- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: To avail Tesla Tax credit, Do I have to owe taxes at the time of filing returns? or is it on top of the refund that I get?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

To avail Tesla Tax credit, Do I have to owe taxes at the time of filing returns? or is it on top of the refund that I get?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

To avail Tesla Tax credit, Do I have to owe taxes at the time of filing returns? or is it on top of the refund that I get?

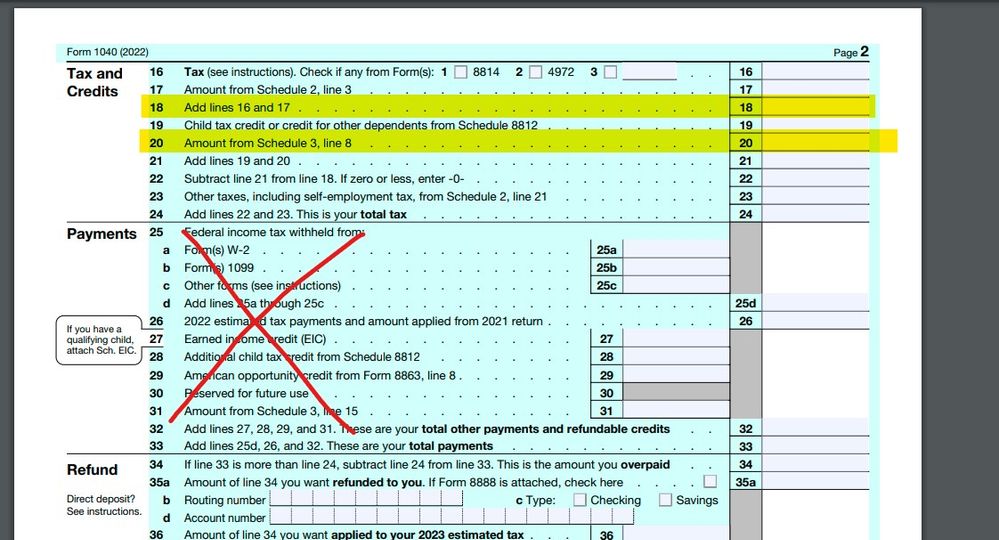

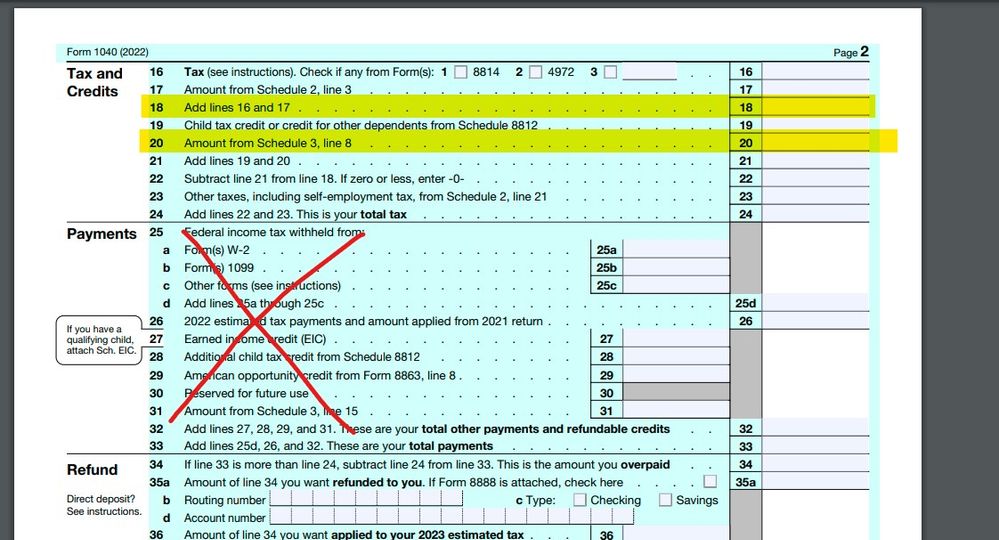

This can be confusing to non tax pros so look at your 2022 tax return form 1040 line 18 ... this was your 2022 tax liability that could be negated by the EV credit on line 20. Amounts in the PAYMENT section (like withholding) are immaterial to how much EV credit you can use.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

To avail Tesla Tax credit, Do I have to owe taxes at the time of filing returns? or is it on top of the refund that I get?

You have to owe taxes (have a calculated tax liability) at the time of filing a return.

The credit is non-refundable, so you won’t get a refund for the unused portion of it. In addition, you can’t carry the credit over to your next year’s return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

To avail Tesla Tax credit, Do I have to owe taxes at the time of filing returns? or is it on top of the refund that I get?

Thanks for quick response.

'Calculated Tax Liability' is the amount on line 37 of Form 1040?

37 Subtract line 33 from line 24. This is the amount you owe.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

To avail Tesla Tax credit, Do I have to owe taxes at the time of filing returns? or is it on top of the refund that I get?

No it's on the tax liability on line 24 Total Tax. Not your refund or tax due.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

To avail Tesla Tax credit, Do I have to owe taxes at the time of filing returns? or is it on top of the refund that I get?

I think it's the tax liability on line 18 (rather than line 24) that the credit is applied against.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

To avail Tesla Tax credit, Do I have to owe taxes at the time of filing returns? or is it on top of the refund that I get?

This can be confusing to non tax pros so look at your 2022 tax return form 1040 line 18 ... this was your 2022 tax liability that could be negated by the EV credit on line 20. Amounts in the PAYMENT section (like withholding) are immaterial to how much EV credit you can use.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

To avail Tesla Tax credit, Do I have to owe taxes at the time of filing returns? or is it on top of the refund that I get?

If we take below as an example,

With Tesla tax credit, Line 20 will become 7,500, Line 21 will be 9500 and Line 22 will be 4,192?

18 Add lines 16 and 17 . . . . . . . . . . . . . . . . . . . . . . . . 18 : 13,692

19 Child tax credit or credit for other dependents from Schedule 8812 .......... 19 : 2,000

20 Amount from Schedule 3, line 8 .................... 20

21 Add lines 19 and 20 ........................ 21 : 2,000

22 Subtract line 21 from line 18. If zero or less, enter -0- .............. 22 : 11,692.

23 Other taxes, including self-employment tax, from Schedule 2, line 21 ......... 23

24 Add lines 22 and 23. This is your total tax ................. 24 : 11,692.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

To avail Tesla Tax credit, Do I have to owe taxes at the time of filing returns? or is it on top of the refund that I get?

Experts ,

Could you please confirm if below example numbers with tesla credit make sense ?

If we take below as an example,

With Tesla tax credit, Line 20 will become 7,500, Line 21 will be 9500 and Line 22 will be 4,192?

18 Add lines 16 and 17 . . . . . . . . . . . . . . . . . . . . . . . . 18 : 13,692

19 Child tax credit or credit for other dependents from Schedule 8812 .......... 19 : 2,000

20 Amount from Schedule 3, line 8 .................... 20

21 Add lines 19 and 20 ........................ 21 : 2,000

22 Subtract line 21 from line 18. If zero or less, enter -0- .............. 22 : 11,692.

23 Other taxes, including self-employment tax, from Schedule 2, line 21 ......... 23

24 Add lines 22 and 23. This is your total tax ................. 24 : 11,692.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

To avail Tesla Tax credit, Do I have to owe taxes at the time of filing returns? or is it on top of the refund that I get?

Q. Could you please confirm if below example numbers with tesla credit make sense ? If we take below as an example, With Tesla tax credit, Line 20 will become 7,500, Line 21 will be 9500 and Line 22 will be 4,192?

A. Yes, if you qualify for the full $7500, on your 2022 tax return*. The (up to) $7500 is first calculated on form 8936 and gets to line 20 (of form 1040) via Schedule 3.

*https://www.irs.gov/credits-deductions/credits-for-new-electric-vehicles-purchased-in-2022-or-before

EV Credit rules for 2023 and beyond:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

To avail Tesla Tax credit, Do I have to owe taxes at the time of filing returns? or is it on top of the refund that I get?

perfect .. thank you very much for all the help !!!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tjsheth69

New Member

cramh

New Member

raj98

New Member

virii19790829

New Member

Marjie33

Level 1

in [Event] FIrst Financial Bank + TurboTax | Ask the Experts About Your Taxes