- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

It is not recommended to make entries that differ from what is on your Form 1099-R. The IRS make take acception to it and it may invalidate your TurboTax accuracy guarantee.

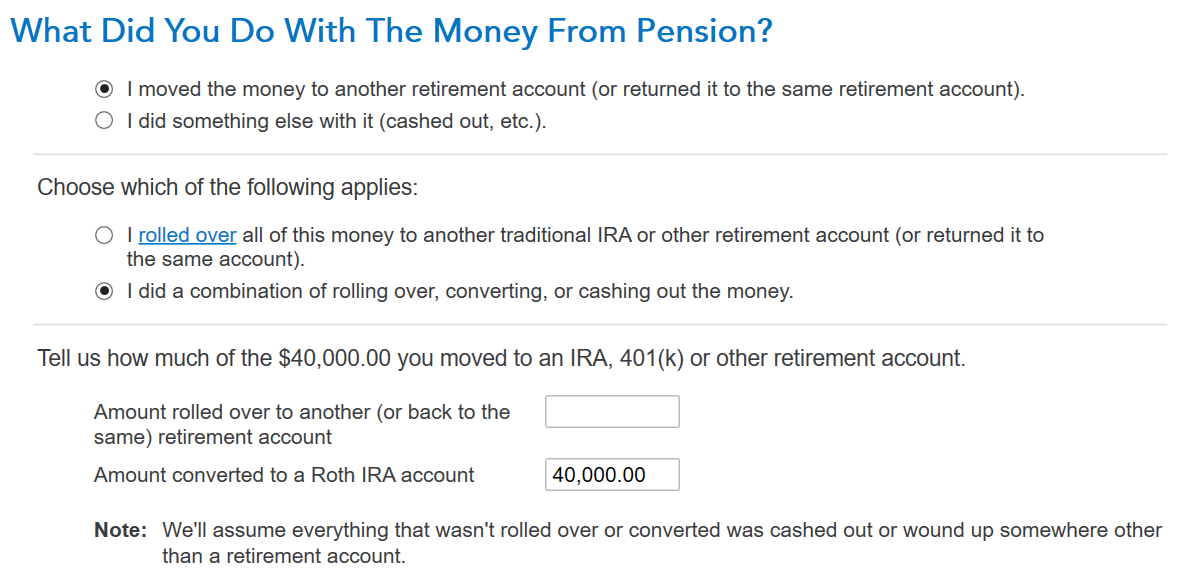

Even if box 2(a) shows the distribution as being taxable, if you answer the questions right in TurboTax you can have it listed as non-taxable on your Form 1040. When asked, you have to indicate that you moved the money to another retirement account and enter the amount converted to your ROTH IRA.

Later on, you will be asked if you made non-deductible contributions to your IRA, which you did, so answer "yes". Then you will be asked for your basis in IRA's at December 21, 1021, to which I answered $40,000. On the next page it asked for the value of traditional IRA's at December 31, 2022, to which I answered $0. When I did this the distribution showed as not taxable on line 4(b) of Form 1040. TurboTax assumed the non-deductible IRA balance (the basis) at end of the previous year was the amount distributed to complete the ROTH IRA conversion, since the ending balance was $0.

**Mark the post that answers your question by clicking on "Mark as Best Answer"