- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Why when I filed my taxes it didn’t ask for my ip PIN number?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why when I filed my taxes it didn’t ask for my ip PIN number?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why when I filed my taxes it didn’t ask for my ip PIN number?

If you received an IP PIN from the IRS in December or January and did not enter the IP PIN on the tax return, then the IRS will reject your tax return. You need to wait for the IRS to reject the return sometime on or after January 27. Once the return is rejected you can enter the IP PIN you received and re-file.

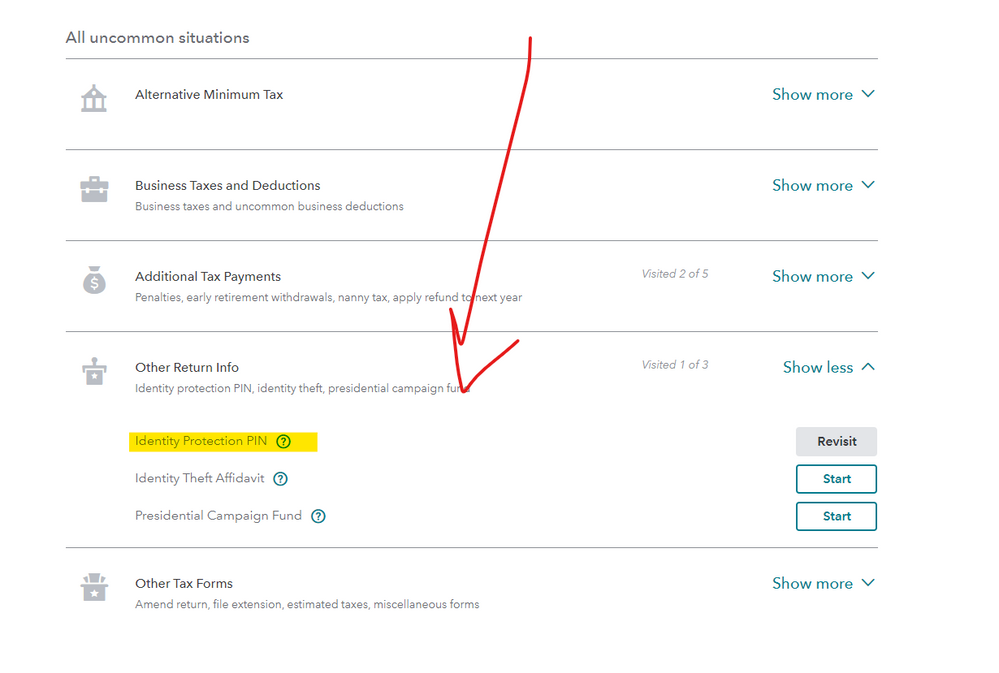

To enter a 6 digit IP PIN

- Click on Federal Taxes (Personal using Home and Business)

- Click on Other Tax Situations

- Scroll down to Other Return Info

- On Identity Protection PIN, click the start button

Or enter ip pin in the Search box located in the upper right of the program screen. Click on Jump to ip pin

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why when I filed my taxes it didn’t ask for my ip PIN number?

Why didn't the TurboTax software prompt me for a PIN? I was waiting to be prompted and it never asked for the PIN. I used one in previous years and transferred last years information so it should have known that one was provided in the previous year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why when I filed my taxes it didn’t ask for my ip PIN number?

The self-selected five digit PIN is a security issue so TurboTax does not transfer it with the return. If you do not remember it, you can use the prior year adjusted gross income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why when I filed my taxes it didn’t ask for my ip PIN number?

I had my 2019 unique PIN ready. I just wasn't prompted and I wanted to give that feedback that the software was lacking in not asking the specific question. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why when I filed my taxes it didn’t ask for my ip PIN number?

I never was asked by turbo tax to provide that IDme pin. I even provided last years AGI and it doesn’t matter. Still need the pin to send your tax returns. Don’t know about you, but I’m really pissed off! This is a huge inconvenience!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why when I filed my taxes it didn’t ask for my ip PIN number?

That’s not true! I provided my last years AGI and I still had to provide the IDme pin, that I never received!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why when I filed my taxes it didn’t ask for my ip PIN number?

@dmcharg88 If you received a 6 digit Identity Protection PIN from the IRS due to reporting an identity theft to the IRS -

To enter, edit or delete a 6 digit IP PIN

- Click on Federal Taxes (Personal using Home and Business)

- Click on Other Tax Situations

- Scroll down to Other Return Info

- On Identity Protection PIN, click the start button

Or enter ip pin in the Search box located in the upper right of the program screen. Click on Jump to ip pin

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why when I filed my taxes it didn’t ask for my ip PIN number?

It's 2022 now and the responses to this question are confusing... some say it will be rejected if you don't include the ippin, and others say the turbotax software uses the last year AIG method for identity confirmation and does not "transmit" the ippin for security reasons... which is it?

I was issued an ippin (though I don't know why... I did not request one nor was I a victim of identity theft that I know of) and so I was ready to provide it when doing my taxes, but I was never asked if I had one and it looks like my submitted forms are missing it.

Will my submission be rejected?

Why doesn't the turbotax process at least ask if you have one?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why when I filed my taxes it didn’t ask for my ip PIN number?

If you received an IP PIN or CP01A notice from the IRS in the past (or you opted in to the pilot program) you must use your 2021 IP PIN to validate your identity when you file your 2021 return.

For more information, please see the TurboTax FAQ below:

What's an IP PIN? Do I need one?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why when I filed my taxes it didn’t ask for my ip PIN number?

It was rejected. Good news is that it happened in about an hour and I was able to add the info and re-submit. Now we'll see what happens.

Why turbotax doesn't ask if you have an Identity Protection Personal Identification Number as part of the question process or review is completely beyond me. It seems like a ridiculous oversight and makes me question the integrity of turbotax... what else is it missing/forgetting? I'm not sure I would recommend it to others. I know it can be entered by drilling into the right form in the right place but not asking when it can mean having the forms rejected and possibly delaying a refund is unfortunate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why when I filed my taxes it didn’t ask for my ip PIN number?

I have the same problem...FIX IT!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why when I filed my taxes it didn’t ask for my ip PIN number?

Yes, you can enter your IP PIN in TurboTax. This is how to find it:

- Sign in to your account and open your return. If your return was e-filed and rejected, you will need to click on Fix my return.

- Select Federal from the left side menu.

- Select Other Tax Situations on the left.

- Scroll down/ expand the list and look for Other Return Info.

- Expand the section and click on Start or Update to the right of Identity Protection PIN.

- Answer the first question Yes.

- Select your name and click Add to the right.

- Enter the number on the next screen.

- At this point, you can complete and file your tax return.

Click here to find out more and to retrieve your IP PIN from the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why when I filed my taxes it didn’t ask for my ip PIN number?

Why doesn’t turbo tax ask for my irs number

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why when I filed my taxes it didn’t ask for my ip PIN number?

First the program does ask if you do not jump past that section ... I see it in each and every test return I do. Next since you know you need to enter it so simply don't file until you do ... you will get a number each and every year going forward ... save the instructions for next year so you know where to go ...

In Online TurboTax, here are 3 ways to get to the right place to enter the IP PIN. You only need to use one method. You can choose which method works for you the best.

- Open the interview back up and click in the top right on the SEARCH icon.

- Enter the term IP PIN without quotes. When entering, ignore the dropdown menu, and instead click the small magnifying glass on that same line.

- Then click on Jump to IP PIN.

Or here's a second way:

- With your return open, click in the left menu column on TAX TOOLS, then choose TOOLS.

- In the Tools window choose TOPIC SEARCH.

- Enter the term IP PIN without quotes.

- In the selection list highlight IP PIN and click GO.

Or here's a third navigation method:

- With your return open, in the left menu column, click Federal.

- Then at the top of the screen choose Other Tax Situation

- If this is your first time in that section, answer the preliminary questions, and it may ask you if you have an IP PIN. If so, indicate "yes", and keep following the screens as it guides you to enter it.

- If it doesn't, such as if you've previously been in that section, click on "See all uncommon tax situations" to see all the topics in that section.

- In the "Uncommon tax situations" list, scroll down to Other Return Info, and expand to see the subtopics, one of which is Identity Protection PIN.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

import32

Level 1

johnmayorga912

New Member

mrtate1965

New Member

user17609684125

Returning Member

annieroroberts60

New Member