- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Why are my long-term capital gains being taxed when my total earned income is less than $40,0...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my long-term capital gains being taxed when my total earned income is less than $40,000? Seems like a glitch in Turbotax software!

There are like 7 different ways to calculate the tax.

It depends what kind of income you have. Even though the full amount shows up in the total income on the 1040 line 7, if you have capital gains or qualified dividends the tax is not taken from the tax table but is calculated separately from Schedule D. The tax will be calculated on the Qualified Dividends and Capital Gain Tax Worksheet. It does not get filed with your return. In the online version you need to save your return as a pdf file and include all the worksheets to see it.

For the Desktop version you can switch to Forms Mode and open the worksheet to see it. Click Forms in the upper right (upper left for Mac) and look through the list and open the Qualified Dividends and Capital Gain Tax Worksheet. And you will need to use this IRS worksheet on page 15.

https://www.irs.gov/pub/irs-pdf/i1040tt.pdf

IRS Qualified Dividends and Capital Gain Tax Worksheet—Line 16 on 1040 instructions page 37

https://www.irs.gov/pub/irs-pdf/i1040gi.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my long-term capital gains being taxed when my total earned income is less than $40,000? Seems like a glitch in Turbotax software!

I’m having this problem now. I’m not getting taxed on longterm capital gains at 0% even though I made less than $40,000 regular income. This seems like a software glitch. Hopefully TurboTax can fix this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my long-term capital gains being taxed when my total earned income is less than $40,000? Seems like a glitch in Turbotax software!

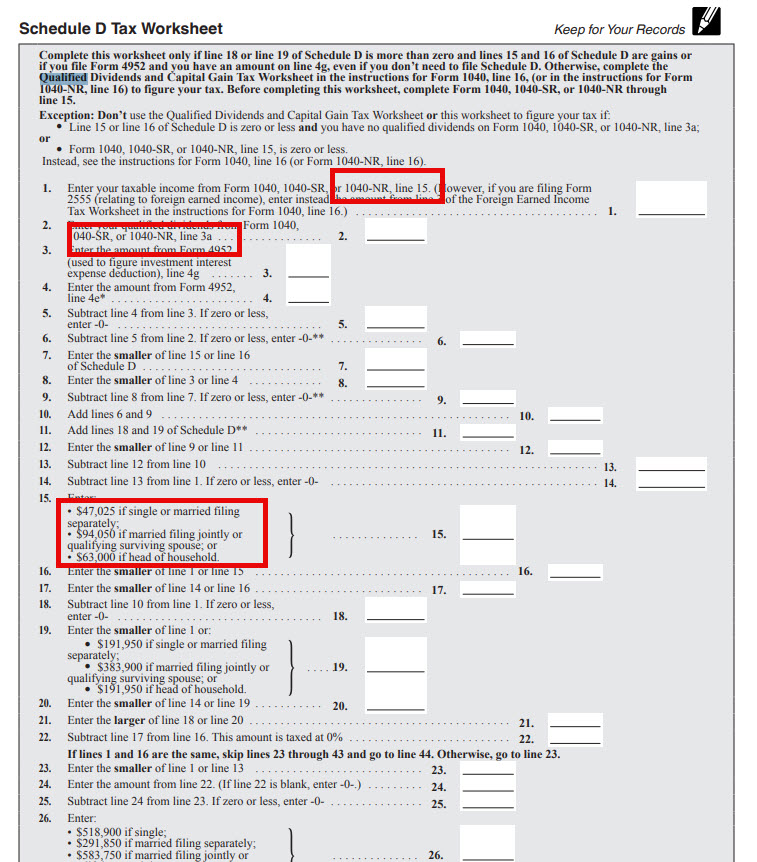

Does your tax return contain a Qualified Dividends and Capital Gain Tax Worksheet or a Schedule D Tax Worksheet that calculates the tax burden? The worksheet will tell you how the tax was computed.

In the online versions, you may view or print at Tax Tools / Print Center / Print, save or preview this year's return / Include government and TurboTax worksheets after you have paid for the software.

In the Desktop versions, one can look at the tax return by clicking FORMS, or by viewing the PDF through the Print Center.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my long-term capital gains being taxed when my total earned income is less than $40,000? Seems like a glitch in Turbotax software!

Why do I need to look at worksheets? The front page says I’m being taxed at 15% for the longterm capital gains.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my long-term capital gains being taxed when my total earned income is less than $40,000? Seems like a glitch in Turbotax software!

[Edit: Corrected the calculation to use 2024 LTCG tax bracket instead of the 2025 bracket]

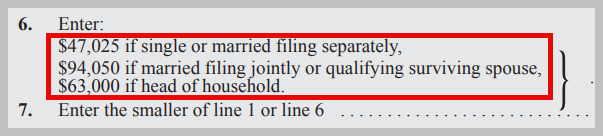

The LTCG tax rate to be used takes into account all of your taxable income, not just the amount of your ordinary income. For example (for 2024), if you file Single and, your total taxable income is $70,000 and your LTCG is $30,000, $70,000 minus the 0% LTCG upper threshold of $47,020 would result in $22,975 of the LTCG being taxed at the 15% rate. Just because your ordinary taxable income is only $40,000 doesn't mean that all of your LTCG are taxed at 0%. Only the $7,025 portion between $40,000 and $47,025 is taxed at 0%.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my long-term capital gains being taxed when my total earned income is less than $40,000? Seems like a glitch in Turbotax software!

The worksheets may be helpful if you had any adjustments made to the income reported on your 1040 line 15, such as adding non-taxable Qualifying Dividends listed on your 1040 line 3a. These adjustments may have increased your income to be over the 47,025 limit.

See IRS Schedule D tax worksheet in the Schedule D instructions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my long-term capital gains being taxed when my total earned income is less than $40,000? Seems like a glitch in Turbotax software!

Ok I understand this information. How do I correct the TurboTax program to give me the 0% rate? Do I need to open up these forms on the program and fill them in?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my long-term capital gains being taxed when my total earned income is less than $40,000? Seems like a glitch in Turbotax software!

It depends. The wages are indicated however, if the capital gains, together with your wages puts you above the threshold for your filing status, then you many not have a 0% tax on any of the capital gains.

Note the worksheet posted above by @KrisD15, line 15. The link for the worksheet is attached here as well.

- Schedule D Instructions - page D-16

- Form 1040 Instructions - page 36 (Qualified Dividends and Capital Gains Tax Worksheet)

- Keep in mind that overrides will eliminate the TurboTax guarantee.

- @Masters23

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my long-term capital gains being taxed when my total earned income is less than $40,000? Seems like a glitch in Turbotax software!

Help.

Could you specified which worksheets and which line you manually did to get the 0% tax on capital gain? My taxable amount on line 6b form 1040SR is less than $40k.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my long-term capital gains being taxed when my total earned income is less than $40,000? Seems like a glitch in Turbotax software!

The line you reference is for social security income. We'd love to help you complete your tax return, but need more information. Can you please clarify your question?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my long-term capital gains being taxed when my total earned income is less than $40,000? Seems like a glitch in Turbotax software!

On form 1040SR, line 6a is the "social security benefit". On my question above line 6b is the "Taxable amount" which is less than $40k. So question was "why do I need to add in y capital gain if my taxable income is less then $40k?

Best regards,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my long-term capital gains being taxed when my total earned income is less than $40,000? Seems like a glitch in Turbotax software!

Line 6b is the taxable amount of Social Security. Do you have any other income besides SS and Capital Gains? You need to look at line 15 for taxable income which will include the Captial Gains. Yes you have to report all your income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my long-term capital gains being taxed when my total earned income is less than $40,000? Seems like a glitch in Turbotax software!

Yes, as VolvoGirl explains, all income must be reported. The IRS will not know that you qualify for the special capital gains tax unless you file your return to show it, even if it falls to the 0% tax.

Use the information below to report your investment income.

To enter your capital gain transaction in TurboTax, follow these steps. Click this link for more information. Where do I enter Investment Sales?

- Open or continue your return.

- Navigate to the investment sales section:

- TurboTax Online/Mobile: Go to investment sales. If using this application, make sure it is open

- TurboTax Desktop: Search for investment sales and then select the Jump to link.

- Or Personal Tab > Continue > I'll choose what I work on > Scroll to Investment Income > Select Stocks, Cryptocurrency, Mutual Funds, Bonds, Other

- Answer Yes to the question Did you sell any of these investments in 2024? (or Okay! to Time to kickoff your investments!).

- If you land on the Investment sales summary or Your investments and savings screen, select Add More Sales or Add investments.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my long-term capital gains being taxed when my total earned income is less than $40,000? Seems like a glitch in Turbotax software!

My taxable amount under $40k includes "SS taxable + bank interest". Beside that I only have capital gain amount which should be 0% tax per IRS rule.

However, 1040SR form line16 did not give 0% tax on my capital gain.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my long-term capital gains being taxed when my total earned income is less than $40,000? Seems like a glitch in Turbotax software!

Any capital gain you received is included as income on your Form 1040. It is entered on the Form 1040 Line 7

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sonia-yu

New Member

scatkins

Level 2

ilenearg

Level 2

VAer

Level 4

soccerfan1357

Level 1