- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I have had an opportunity to review your tax return and try to figure out the issue with the mortgage interest not calculating.

When I first went into your return on the Deductions and Credits screen in the 2021 column next to Mortgage Interest it said "Review". I clicked on "Update" and clicked through the screens and when finished it showed the amount of interest. However, when I switched to Forms mode and looked at Schedule A it did not give you any credit for the mortgage interest. I switched back to Step-by-Step and back to Mortgage Interest and clicked on "Update". Then clicked on Edit next to the Mortgage Interest listed. This time I went through and answer the questions:

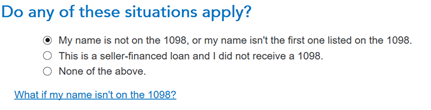

- On the first screen, you need to pick one of the three. I answered as you see below:

- The next screen asks you to "Enter the Other Persons Information". You need to enter your spouse's information in the Boxes.

- On the next screen in Box 1, you enter the interest. If you are splitting the interest you enter your share of the interest and then check the box underneath Box 1. See ScreenShot.

- Answer the remaining questions until you get back to the "Home Loan Deduction Summary" screen.

- Click "Done" and enter the date of the original mortgage on the next screen.

- The next screen is what determines whether you will get the interest or not. If you answer "Yes" to this question you will not get the interest deduction; if you answer "No" you will get the internet deduction. However, you do not get the full amount of the interest because since the mortgage principal balance is more than $375k and with married filing separately it is limiting the amount of interest you can receive. The interest deduction you are getting is $8,196.

- The total Schedule A amount is $13,546. Since this is more than the $12,550 TurboTax will use itemized deductions.

- This reduced your tax obligation to $5,266.

NOTE: Because you are filing MFS your spouse must file MFS. If you itemize on your return, he has to itemize on his return. (The first of the two of you to file your tax return, you both have to file the same way. Meaning if the first to file uses standard deduction, you both have to file standard deduction or if the first to file uses itemized, then you both have to file using itemized.)

In summary, the way you answer the question on the screen "Do either of these apply to this loan from . . . ?" determines whether you get the interest deduction.