- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How to enter cryptocurrency on the downloaded version???

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

@MaxRLC wrote:What directions?

This? You didn't see my earlier posts on other threads?

You can only import crypto into the Online version. For Desktop program you can start a free online Premier return to import it then download the .tax2021 file for free and open it in the Desktop program. But that would mean starting over with the new file and losing all the Desktop entries you already made.

See the last answer by Expert Patricia here,

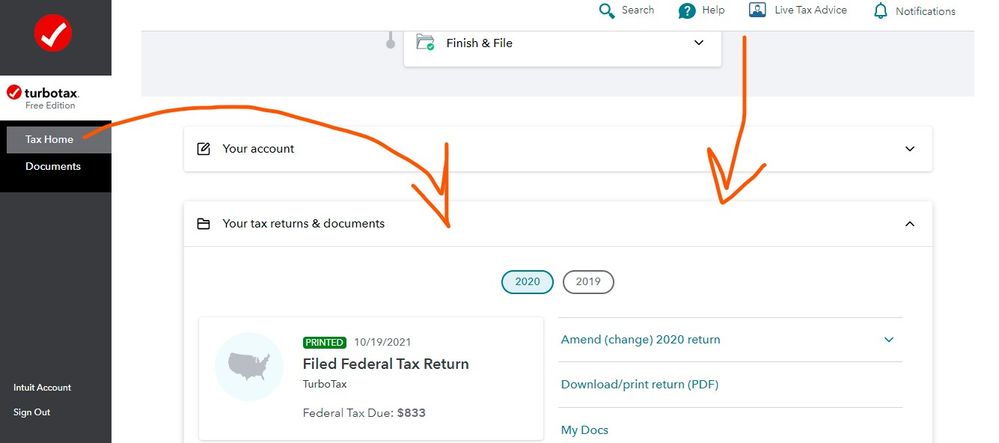

Since you have to start a new blank Online return you can start the Online return by transferring 2020 from your computer if you used Turbo Tax last year.

How to transfer into the Online version. You need to have the prior year .tax2020 file on your computer. Expand the link if you used the CD/download last year........

Then import crypto and download the .tax2021 file to open in the Desktop program. Download the .tax2021 file for free

How do I save my TurboTax Online return as a tax data file?

Then to continue in the desktop version see this…….

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

Lots of work -

Turbo Tax and the exchanges should have come up with an easier, more efficient way.

No surprise that they didn't.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

If I start TT tax year 2021 via the online TT version then AFTER i upload my crypto transactions

How or where do I download the TT file created online so I can finish with my Macintosh Desktop version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

Simple ... log in and on the landing page scroll down and choose 2021 then download the .taxfile.

Then install and update the downloaded version and OPEN the return ... do not transfer or import it. If you had started a state return in the online program then delete it before you save the .taxfile and if you cannot remove it then you will have to start a fake return in the downloaded program and fill in just enough the start the state return so you can download the needed state which is in the .taxfile.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

ty can i still import info into it from my prev yr tt tax return created from a desktop mac version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

Sorry no. But there might be a way. Since you have to start a new blank Online return you can start the Online return by transferring 2020 from your computer if you used Turbo Tax last year. Then download the crypto and move the online return to the Desktop program.

How to transfer into the Online version. You need to have the prior year .tax2020 file on your computer. Expand the link if you used the CD/download last year........

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

{22-10-15 @ 14:45 EDT}

Option 2: NG

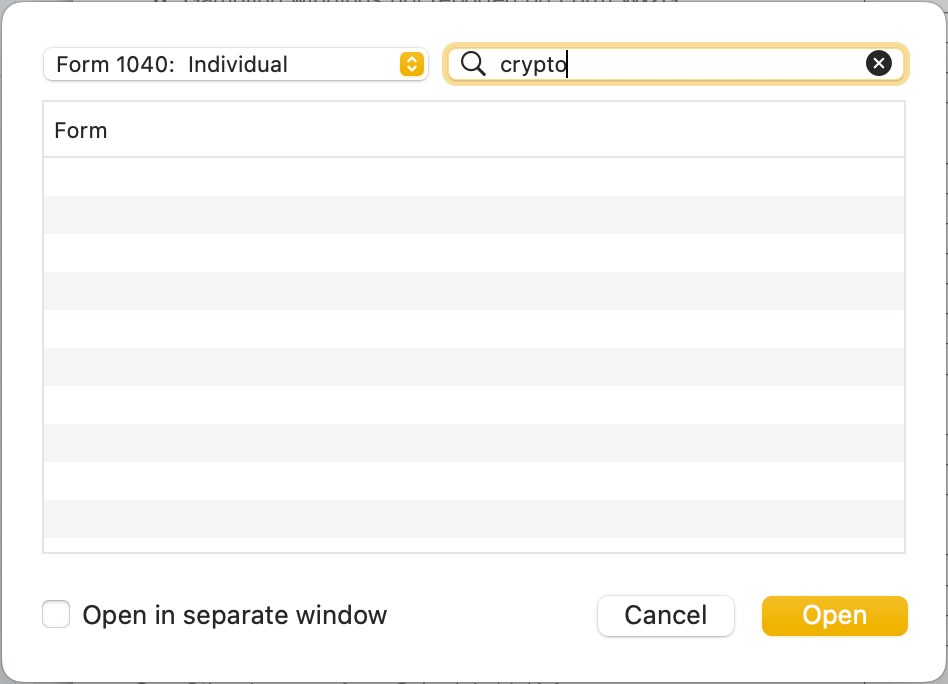

Sorry, just did what you said in TT2021/CD H&B and no form was found. The lack of support for cryptocurrency is very displeasing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

This is a nice suggestion Cathryn, unfortunately, when opening forms, and searching Crypto... nothing comes up (see attached screenshot).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

The easytxf.com method worked for me as well for tax year 2021. When I imported my tax year 2022 crypto transactions, though, the wrong sales categories were populated (e.g., Box A covered instead of Box C not reported). I have hundreds of transactions with the wrong sales category assigned, so editing each one is not an option. I would rather not enter summary data and mail in details with Form 8453. Any suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

Are you downloading a .csv file?

You may be able to correct the .csv file in a spreadsheet faster than correcting each individual entry after it has been downloaded into the software.

Then run the file through easytxt.com.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

Thanks for reply. I did download a csv then successfully converted with easytxf. The import file into TT desktop version did not have a field for the short or long term. Turbo Tax ust populated the Boxes as Reported rather than Not Reported. I finally gave up and went to the Forms view to change the Reported to IRS/Reported on 1099B boxes to No for each transaction. This was at least faster than doing it in Step by Step. Pretty sad the Turbo Tax has not come up with a better method for the desktop version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

THANK YOU!! This has been a problem for me for months! Even though your advise is over a year old, it still applies and worked!! Yes!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

there are no 1099s! That is my problem

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

If you didn't receive a 1099 for your crypto trades you should enter the information as though you did. Use the transaction information that was provided to you to fill out the 1099 form as though you received one.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

no 1099, no tax info, no help & we are talking about over 1,000 entries! Have to report everything even if left in account. Downloading would be the only way to go versus manually,

Thanks

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jeffry-jackson

New Member

tomjenzen

New Member

SB2013

Level 2

fellynbal

Level 3

steve-knoll

New Member