- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Yes I do have a W on my W-2 in box 12 which shows the value my employer contributed to my HSA. I did also select "No, I did not have coverage" to the question of was I covered by a HDHP in 2020. It then tells me that I have an excess contribution and I select that I'll withdraw the excess employer contributions by April 15, 2021.

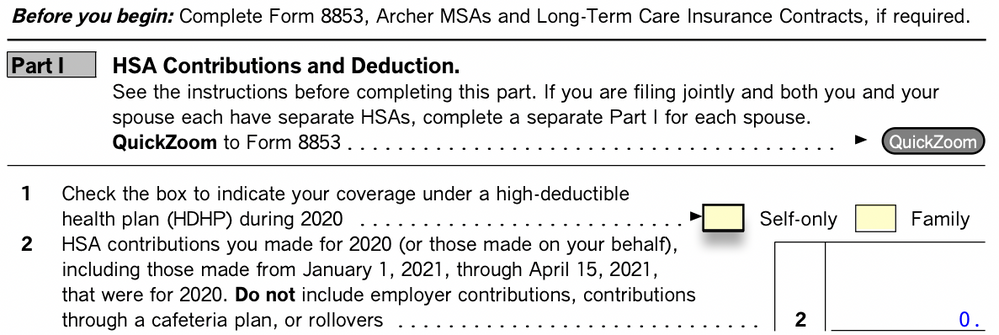

Still when I get to the end of my taxes and do the Smart Check, I get that error from my previous post asking me to select what HDHP coverage I had in 2020. It looks like it is forcing this question because line 1 on the 8889-T form requires an answer, screen shot of the 8889-T form below:

March 7, 2021

11:38 AM