- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

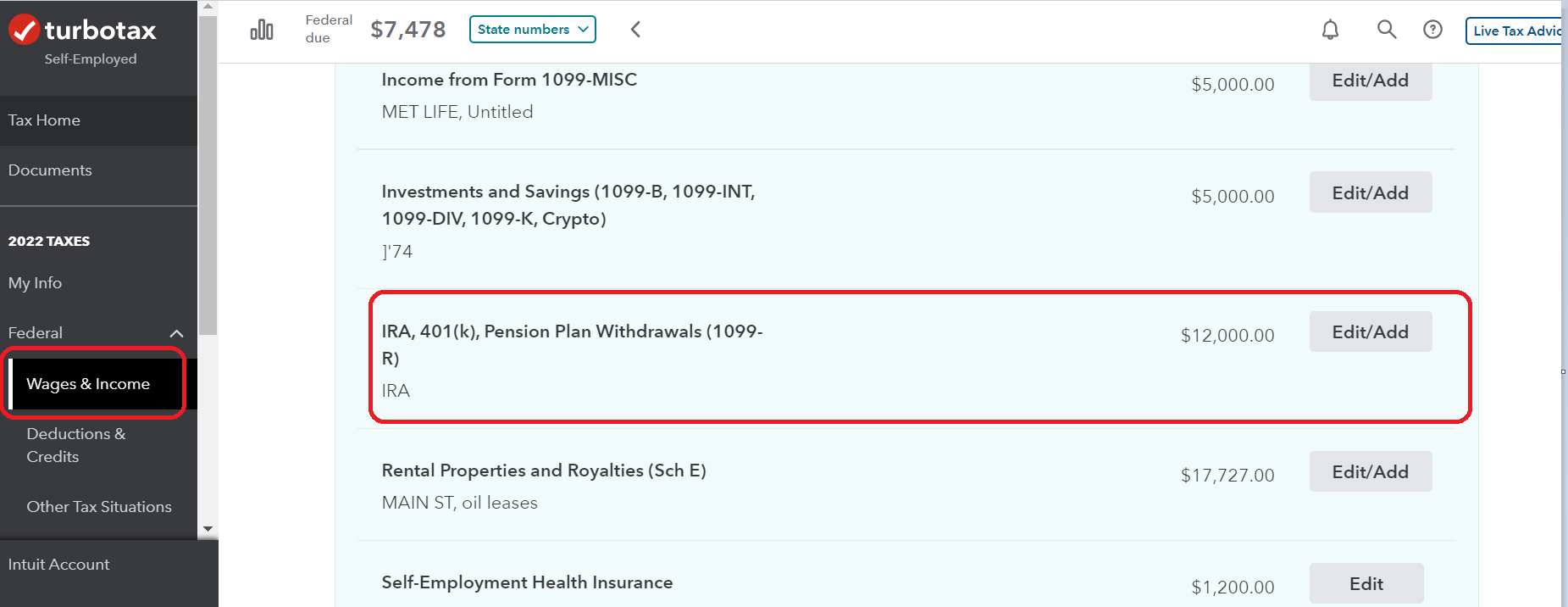

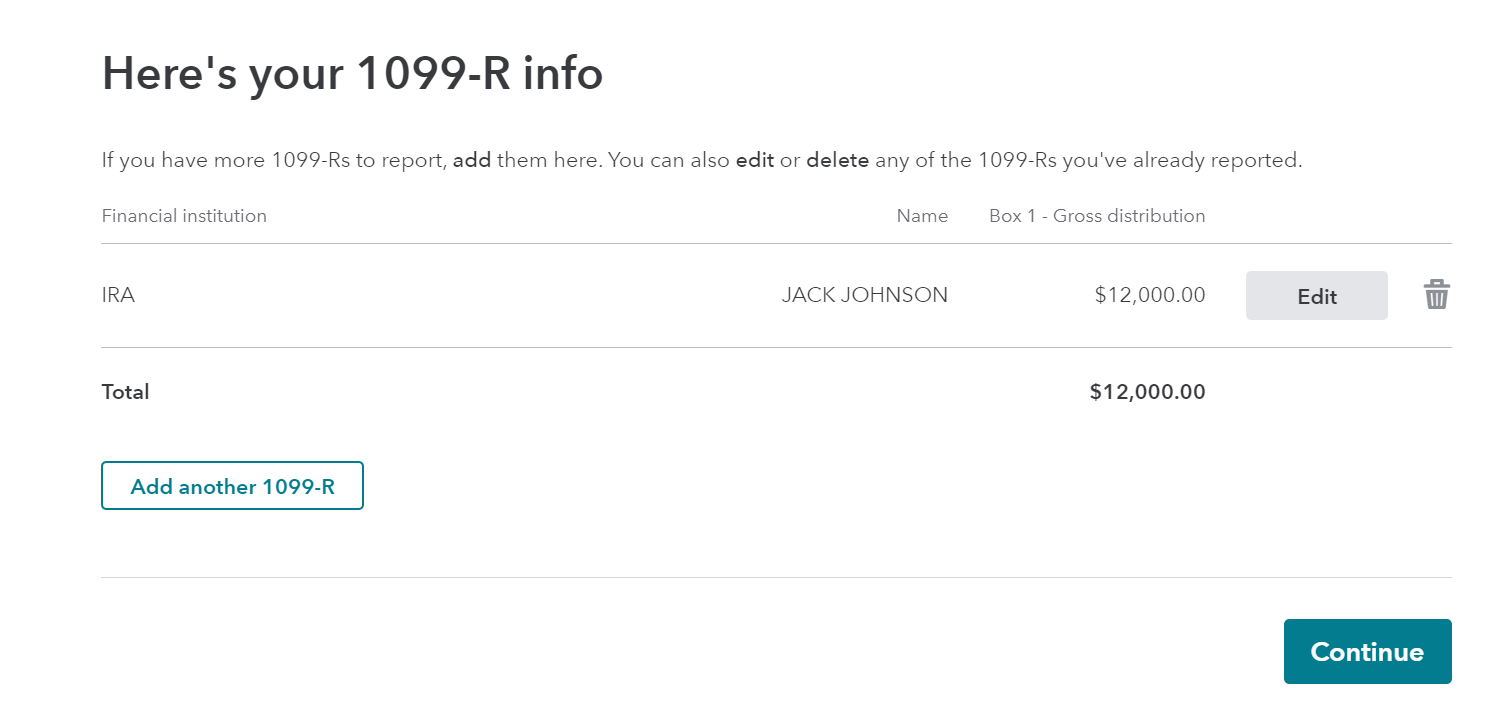

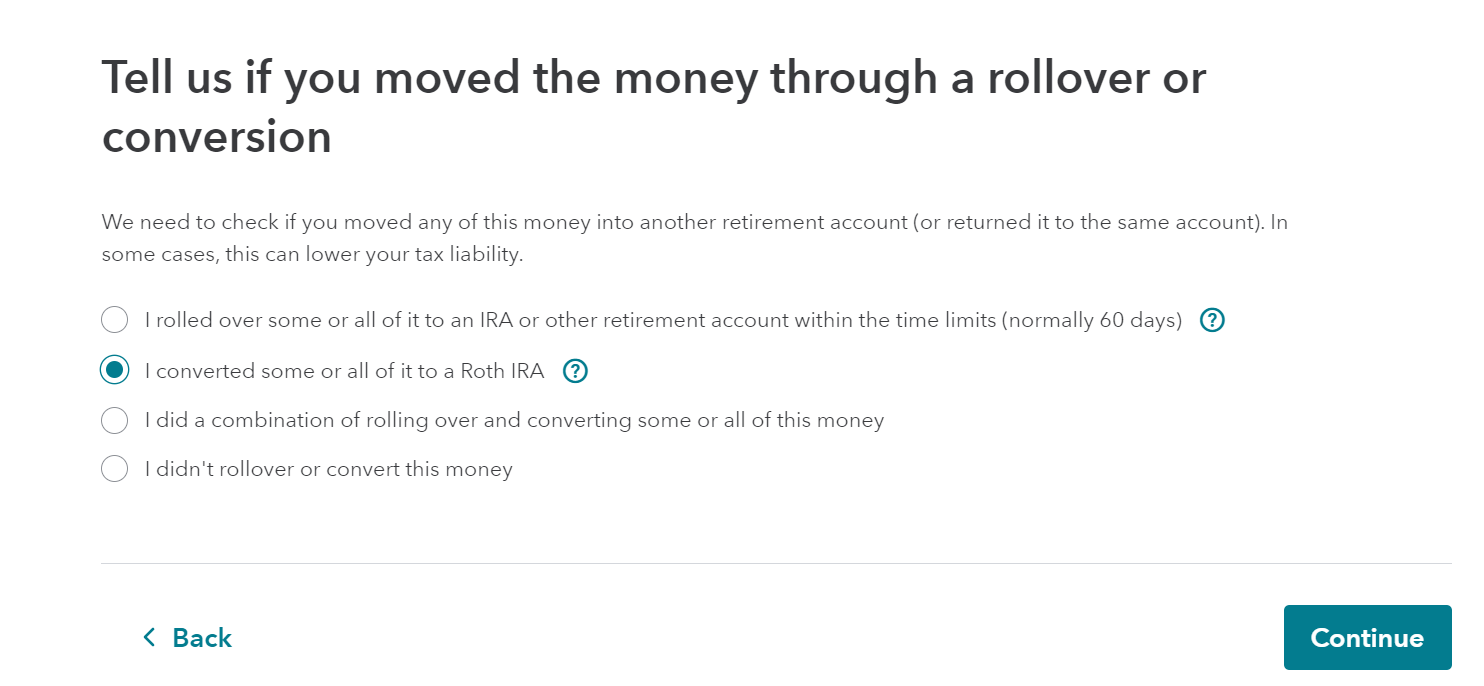

This is entered in the Wages & Income section (see below). First you will have to DELETE the Roth IRA entry. Next, Edit the 1099-R for the traditional IRA and you must indicate that it was converted to a Roth IRA. You will go back to the "Here's your 1099-R info"- Continue.

Next you will see Have you ever taken a disaster distribution before 2022?

Next is Any Nondeductible Contributions to JACK's IRA?

Then you have to go back and enter the 1099-R for the ROTH IRA.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 22, 2023

8:34 PM