- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Program is making me file a 8889-T form for high deductible health plan (HDHP) because I have...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Program is making me file a 8889-T form for high deductible health plan (HDHP) because I have an HSA, but I did not have a HDHP

I cannot complete my file because there is one error in my Federal tax return. I have in Box 12 of my W-2 a "W" which indicates I have a HSA. I did not have a HDHP coverage for my health insurance, so I do not have an entry for the 8889-T form. What am I supposed to do to complete this? I tried deleting the form and instead, the software automatically selects the form to fill out for me.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Program is making me file a 8889-T form for high deductible health plan (HDHP) because I have an HSA, but I did not have a HDHP

Since you had a Code W in Box 12 on your W-2, you received a pre-tax deduction for your HSA.

Since you didn't have an HDHP health plan, you won't be able to get the deduction for your HSA contribution.

The Form 8889-T is generated because of the HSA on your W-2. You can still use your HSA for Medical Expenses, you just can't deduct it. You may have an 'excess contribution' which you can withdraw by April 15, 2021.

Click this link for more info on Form 8889-T. TurboTax will fill out the form for you. You may want to go through the HSA section again to check your entries.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Program is making me file a 8889-T form for high deductible health plan (HDHP) because I have an HSA, but I did not have a HDHP

I have the same situation, I was on a HDHP in 2019 and had an HSA. For 2020 however I am no longer on a HDHP but my employer made a contribution to my HSA so TurboTax is having me complete the 8889-T. Except I can't get past an error on the form, specifically it's line 1 where it asks to check the HDHP coverage I had in 2020 and the only options are Self or Family. I wasn't on a HDHP for 2020 and there is not a None option. I am stuck at this step and cannot continue filing my taxes. Help!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Program is making me file a 8889-T form for high deductible health plan (HDHP) because I have an HSA, but I did not have a HDHP

A code W in box 12 of a W-2 reported a pre-tax deduction for your Health Savings Account.

IRS Form 8889 determines whether you qualify for the pre-tax deduction.

If you are not able to click Yes, I was covered by an HDHP during at least one month during 2020, you may have excess contributions which you can withdraw by April 15.

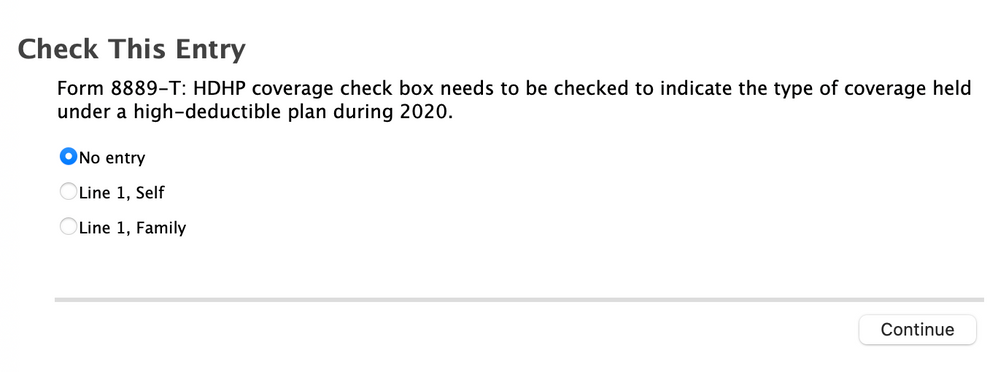

Is this the error message that you are receiving?

See also this TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Program is making me file a 8889-T form for high deductible health plan (HDHP) because I have an HSA, but I did not have a HDHP

Attached is a screenshot of the error message. I didn't have a HDHP for 2020 so I don't think I should select that I did.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Program is making me file a 8889-T form for high deductible health plan (HDHP) because I have an HSA, but I did not have a HDHP

To be eligible to contribute to an Health Savings Account in 2020, you:

- Must have been covered by a high-deductible health plan (HDHP);

- Did not have Medicare or other secondary health insurance policy; and

- Were not eligible to be claimed as a dependent on another return, no matter if you were claimed or not.

Do you have a code W in box 12 of a W-2? If so, it reported a pre-tax deduction for a Health Savings Account.

It sounds like that at the screen Were you covered by a High Deductible Health Plan (HDHP) in 2020?, you need to select No I did not have coverage.

The software will likely conclude that you have an excess contribution that may be:

- Withdrawn in part by April 15,

- Withdrawn in full by April 15, or

- Subject to an extra tax of 6%.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Program is making me file a 8889-T form for high deductible health plan (HDHP) because I have an HSA, but I did not have a HDHP

Yes I do have a W on my W-2 in box 12 which shows the value my employer contributed to my HSA. I did also select "No, I did not have coverage" to the question of was I covered by a HDHP in 2020. It then tells me that I have an excess contribution and I select that I'll withdraw the excess employer contributions by April 15, 2021.

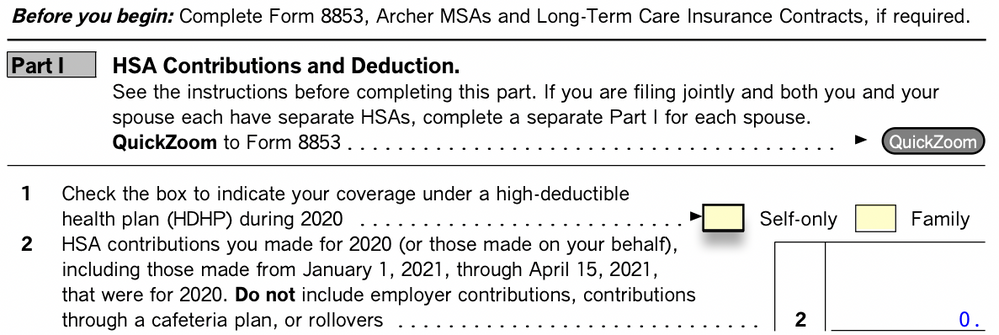

Still when I get to the end of my taxes and do the Smart Check, I get that error from my previous post asking me to select what HDHP coverage I had in 2020. It looks like it is forcing this question because line 1 on the 8889-T form requires an answer, screen shot of the 8889-T form below:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Program is making me file a 8889-T form for high deductible health plan (HDHP) because I have an HSA, but I did not have a HDHP

So should I ignore the Smart Check error above and just leave question 1 blank on the 8889-T form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Program is making me file a 8889-T form for high deductible health plan (HDHP) because I have an HSA, but I did not have a HDHP

You have two choices:

1. Ask your employer if they will take back the contribution for 202 when they knew that you were not eligible. This is one case in which the IRS will allow the employer to withdraw funds from your HSA. Then the employer owes you a corrected W-2, showing no code W entry in box 12 on the W-2. Without that code W entry, TurboTax won't trigger the 8889.

-- or --

2. Let TurboTax tell you about the excess contribution; call the HSA custodian to withdraw the excess (they will calculate any earnings and add them to the check they send you); early next year you will receive a 1099-SA so that the earnings can be taxed next year.

Then, to bypass the Smart Check error, go into Forms mode (I assume you have the CD/download software), and check the Self box on line 1. But you will object that you didn't have any HDHP coverage in 2020 - that's true, but it won't matter.

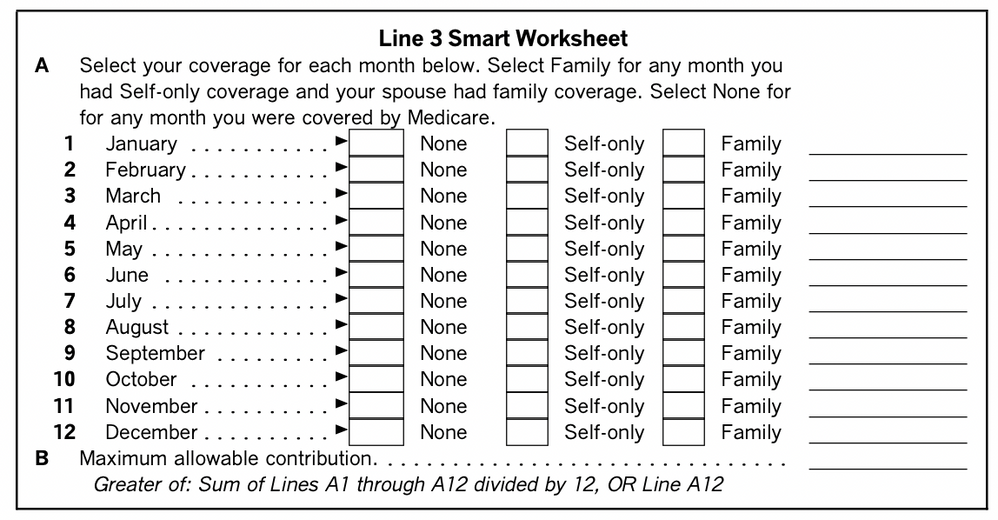

On line 3 on the 8889, you are showing no HDHP coverage for any month, so this is correct. You are making this line one entry just to get past the error check in TurboTax. Your 8889 will be substantially correct.

Make a note to your self of what I asked you to do and stick it in your permanent tax file, in the very unlikely case that anyone ever asks.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Program is making me file a 8889-T form for high deductible health plan (HDHP) because I have an HSA, but I did not have a HDHP

Thank you for the response. I'm going through option 2 as suggested but just want to confirm that selecting None for the months on line 3 of the 8889 won't set off any red flags because the instructions say to select None if you were covered by Medicare for those months. Screenshot below for reference:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Program is making me file a 8889-T form for high deductible health plan (HDHP) because I have an HSA, but I did not have a HDHP

Yes, on Line 3, None is the right answer if you did not have Self-only or Family HDHP coverage for that month. NONE basically means No valid HDHP coverage, and covers Medicare, no coverage, HDHP with conflicting coverage, and so on.

In the Step-by-step HSA interview did you see the question "Did you have HDHP coverage for any month in 2020? (or however it is phrased)?" You should have answered No. This should have marked each month as NONE for you already.

Well, no matter, NONE is what you want on line 3 for each month.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Program is making me file a 8889-T form for high deductible health plan (HDHP) because I have an HSA, but I did not have a HDHP

I am trying to finish up my taxes and continue to get an error about a 8889-T form that I don't have. I do have a 1095-C form but I don't know where to put that info. I don't have a HDHP and turbo tax keeps asking if I do. Im not sure what to do

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Program is making me file a 8889-T form for high deductible health plan (HDHP) because I have an HSA, but I did not have a HDHP

You do not have to enter a 1095-C in TurboTax.

Do you have a W-2 with a code W in box 12 reported a pre-tax deduction for your Health Savings Account?

IRS Form 8889 determines whether you qualify for the pre-tax deduction.

If you are not able to click Yes, I was covered by an HDHP during at least one month during 2020, you may have excess contributions which you can withdraw by April 15.

Is this the error message that you are receiving?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Program is making me file a 8889-T form for high deductible health plan (HDHP) because I have an HSA, but I did not have a HDHP

I also get the error above for no valid reason. I did NOT have a W in box 12 of any W-2s. I did not give any indication that I had HDHP coverage. I have had employer provided coverage for the last 10 years. I cannot find anything wrong with my TurboTax questions that forces me down this invalid path. I truly think this is an issue with the TurboTax software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Program is making me file a 8889-T form for high deductible health plan (HDHP) because I have an HSA, but I did not have a HDHP

Please provide additional details about the error you are seeing.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

davidthomasmueller

New Member

KenJJ

New Member

Steveaub73

New Member

coasttocoast

New Member

suill

Level 1