- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- [NOT YET SOLVED] Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[NOT YET SOLVED] Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

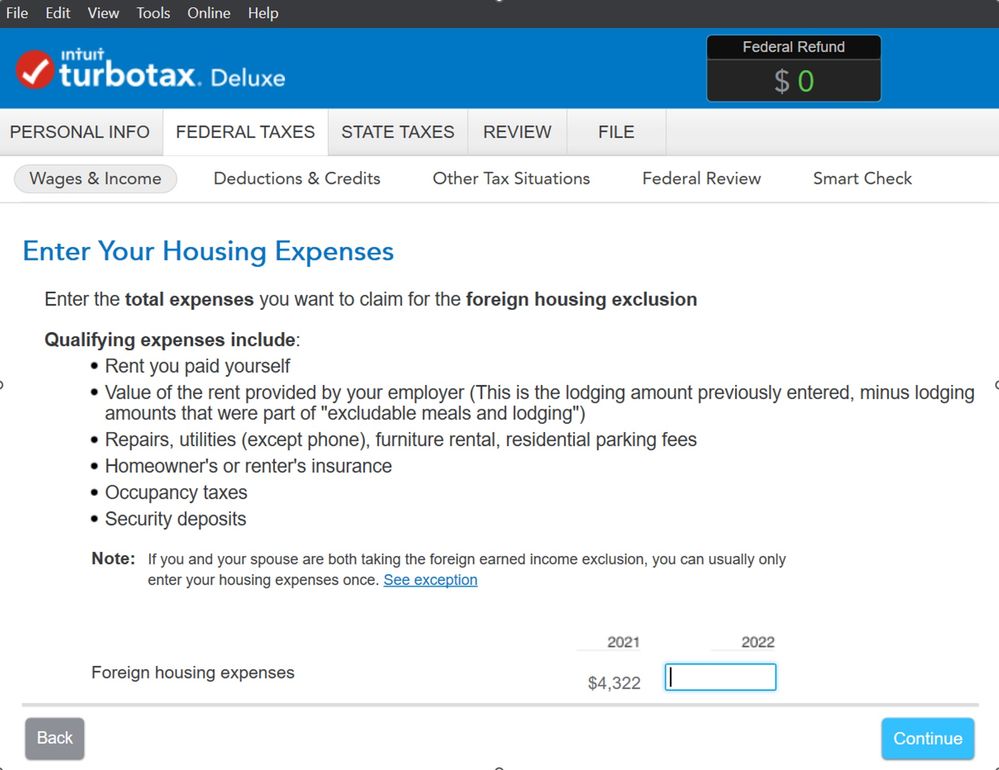

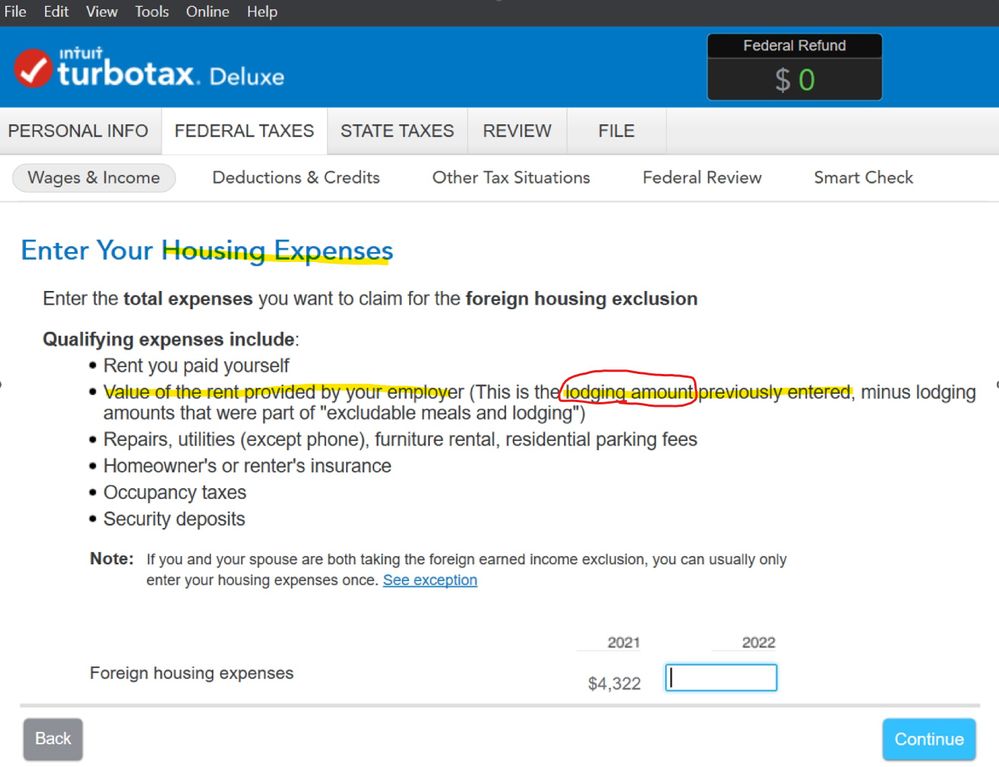

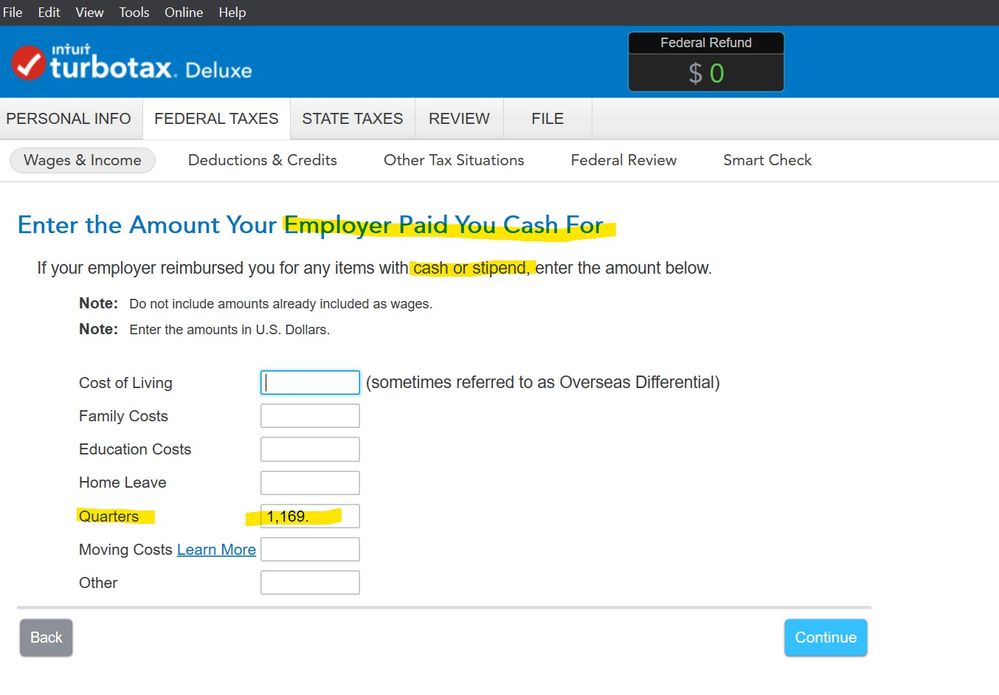

I have a question for this TurboTax page in the screenshot. [NOTE: I asked this already but I have NOT gotten a full answer that I know to be right yet.]

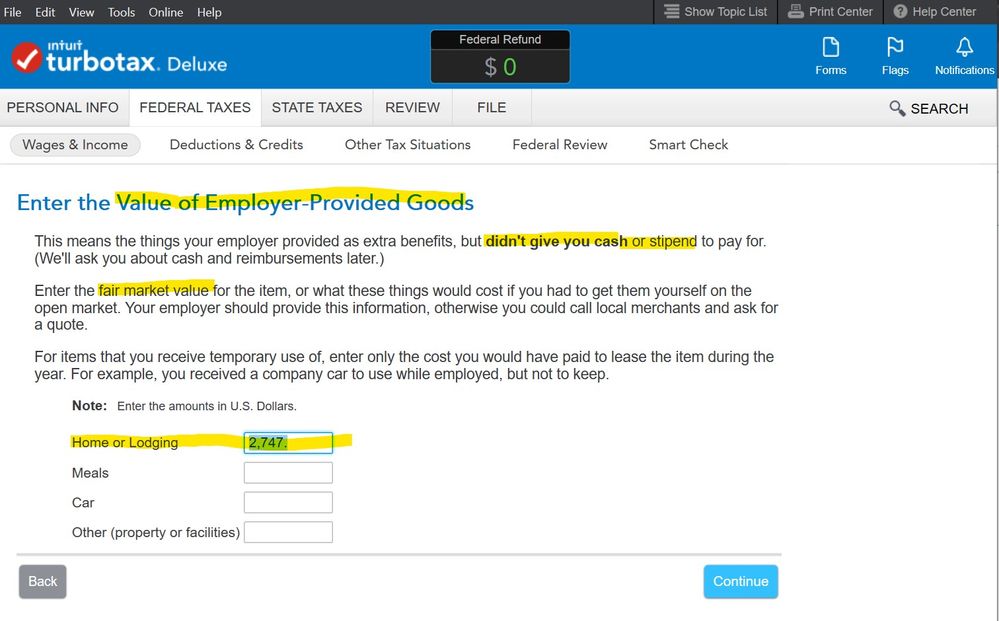

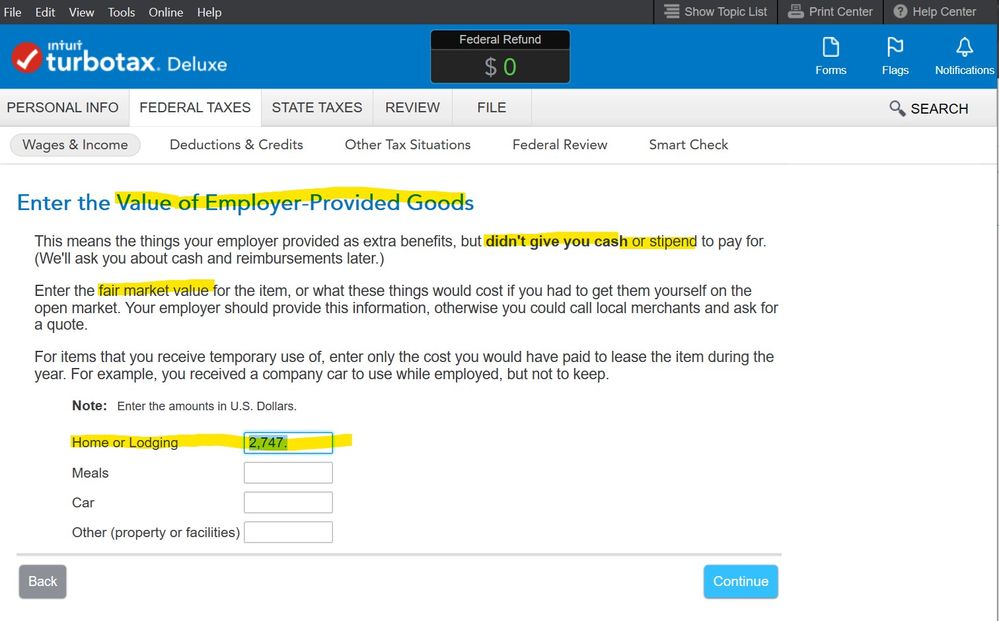

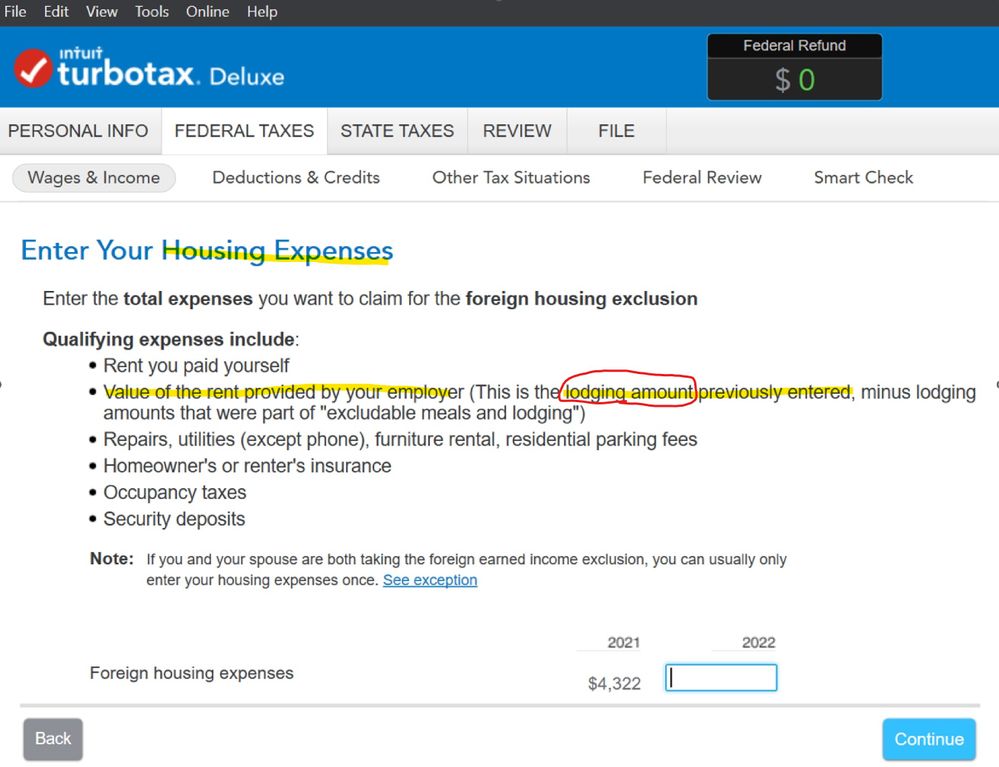

For the first part of the 2022 year, I had foreign employer-provided housing which I inputted the amount on a previous page that said the fair value of the housing.

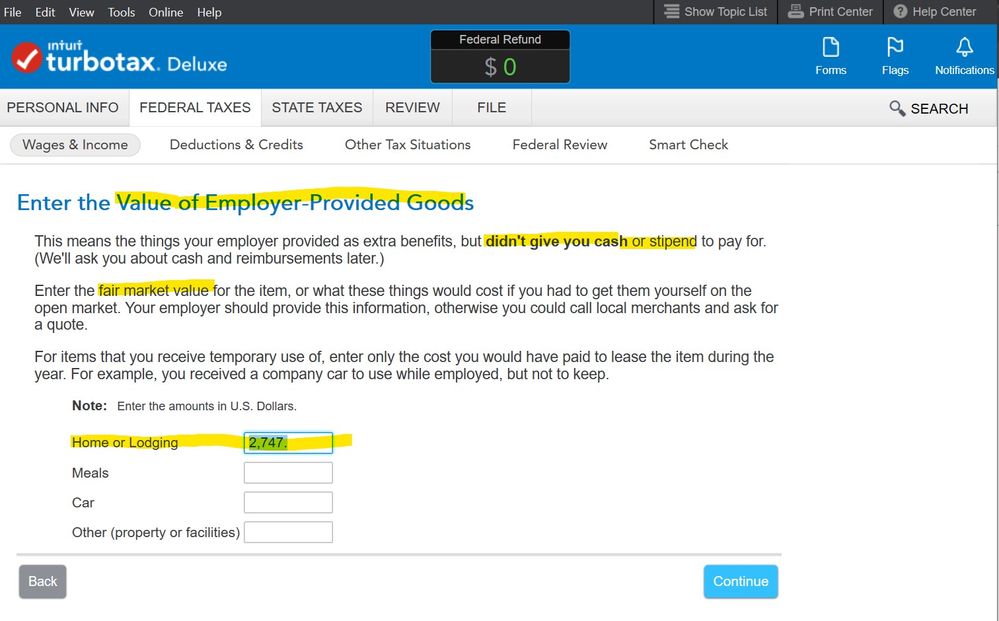

For the second part of 2022, I received a HOUSING ALLOWANCE (CASH STIPEND) in lieu of housing. I inputted this on another page which showed money paid in cash for "Quarters" by the foreign employee.

For the Foreign housing expenses, do I only include the first part (value of the foreign employer-provided housing)? Or the combination of both the employer-provided housing market value AND the CASH provided in the housing allowance (cash stipend)? I didn't fully use the cash stipend directly towards rent and I don't want to itemize all of the other things on there (utilities, taxes, etc.).

For now, I just put the foreign employer-provided housing only ($2746.54). But, if I need to add the housing allowance (cash stipend $1,168.80) to it, I can.

Is it maybe even my choice since it's an exclusion? Thanks in advance! 😄

More detailed info:

Because the Foreign Earned Income Exclusion already brings my taxes to $0, doing this additional Foreign Housing Exclusion seems like it's not needed but TurboTax asks me anyway. I did it last year but last year I only had employer-provided housing so it was simple: I just put in the same number when it asked me how much the employer-provided housing fair market value was and then also on this page (in my screenshot) for the Foreign Housing Exclusion.

But, this year, at the beginning of the year, I had the same type of employer-provided housing (free house no rent needed to be paid) and so I marked all the forms the same way I did last year when it asked me. The fair market value of the employer-provided housing is $2746.54.

On top of that fair market value, I moved out of housing and moved in with my girlfriend (now my wife). So, I got extra CASH in my paycheck instead every month as a housing allowance/housing stipend. The amount I received for that was $1,168.80. I also had to input this on another page when it asked me how much I was given in CASH for housing.

So, my question was, do I just put in the $2746.54 since that is what the question says "Value of the rent provided by your employer". It says that is "the amount you entered previously" when it asked me the fair market value... So, I though maybe it's just the $2746.54 since the extra $1,168.80 was CASH and it doesn't mention the CASH payments on that screen (it just says rent you paid for yourself, utilities, etc. and I don't wanna itemize all that out). So, I'm not sure how to do it. Is it $2746.54? Or $2746.54 + $1,168.80? Or, it doesn't really matter? Please let me know.

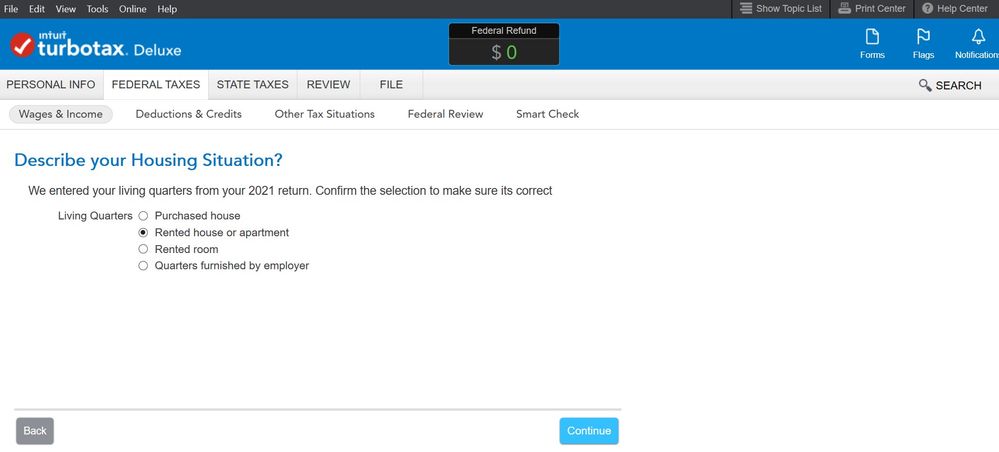

Edit: I will add my other question (https://ttlc.intuit.com/community/taxes/discussion/foreign-earned-income-exclusion-help-advice-pleas...) to this one in case someone knows and sees it: Quick secondary question: Since I lived at BOTH employer-provided housing (at the beginning of year for 7 months) and then moved to an unrelated apartment with an extra cash stipend from the employer (for the last 5 months of the year). How do I answer this question? I was going to pick "rented house or apartment" as that was the condition at the end of the tax year. Does this matter? I technically was at employer-provided housing for longer, but at the end of the year, I was at an unrelated house getting the stipend. As you can see, I inputted values for BOTH employer-provided housing (lodging) AND for cash stipends for housing allowance (quarters) on previous pages.

Thanks,

Shane

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[NOT YET SOLVED] Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

@shanesnh , you are correct in that the wording of the screens are indeed quite confusing -- think they were trying to cater to all and sundry scenarios and instead made it QUITE confusing.

In general all monies and/or benefit in kind ( in-lieu of cash ) are part of your foreign income and eligible for Foreign Earned Income exclusion -- for purposes of ameliorating burden of double taxation.

If you are satisfied with our efforts , please would close this as "solved" or tell me how I can help you in solving this.

BTW -- you mentioned earning interest , -- note that as a US citizen and unless your spouse agrees to file jointly with you and be subject to US taxes on her world income, it is ONLY your income that is eligible for Foreign Earned Income Exclusion.

Does this make sense ?

pk

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[NOT YET SOLVED] Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

Sorry for tagging people but I really need help and you guys are the best. Thanks 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[NOT YET SOLVED] Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

Bump.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[NOT YET SOLVED] Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

Bump...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[NOT YET SOLVED] Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

I can't answer for the foreign housing exclusion, but I can tell you how housing expenses would be calculated for the clergy housing allowance. I suspect the rules are similar.

For the period when you received free housing, your "cost" is the fair market value of the housing, and the taxable value is also the fair market value. For the period when you received a cash stipend, the value of the cash stipend is the cash, and the cost of housing is what you actually paid.

The calculation (over the course of a whole year) would look like this:

| Report as cost | Report as value | ||

| January | Free housing worth $1500/month | $1500 | $1500 |

| Feb | Free housing worth $1500/month | $1500 | $1500 |

| March | Free housing worth $1500/month | $1500 | $1500 |

| Apr, May, June | Free housing worth $1500/month | $4500 | $4500 |

| July | Cash stipend of $1500, actual cost was $2000 | $1500 | $2000 |

| Aug | Cash stipend of $1500, actual cost was $1900 | $1500 | $1900 |

| Sept | Cash stipend of $1500, actual cost was $1800 | $1500 | $1800 |

| Oct | Cash stipend of $1500, actual cost was $1500 | $1500 | $1500 |

| Nov | Cash stipend of $1500, actual cost was $1300 | $1500 | $1500 |

| Dec | Cash stipend of $1500, actual cost was $1300 | $1500 | $1500 |

| Total | $18,000 | $19,200 |

(For this example, I assume you are living in a hot country and your utilities were higher due to air conditioning. The example would be calculated the same if your actual cost varied for any other reason, such as changing utilities, various housing fees, insurance, rent increases, and so on.)

I hope that makes sense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[NOT YET SOLVED] Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

Thanks for the really detailed answer. I don't think I'll itemize out utilities and other fees as I'll owe $0 either way.

In your example, I would be putting both the employer-provided housing FMV + the later received housing stipend's value. I was just worried if the second part (stipend) is meant to be on this exclusion since TurboTax just says it as "Value of the rent provided by your employer (This is the lodging amount previously entered...)" Sometimes when I read it, it sounds like only the first part (FMV of employer provided housing) and sometimes it sounds like it could be both or it's very ambiguous.

And, I just went back through the guide and it shows the lodging amount that I just quoted on the "Enter the Value of Employer-Provided Goods" screen where "didn't give you cash or stipend" is bolded. And it says it will ask about cash stipends later (which it does on another screen). So, I'm wondering if it's just the FMV of the home/lodging provided by the employer and NOT the cash stipend that goes on that Foreign Housing Exclusion page (unless I directly paid rent myself). Of course, people are able to put in the other items on that list but I don't want to or need to since it's already a zeroed-out return due to the other Foreign Earned Income Exclusion.

What do you think @Opus 17 ? (Or anyone else)? Thanks in advance! 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[NOT YET SOLVED] Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

I haven't explored that part of the program, so I don't know if you are later asked separately for cash stipends use for housing, versus other cash stipends. If non-cash housing is reported on one screen, and cash housing is reported on another screen, then you would enter the correct information on both places; the non-cash value of free housing for the first part of the year on that screen that asks for it, and the cash stipend for housing and the actual housing expenses on the screen that asks for that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[NOT YET SOLVED] Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

Yes, it has 3 sections:

The 1st one is the one in the last post where it asks for FMV of lodging provided by the employer, the 2nd one is this where it asks for CASH provided for things like moving or quarters (so, housing/lodging stipend goes here). [Screenshots below]

The last (3rd part) is the original screenshot in the original post on this thread that then asks me what the value is for the Foreign Housing Exclusion and I was confused if I put in just the amount from the 1st one, or 1st+2nd combined. With the way it's worded (in the 3rd part), I think, I should just put the 1st value...

Section 1:

Section 2:

Section 3:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[NOT YET SOLVED] Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[NOT YET SOLVED] Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[NOT YET SOLVED] Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[NOT YET SOLVED] Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

The reason you have not had any replies:

- this is not an area that the individuals have experience in

- most of the TT employees are not around since they are seasonal. Some could be back for the 10/15 deadline, but not sure of their expertise in the area

- The individual with the most expertise is @pk so I will tag this champion.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[NOT YET SOLVED] Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

@shanesnh , thought I had answered this question in another post by you --no ? Is there more I can/need to do for this to be closed to your satisfaction ?

@Rick19744 thank you for brining this to my attention -- see my response to the original poster --- housing expenses , if chosen to be excluded includes all amounts paid directly or indirectly by the employer including FMV of housing provided and/or rent paid on your behalf. The form is trying to capture all expenses by the employer on the employee ( wages , children's education, home leave, housing benefits etc. etc. ) as part of Foreign Earned Income exclusion eligibility.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[NOT YET SOLVED] Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

@pk , I'm truly sorry. You helped a lot! TurboTax's wording on this page (below) is what threw me off. Long story short, I was living with my gf (now wife) and we don't really have to pay rent here (we have a low-interest loan on a large deposit that's in this house and that's about it). So, I don't think I can include the housing cash stipend since it was basically just given since I moved out of the employer housing and paid in my paycheck without me really using it for rent. I just basically looked at it as a raise (and reported it properly on screenshot 3.)

These are the screenshots and the wording throwing me off: "Value of the rent provided by your employer (This is the lodging amount previously entered...)"

That lodging comment in screenshot 1 is referring to screenshot 2's lodging value. Screenshot 1 has the wording that is referring to screenshot 2. But it is NOT referring to the cash stipend in screenshot 3.

Thank you so much @pk and everyone else too @Rick19744 and also @Opus 17 (who gave example of clergy tax credit which may be similar).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[NOT YET SOLVED] Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

@shanesnh , you are correct in that the wording of the screens are indeed quite confusing -- think they were trying to cater to all and sundry scenarios and instead made it QUITE confusing.

In general all monies and/or benefit in kind ( in-lieu of cash ) are part of your foreign income and eligible for Foreign Earned Income exclusion -- for purposes of ameliorating burden of double taxation.

If you are satisfied with our efforts , please would close this as "solved" or tell me how I can help you in solving this.

BTW -- you mentioned earning interest , -- note that as a US citizen and unless your spouse agrees to file jointly with you and be subject to US taxes on her world income, it is ONLY your income that is eligible for Foreign Earned Income Exclusion.

Does this make sense ?

pk

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

maylh

New Member

frankdigiu

Level 1

mpiseter

New Member

K_lead90

New Member

TomG6

New Member