- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Deduction for married filling separately

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interests deduction for married filling separately

I am married in 2021 and I want to fill as married filling separately.

I found that in "Federal Review" section, my itemized deduction is only $5000, while in "Deductions & Credits" section, I have more than $10k mortgage interest and more than $10k property taxes.

More specifically, in the Federal Review section, I saw, the Real estate taxes and State and local taxes add up to $5k, which is the cap for me. Mortgage interested is the same as what I entered (more than $10k). However, the total deduction is just $5k, so the mortgage does not actually count. That sounds like a software bug to be honest.

I tried to modify my status to be single and I got all of those tax deduction. My understanding is that I may have lower deduction caps but not losing them. Do I miss anything?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interests deduction for married filling separately

When you file married filing separately, the cap for total state and local taxes is $5000. That includes all of your state and local income or sales tax and your real estate taxes too.

The mortgage interest deduction is limited to the interest on up to $375,000 mortgage loan when you file separately.

You may not be aware that if you itemize, your spouse must itemize too. If you take the standard deduction, your spouse must do the same.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interests deduction for married filling separately

Are you in a Community Property State? If so, generally everything must be split 50/50.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interests deduction for married filling separately

Thanks for the reply!

> the cap for total state and local taxes is $5000 -> this is the case for me

> The mortgage interest deduction is limited to the interest on up to $375,000 mortgage loan when you file separately -> I am not getting any credit for mortgage interest deduction, as the total deduction is $5000

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interests deduction for married filling separately

When you say you are married and not filing a return with your spouse, TurboTax defaults to the standard deduction. But if your spouse is claiming itemized deductions, you also have to claim itemized deductions, even if it is lower than the standard deduction. To change your deduction from standard to itemized, follow the instructions found here. Your mortgage interest will show up on Form 1040 once you make the change. But warning, your standard deduction will be removed as well.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interests deduction for married filling separately

I did selected itemized deductions, but still the mortgage interests were not counted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interests deduction for married filling separately

It is possible for the mortgage interest not to be counted. If the total amount on your Schedule A does not exceed the standard deduction, then you will get the standard deduction. If you are filing married filing separately that standard deduction is $12,550. Your total deductions on Schedule A would need to be more than $12,550.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interests deduction for married filling separately

I believe the total itemized deduction is more than $12500 if my mortgage interest is counted. Right now, only tax ($5000) is counted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interests deduction for married filling separately

Is the amount of your mortgage more than the $375,000 for a single or $750,000 for a married filing joint. If so, your interest deduction is being limited. Without seeing your return it is difficult for anyone to give you any guidance as to what is or isn't being included.

If you would like someone to take a look at your return, you can send us a token number and we can take a look at your return. This is called a diagnostic copy. To get a token number, go to Tax Tools > Tools > Share my Return with an Agent. When you click on Share my Return with an Agent, you will see a 6 digit number pop up on your screen. Send this token number in a response to us and someone can take a look at your return. We are not able to see any private information with the token number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interests deduction for married filling separately

My token number is 986888. Please let me know if you need more information. Thanks in advance!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interests deduction for married filling separately

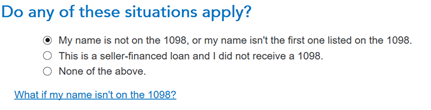

Go back through the mortgage interest section. When you get to the screen that says Do any of these apply to this loan from your lender? answer NO, and see if that gets your mortgage deduction to show up on Schedule A.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interests deduction for married filling separately

Do you mean "Do any of these situations apply?" I already selected "No" for this question.

I discussed with some friends who is in similar situation and they mentioned they did not hit "We need a bit more information to wrap up this deduction". Also in their Home Int Wkst, they don't have principal applied and Ending balance filled as G5 and G6. Hope that can be a hint about what was wrong.

My token number is 986888

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interests deduction for married filling separately

I have had an opportunity to review your tax return and try to figure out the issue with the mortgage interest not calculating.

When I first went into your return on the Deductions and Credits screen in the 2021 column next to Mortgage Interest it said "Review". I clicked on "Update" and clicked through the screens and when finished it showed the amount of interest. However, when I switched to Forms mode and looked at Schedule A it did not give you any credit for the mortgage interest. I switched back to Step-by-Step and back to Mortgage Interest and clicked on "Update". Then clicked on Edit next to the Mortgage Interest listed. This time I went through and answer the questions:

- On the first screen, you need to pick one of the three. I answered as you see below:

- The next screen asks you to "Enter the Other Persons Information". You need to enter your spouse's information in the Boxes.

- On the next screen in Box 1, you enter the interest. If you are splitting the interest you enter your share of the interest and then check the box underneath Box 1. See ScreenShot.

- Answer the remaining questions until you get back to the "Home Loan Deduction Summary" screen.

- Click "Done" and enter the date of the original mortgage on the next screen.

- The next screen is what determines whether you will get the interest or not. If you answer "Yes" to this question you will not get the interest deduction; if you answer "No" you will get the internet deduction. However, you do not get the full amount of the interest because since the mortgage principal balance is more than $375k and with married filing separately it is limiting the amount of interest you can receive. The interest deduction you are getting is $8,196.

- The total Schedule A amount is $13,546. Since this is more than the $12,550 TurboTax will use itemized deductions.

- This reduced your tax obligation to $5,266.

NOTE: Because you are filing MFS your spouse must file MFS. If you itemize on your return, he has to itemize on his return. (The first of the two of you to file your tax return, you both have to file the same way. Meaning if the first to file uses standard deduction, you both have to file standard deduction or if the first to file uses itemized, then you both have to file using itemized.)

In summary, the way you answer the question on the screen "Do either of these apply to this loan from . . . ?" determines whether you get the interest deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interests deduction for married filling separately

> On the first screen, you need to pick one of the three. I answered as you see below.

My name is actually in the 1098 form and I am the only one in the mortgage term, so I should answer "None of the above". No question is asked for my husband in this case.

Also, my mortgage was initialized before 12/15/2017, so the $375k rule should not be applied to me. It takes effect for loans after 2018. However, the cap should be $500k for my case and my principal is more than that. I guess that means only partial of my mortgage interests is eligible and that caused the confusion of the software. I think the deduction should be more than $8196 (where only $375k principal count) and less than $12912 (where all $596k principal count).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

armandoramonjr43

New Member

rossamanda15

New Member

user17581270646

Level 2

mscholl15

New Member

jlthomas41

New Member