- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Unemployment Benefits

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Benefits

I have received emails from turbo tax not to worry about filing a amendment for unemployment. Do you know when IRS will send payments for that since President Binden passed the law after I filed.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Benefits

Here is why you do NOT amend your federal return for unemployment:

Please read this very recent news from the IRS:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Benefits

I wasn't asking if I needed to do a ammendment to my return. I am asking how do I know how much I will get and when I will receive it. Also is there a IRS tool that I can check the status

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Benefits

@anitracllns We cannot tell you how much you will get back since we cannot see your tax return and do not know how much you had withheld from your unemployment or what other income you had. The IRS will do those calculations. The checks are being issued by the IRS, and no, there is not a way to track when you will get your additional check. They began to send the checks out recently and will continue during the coming months.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Benefits

Is there a phone number that I can call to actually speak to someone at the IRS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Benefits

To call the IRS:IRS: 800-829-1040 hours 7 AM - 7 PM local time Mon-Fri

Listen to each menu before making the selection.

First choose your language. Press 1 for English.

Then do NOT choose the first choice re: "Refund", or it will send you to an automated phone line.

Instead, press 2 for "personal income tax".

Then press 1 for "form, tax history, or payment".

Then press 3 "for all other questions."

Then press 2 "for all other questions." It should then transfer you to an agent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Benefits

EVERYONE ... Log into your account to see the updated return and the new refund amount. The program was updates more than a month ago but the IRS may take a couple of months to fix everyone's return on their end.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Benefits

I don't see anything different unless it has not updated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Benefits

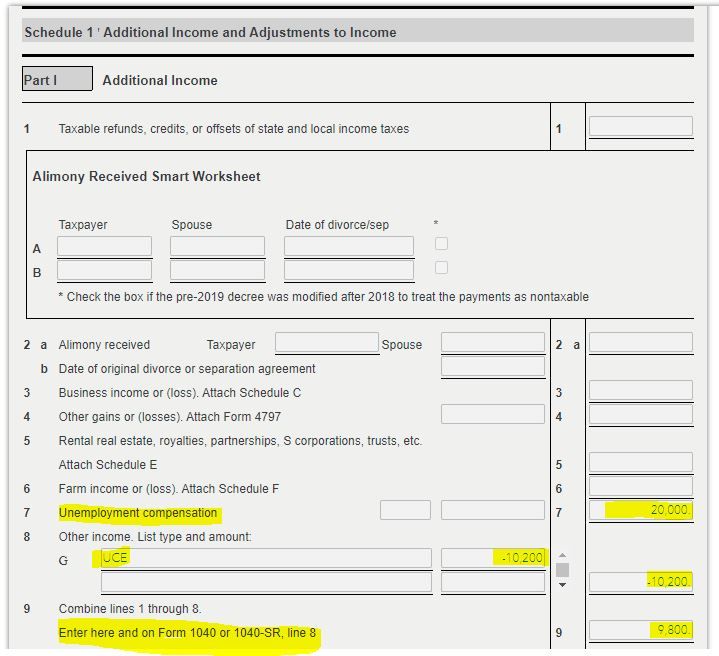

The exclusion is reported on Schedule 1 Line 8 as a negative number. The unemployment compensation received is on Line 7 of Schedule 1. The result flows to Form 1040 Line 8.

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Benefits

I don't have tools on the left side of the screen. All it says on the left side is TurboTax and Taxhome that's it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Benefits

@anitracllns wrote:

I don't have tools on the left side of the screen. All it says on the left side is TurboTax and Taxhome that's it.

To access your current or prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

When you sign onto your online account and land on the Tax Home web page, scroll down and click on Add a state.

This will take you back to the 2020 online tax return where the links on the left side column will be available.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Benefits

Good morning I know the IRS has started issuing refunds for the unemployment tax refund. When I log into Turbo tax I see the amount has been adjusted however I still have not received a refund as of yet which I know will be issued throughout the summer. My concern is that there is no way to track the unemployment refund and I have heard and seen online that other Turbo tax users have the same issue and concern I have even tried contacting the IRS and was unable to get a answer of the status of the return.

Does Turbo tax predict any issues with this like it was for the 3rd Stimulus check where the refund went to the wrong place????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Benefits

TurboTax cannot tell you when the IRS will issue the refund for the unemployment tax. Only the IRS can tell you---and they are already so backlogged they will not be thrilled to start getting phone calls about those checks. You should expect the refund to go to the same account you used for the refund on your 2020 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Benefits

Will Turbo Tax continue to get updates regarding the Unemployment tax exemption for 2020 tax break.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Benefits

@anitracllns No. TurboTax will not get any updates about the unemployment refunds that are being sent out. The IRS is doing that and the payments will be sent out during the next several months. TT cannot predict or track when you will get your refund.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

talib-ilm1

New Member

mollybuo

New Member

JLeeStevens1980

New Member

Sbrandon97

Level 1

TakeFive

Level 2