- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How to contact my Full Service expert?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to contact my Full Service expert?

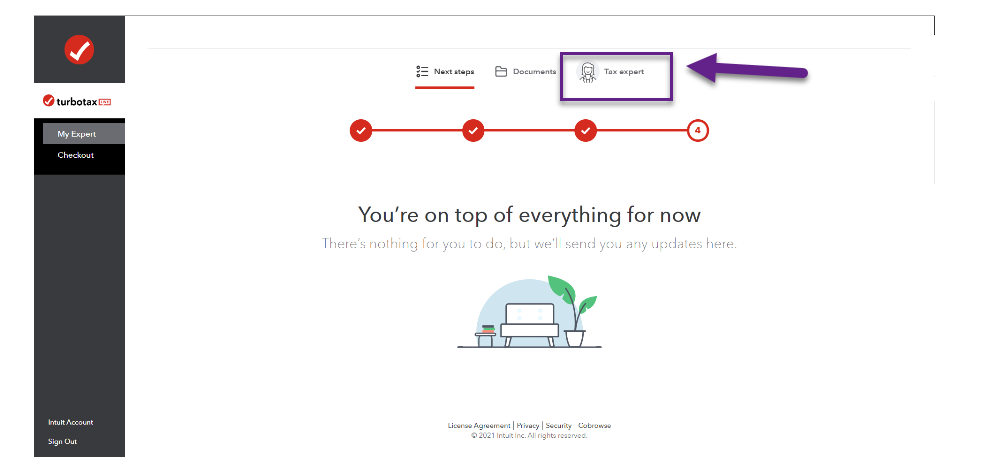

If you'd like to start a chat, please select "Tax Expert" on the top of the screen on the right.

Check out this FAQ on how to upload your documents: How do I upload documents to my tax expert?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to contact my Full Service expert?

Why am I on my third phone call with customer service with no results?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to contact my Full Service expert?

HRD2 So that we can best help you, what exactly do you need assistance with?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to contact my Full Service expert?

My taxes will be different in 2020. I purchased a home and purchased solar. Do I need an expert?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to contact my Full Service expert?

You can always start out doing your tax preparation yourself. If you decide later that you want direct access to tax experts, you can add TurboTax Live or if you decide that you would like a tax expert to complete and file your tax return for you, you can switch to Full-Service. You can add these at any time during your tax preparation; each link above explains these options in detail.

TurboTax will walk you through entering your tax information for both your home purchase (congrats on that!) and the credits from your qualified energy improvements (solar). Under the Residential Energy Efficient Property Credit, you can get a federal tax credit (up to 30% of the costs including labor) for installing alternative energy equipment, such as solar electric property, solar water heaters, and geothermal heat pumps. The credit is non-refundable so it is limited to your tax liability.

Depending on when you purchased the home in 2020, you may or may not receive a tax benefit on your 2020 tax return. As a homeowner, you may be able to deduct:

- Mortgage interest (including points)

- Property (real estate) tax

- Mortgage insurance (PMI or MIP)

- Refinancing costs

You have to itemize your deductions in order to take these homeowner credits. So, if you purchased the home late in 2020, you may not have enough mortgage interest to itemize this year, but if you purchased the home early in 2020, you have closer to a full year of costs to include. You can enter all of your deductions and TurboTax will choose the deduction (standard or itemized) that is best for you automatically, so you don't have to decide that on your own. @cdcount1a

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to contact my Full Service expert?

Have experienced similar frustrating issues trying to sign up for 'full service' for the first time this year.

2 main issues I've come across in talking with at least 5 that have been erroneously assigned to me today.

1. If I request a future contact date after requesting full service, I don't get to choose that future date and subsequently get a call in 5 minutes.

2. Once I was able to connect with my initial expert, the case was somehow able to be taken by a subsequent expert. Perhaps this is due to my request to have future contact?

This is getting super old and I'm likely going to go local next year which I should have done this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to contact my Full Service expert?

You would need to use the FAQ link posted below to reach out to TurboTax customer service for help:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to contact my Full Service expert?

Lol at finding an expert at turbo tax. They pass you around and tell you to come to the community for answers

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to contact my Full Service expert?

Where do I enter the Tax Withheld for tax of Pennsylvania Unemployment Compensation shown on the UC-1099G with Turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to contact my Full Service expert?

Please use the FAQ link posted below and follow the steps walking you through where to enter your 1099-G:

Where do I enter a 1099-G for a state or local tax refund?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to contact my Full Service expert?

TurboTax is a nightmare. It's time to get the word spread around to make people drop out of future problems with the company.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to contact my Full Service expert?

Most of these comments are not related to contacting your Full Service agent. I am closing this thread.

If you need additional assistance, please start your own thread on one of these topics or search for answers here.

@bustadimes Thank you for your feedback.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lmkacher

New Member

gprud910228

New Member

shanesnh

Level 3

user17520162976

New Member

NicholeChristine14

New Member