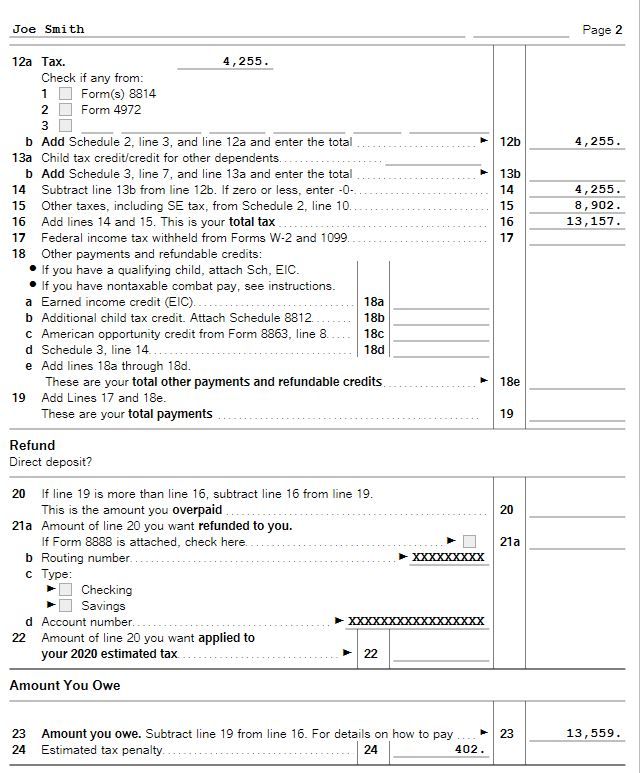

I put the 68,000 income and 5,000 expenses into my 2019 Desktop program. Here is the 2019 1040 pages 1 & 2 to see how it would be. I used Single.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax estimator shows federal tax due as rather low. Does it include self-employment taxes?

Here's some math...........

You pay 2 different taxes. The regular income tax and the SE tax. The 1/2 of SE tax on line 8a and the personal 12,200 Standard Deduction line 9 and the QBI line 10 are only deducted from your income for the regular income tax.

The Self Employment tax on line 15 is 15.3% on 92.35% of your Net Profit.

63,000 x .9235 = 58,180.50

58,180.50 x .153 = 8,902 SE TAX

This only gave me a QBI deduction on line 10 of $9,270 instead of 20%. Looks like you have to deduct the 1/2 SE tax from your Net Profit (63,000-4,451) plus some other limitation.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

soccerdad720

Level 2

lsfinn

Level 1

Bwcland1

Level 1

matto1

Level 2

bseraile

New Member