- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax estimator shows federal tax due as rather low. Does it include self-employment taxes?

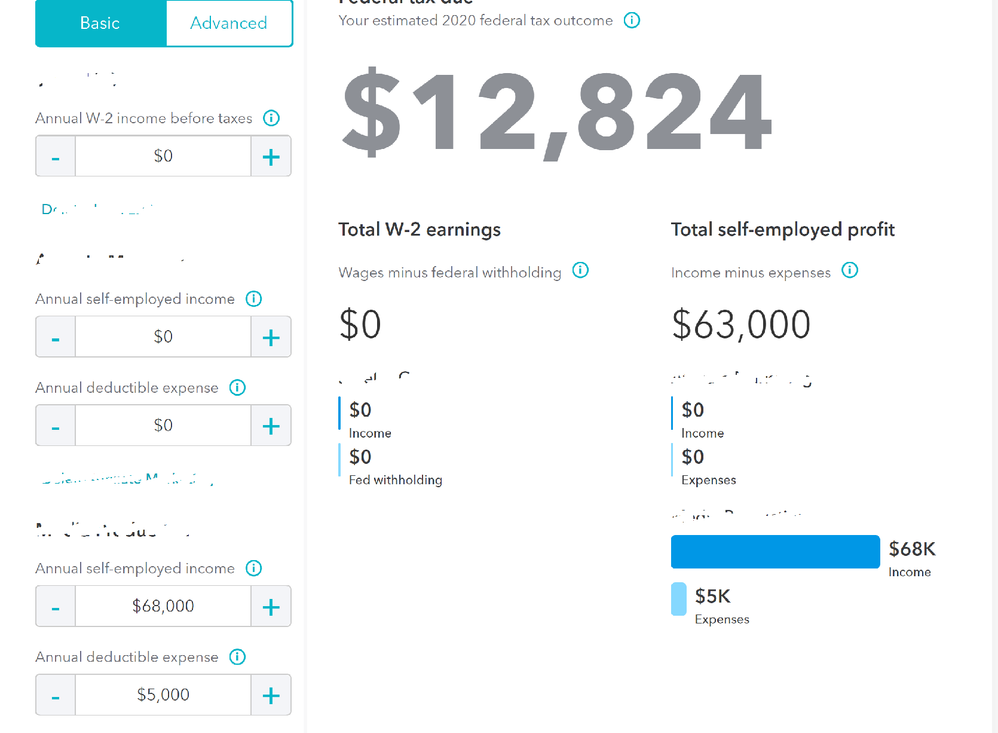

I used the turbo tax estimator to estimate my taxes for 2020. No W2 income this year. Only self employment income ...

I put in income as $68,000 (just an estimate, it could be more at the end of the year)

Expenses $5,000

It put my estimated federal tax due as $12,824 .... my question is, does this include my self employment taxes which are at 15%? I am single and my standard deduction is $12,400 I believe.

At that tax bracket, income taxes are at 22% and estimated taxes at 15%... why does it say estimated federal tax due as 12k?

if my math is correct, $63,000 (income minus 5k expenses) - $12,400 = 50,600

22% tax + 15% SE tax is 37%. 37% of $56,000 is $20,720 ? Why does the estimator say 12k?

Also, do you have an estimator for state taxes?