- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: When is 8915-f going to be available?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

@ddoggydog wrote:

How do I know whether or not I paid taxes on the distributions in 2020?

On the 2020 Form 1099-R there would have been federal income taxes withheld in box 4 of the form. Those taxes are automatically added to the 2020 federal tax return Form 1040 on Line 25b as a tax payment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

I've tried to delete this form numerous times - it's says it Deleted, I click continue. The form never actually deletes and I can't proceed. Any tricks? This is ridiculous.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

Please see the help articles below and select the one that best fits your situation.

How do I view and delete forms in TurboTax Online?

How do I delete a tax form in the TurboTax CD/Download software?

If you need additional assistance, please feel free to contact Customer Support so you can speak with someone who can assist you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

I've followed directions multiple times, it does not work. The form will not delete, even tho is says it's deleted.

Better yet, how do I get a refund from Turbo Tax so I can go elsewhere - since I was charged for taxes I can't even file. 😳

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

Please feel free to contact Customer Support so they can assist you. If you inquire about a refund, you will want to use the keywords billing issues when you call so you get to the right person.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

Perfect, contact support. 😳 I'm so disappointed with Turbo Tax this year. Will be requesting a refund & taking my business elsewhere. Thx!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

The other user is not doing anything wrong. Your software is not deleting the form. It's broken. I do not need the form as we put back our distribution fully into an IRA last year, but I cannot delete the form. I spoke with a support person who just shrugged when the form did not delete properly. I still can't file my taxes because you keep pushing back the date to add the form to your product (it's been available from the IRS since January and other competing products let you file no problem). This is a TurboTax issue, full stop.

Please get a competent engineer to look at this issue. Your software is broken.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

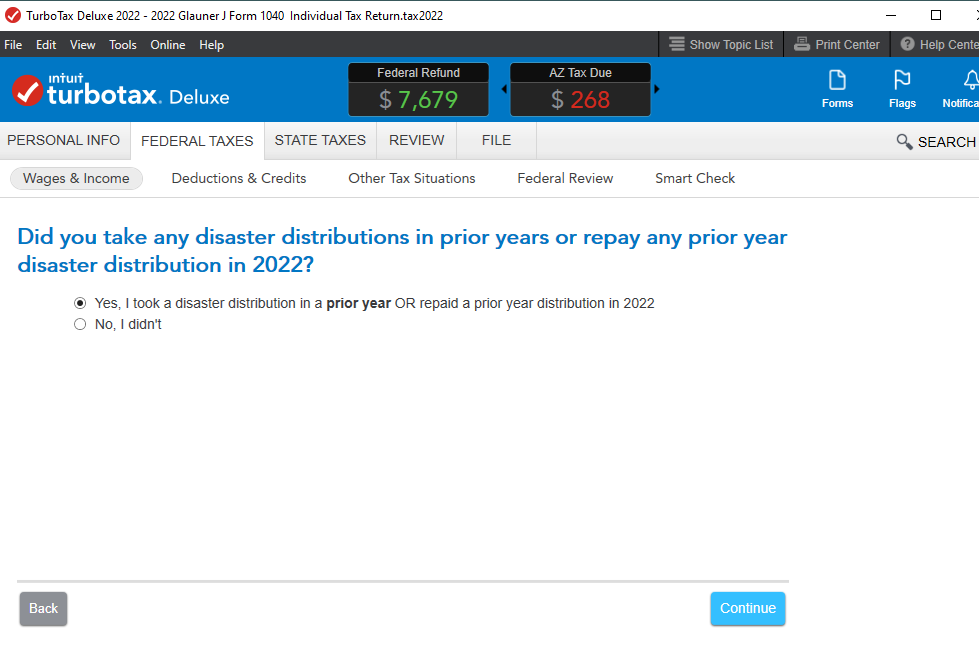

If you indicated in the interview that you had a Disaster Distribution in a prior year (or repaid one) Form 8915 is required and can't be deleted. The current availability date is 03/09/2023.

Here's more info on Form 8915-F.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

Well by working with a customer support rep, I was able to delete the form by deleting the form above it. The IRS accepted it, so hopefully it's all copacetic. I honestly shouldn't need the form because we repaid everything early and were done with this the previous year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

I entered all my info into Taxact as well however I noticed it wasn’t actually calculating my withdrawal as income. It didn’t have line 12 for me to enter amounts only line 13 for the amount to be entered…

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

Tax form 8915-F for tax year 2022 is STILL NOT available. I phoned TurboTax last week Thursday and they could not give me a release date. The release date has been rescheduled 4 times now. I am so sick of waiting on TurboTax to release one single form to finish my taxes. Does anyone have any updates on when this form will be online to finish e-filing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

@Jillian7788 wrote:

Tax form 8915-F for tax year 2022 is STILL NOT available. I phoned TurboTax last week Thursday and they could not give me a release date. The release date has been rescheduled 4 times now. I am so sick of waiting on TurboTax to release one single form to finish my taxes. Does anyone have any updates on when this form will be online to finish e-filing?

Form 8915-F was available in TurboTax on 03/09/2023. If you are using the desktop editions verify that you are at the current software release. Click on Online at the top of the desktop program screen. Click on Check for Updates.

TurboTax website for federal and state forms availability - https://form-status.app.intuit.com/tax-forms-availability/formsavailability?albRedirect=true&product...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

When is the correct form going to be available and for tax year 2022? The software allows the user to select that a 2020 qualified disaster relief distribution was taken related to COVID, but does two things on the form; it fills in box C (which is should not do) with disaster relief code "COVID" AND checks the box in D stating it was a COVID 19 related distribution. The instructions on federal tax form 8915F state to ONLY use Box D if you are reporting a COVID 19 distribution and to leave Box C blank. Please update the software so that when you check the box when completing the user's taxes, it does not populate a COVID disaster relief code that is invalid. It has caused my tax return to be rejected by the federal government thrice now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is 8915-f going to be available?

On this step, I do not have a 1099-R form for 2022, but I have been splitting the declaration of the distribution I took out in 2020 for the last two years, so the only 1099-R form I got is from 2020. So when I answer "No" to the question, "Did you get a 1099-R in 2022?" It doesn't allow me to generate the 8915-F form to declare my last year of the three-year split. Is there an update pending on the TurboTax website, or are we not using the 8915-F form to report the last year of the split?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

news411chris

New Member

mikebones92182

New Member

CMcBeth59

New Member

rleboyd

New Member

qmmorr87

New Member