- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Excess IRA Contribution Reporting

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess IRA Contribution Reporting

Hi,

I have made some excess IRA contributions in Jan 2022 and withdrawn in Dec 2022. Now I am having reporting issues with TurboTax. For simplicity,

1. I contributed $3000 into IRA on Jan 2022

2. I converted the full amount to Roth in a few weeks later

3. Because it turned out I didn't have enough earned income in 2022 for the IRA, I asked to withdraw the entire contribution from Roth, which turned out to be, say, $2000 after capital loss.

In 2023, I received two 1099-R: 1099-R-1 for the Roth, $2000, which is correctly marked as code 8J (excess) in box 7 with table amount (box 2a) of 0. The other one 1099-R-2 is for Simple IRA, $3000, which is marked as taxable amount not determined (2b), and total distribution.

Now the question is how to report the 1099-R-2: If I just enter this 1099-R-2 in Income section as is, Turbotax would treat this as taxable IRA distribution.

In the Deduction & Credit section, should I report this $3000 as IRA contribution even though it was converted to Roth and later full withdrawn? Or should I just not report it on the contribution side at all?

My situation is a bit more complicated than this but would appreciate someone can help me answer this question first.

Thanks,

ZX

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess IRA Contribution Reporting

If you did not deduct the traditional IRA contributions on your tax return, you must indicate that you had nondeductible contributions or the distribution is taxed. Look for the question about nondeductible contributions after you enter your 1099-Rs.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess IRA Contribution Reporting

Thank you - How do I enter nondeductible contributions for this 2022? I tried to enter the IRA contribution at the Deduction and Credit section but didn't seem to be correctly treated as non-deducible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess IRA Contribution Reporting

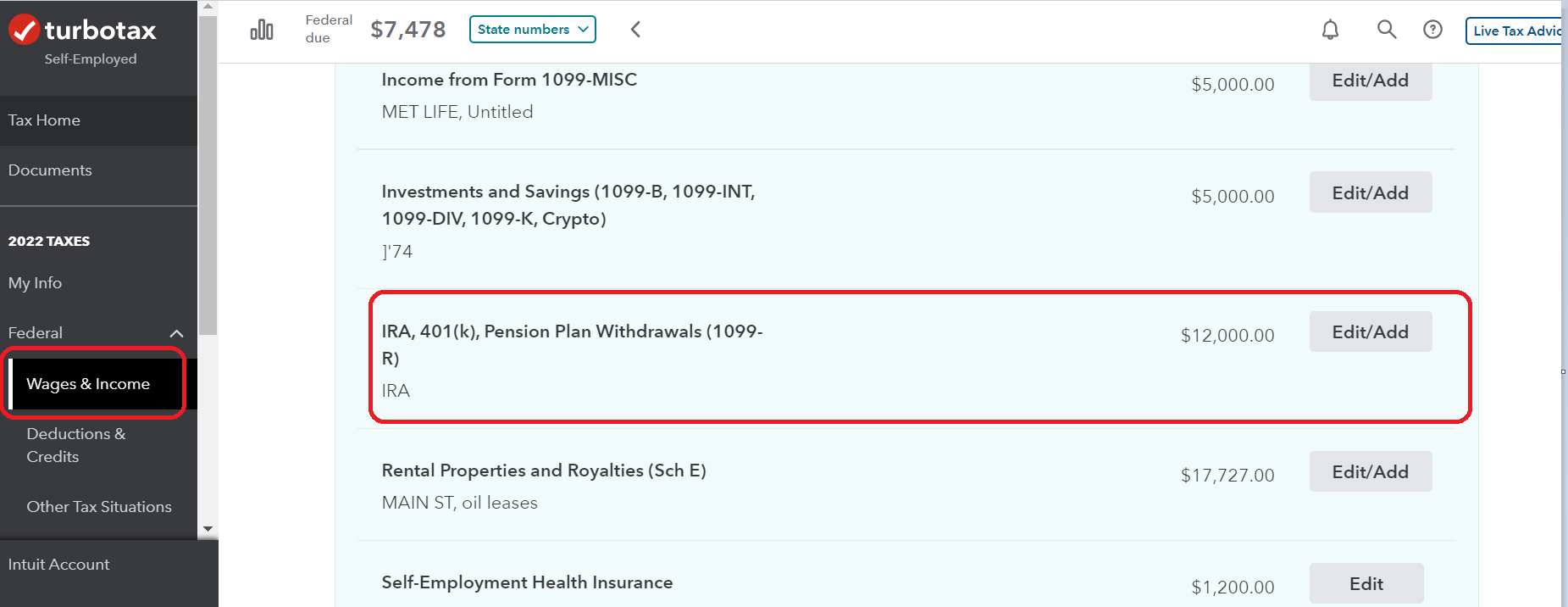

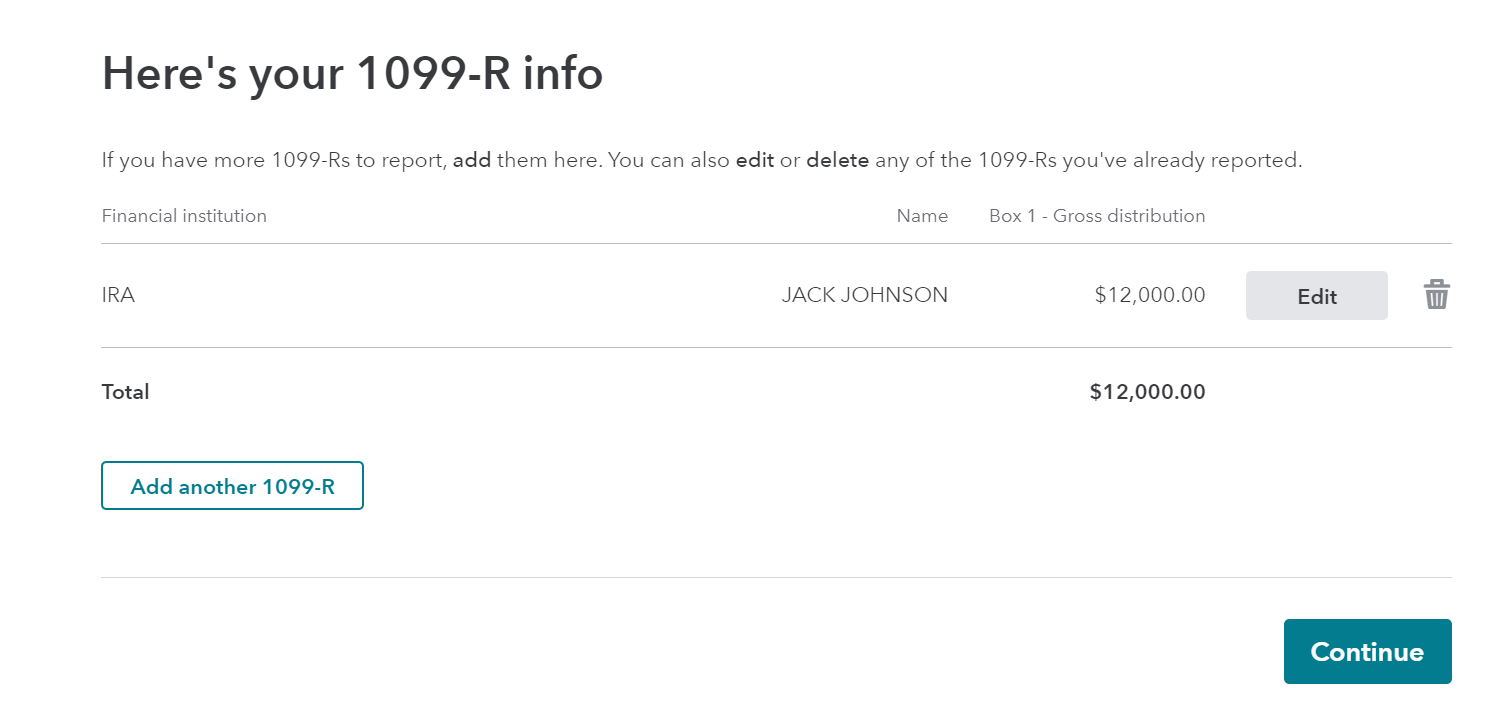

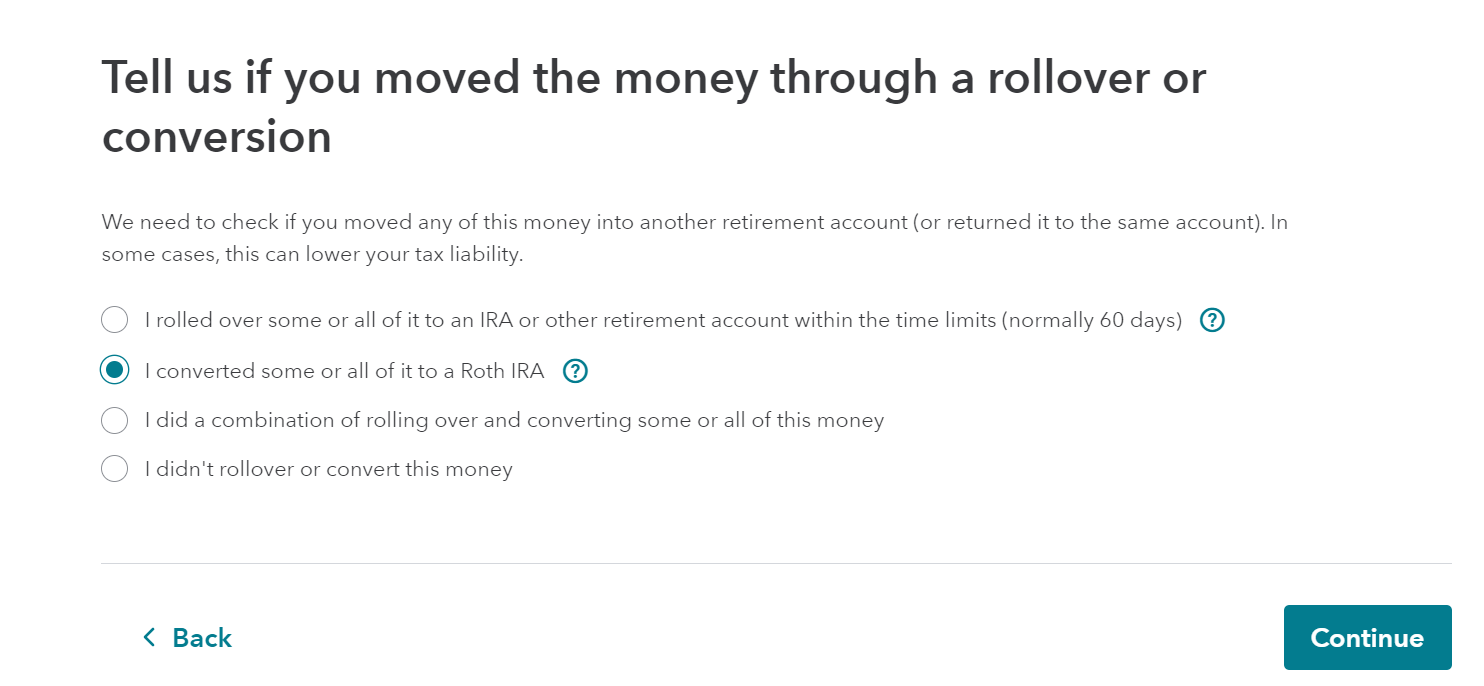

This is entered in the Wages & Income section (see below). First you will have to DELETE the Roth IRA entry. Next, Edit the 1099-R for the traditional IRA and you must indicate that it was converted to a Roth IRA. You will go back to the "Here's your 1099-R info"- Continue.

Next you will see Have you ever taken a disaster distribution before 2022?

Next is Any Nondeductible Contributions to JACK's IRA?

Then you have to go back and enter the 1099-R for the ROTH IRA.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess IRA Contribution Reporting

On the "Any Nondeductible Contributions to IRA" section, it doesn't allow me to specify how much 2022 contribution is nondeductible. It just ask me the basis of Dec 31 2021, which was 0, and the value of Dec 31 2022, which is 0 again. There is no way for me to specify the amount of non-deducible 2022 contribution.

Also does deleting 1099-R for Roth has any effect? I have deleted it and reenter it after adding 1099-R for IRA. It doesn't seem to have any effect.

Is there a way for me to go to Form 8806 (?) directly and modify the number?

Best regards,

ZX

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess IRA Contribution Reporting

Can you clarify what the Box 7 Code on the traditional IRA 1099-R is? You needed to delete the Roth IRA 1099-R and enter the traditional IRS first to get the correct questions. If you are using the online version of TurboTax, you cannot access the Forms-and although you have access to override the forms in the desktop version, by doing so you are not able to e-file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess IRA Contribution Reporting

Box 7 code is 2 and the IRA box is checked.

Box 2b ("Taxable amount is not determined") is checked, Total Distribution is Checked. Box 2a has a number that is equals to Box 1. I was hoping in this case Turbotax would ask me to clarify which portion of the Box 2a number is taxable (should be 0), which is non-taxable (the entire amount). However it didn't.

I had to update Box 2a to 0 to force Turbotax to treat this distribution as non-taxable, which is different from what my institution reports. Is this OK? From my reading, when Box 2b is checked, Box 2a is really not a number to be trusted, so modifying it to make Turbotax work is fine?

Also I figured out why the "Choose Not to Deduct IRA Contributions" is not available to me --- my income was too low so it directly goes to "Contribution is not allowed". I had to put some fake income in place for the "Choose Not to Deduct IRA Contributions" to show up, and then delete the fake income.

Best regards,

ZX

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess IRA Contribution Reporting

It is not recommended to make entries that differ from what is on your Form 1099-R. The IRS make take acception to it and it may invalidate your TurboTax accuracy guarantee.

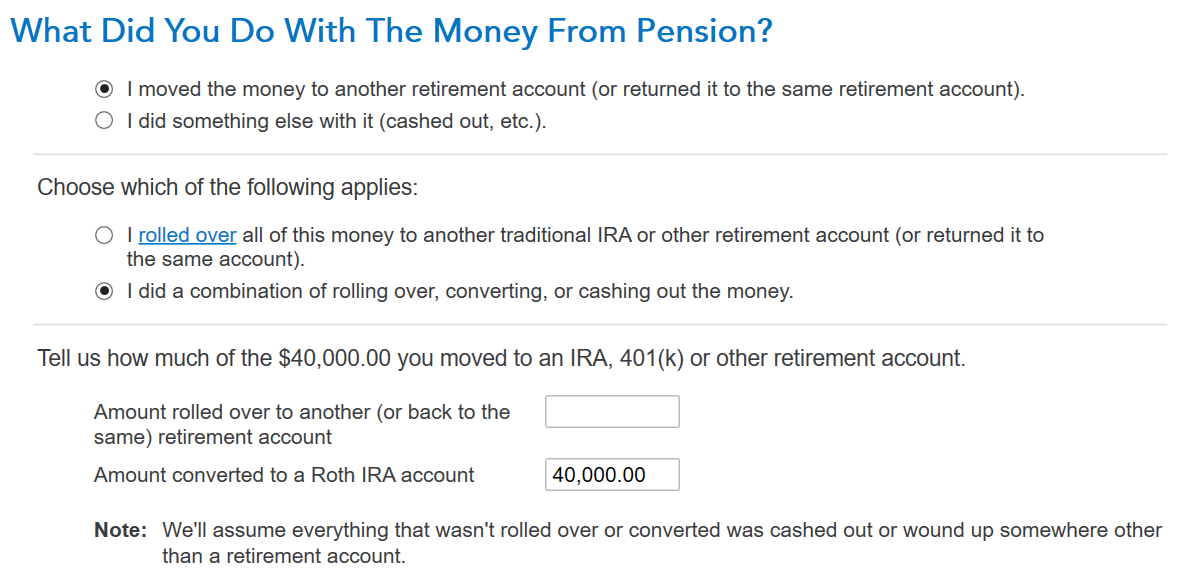

Even if box 2(a) shows the distribution as being taxable, if you answer the questions right in TurboTax you can have it listed as non-taxable on your Form 1040. When asked, you have to indicate that you moved the money to another retirement account and enter the amount converted to your ROTH IRA.

Later on, you will be asked if you made non-deductible contributions to your IRA, which you did, so answer "yes". Then you will be asked for your basis in IRA's at December 21, 1021, to which I answered $40,000. On the next page it asked for the value of traditional IRA's at December 31, 2022, to which I answered $0. When I did this the distribution showed as not taxable on line 4(b) of Form 1040. TurboTax assumed the non-deductible IRA balance (the basis) at end of the previous year was the amount distributed to complete the ROTH IRA conversion, since the ending balance was $0.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess IRA Contribution Reporting

Thanks all for sharing your thoughts.

I use Turbotax Online, which seems to be different from yours.

With the help of an EA from Turbotax Live, the final solution is to mark the distribution as Rollover to tell Turbotax that it is as nontaxable. A "conversion to Roth" would have triggered Turbotax to treat it as taxable, no matter how I tried to mark the original contribution as non-deductible.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gsa705

New Member

Opus 17

Level 15

ambtlb13

Level 1

Kavekreeker

Level 2

rgrave

New Member