- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Where is the form 8915-f for 2023 filing of 2022 taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

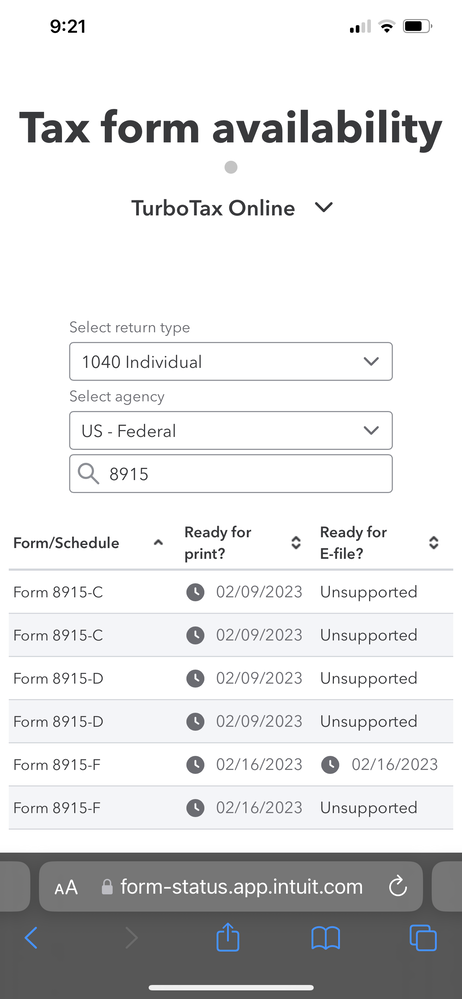

The IRS Form 8915-F Qualified Disaster Retirement Plan Distributions and Retirements is estimated to be finalized and available in TurboTax on 02/16/2023

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

Thanks. I also found where it asks for the form, when I say I have no more 1099-R, it then asks about disaster distributions. Somewhat obtuse...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

I thought they said last year that the 8915 form was. a forever form and we would be able to use it this year for our 2022 taxes. That is why I returned to Turbotax this year. Hoping it is not like last year where we had to wait so long for IRS and Turbotax to get it together so that we could find our taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

@defray wrote:

I thought they said last year that the 8915 form was. a forever form and we would be able to use it this year for our 2022 taxes. That is why I returned to Turbotax this year. Hoping it is not like last year where we had to wait so long for IRS and Turbotax to get it together so that we could find our taxes.

The IRS Form 8915-F Qualified Disaster Retirement Plan Distributions and Retirements is estimated to be available in TurboTax on 02/16/2023

Go to this TurboTax website for federal and state forms availability - https://form-status.app.intuit.com/tax-forms-availability/formsavailability?albRedirect=true&product...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

I called TurboTax today and I was told to try on February 4, 2023 or February 5, 2023. Not sure if I believe the agent. She claims the IRS is releasing the form on February 4, 2023 for e-filing. I thought the form was already released but Turbotax needed until February 16th the time to adapt the form for e-filing. If someone could explain this, I would be grateful.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

Yes, the ability to print and e-file Form 8915-F will not be available until 2/16/2023 per the just released Forms availability list.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

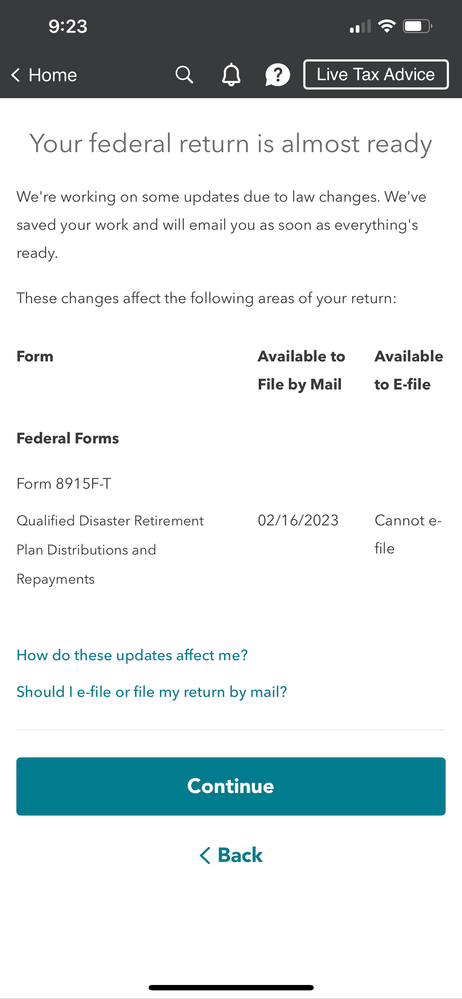

The software is telling me 8915f will be available 2/16/2023. It also indicates it won’t be available for efile and taxes will have to be mailed. I hope this information is not correct. I already completed my taxes and pre paid with the understanding once the firm was available I could efile. Please advise

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

The 8915-F should be available for efile on February 16th. Check back then.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

I received the same message for the primary taxpayer - unsupported and will need to mail. Hoping this is temporary. I find it odd that e-file is still available for "spouse" to e-file on 2/16.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

Form 8915-F is still subject to changes. The estimate when the form will be available for e-file is February 16. This doesn't mean you can't e-file. To e-file, you must check back after February 16 to file your return electronically.

Form 8915 is used to report a disaster-related retirement distribution. For 2022, Form 8915-F will be used to replace Form 8915-E, which was used to report the 2020 COVID-related distribution.

To enter the 8915-F form in TurboTax, follow these instructions:

- Click Wages & Income

- Click Show more under Retirement Plans and Social Security

- Click Start or Revisit beside IRA, 401(k), Pension Plan Withdrawals (1099-R)

- Answer Yes 'Have you ever taken a disaster distribution before 2021?

- Answer Yes, You had a 2020 Qualified Disaster Distribution

- Complete the Information using your 2020 Tax return

- Enter any amount you may have repaid in 2021, if applicable

- Finish the entry for your spouse if applicable or click Continue

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

Why is there a 8915F-S that "can" be e-filed on 2/16 but a 8915F-T that "cannot" be e-filed? The IRS site only lists a 8915F and that's all that is attached when I view a preview of my tax documents within Turbo Tax. Really hoping this gets corrected so we can e-file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

I also received the now updated message that shows 8915F-T (T-Taxpayer) is not going to be available for efile only the 8915F-S (Spouse) will be for efile. I am going to be extremely disappointed if that is the case as this form was available last year and until now it was going to be available this year for efile. This is nonsense because according to the IRS this form is eligible for efile. TT needs to do the work and get this fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

It's now been updated to be available on 2/23/2023 (instead of 2/16); and still no e-file. :(

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

stays

New Member

Major1096

New Member

sreno1127

Level 1

RyanK

Level 2

crowdaryn1006

New Member