- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

[NOT YET SOLVED] Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

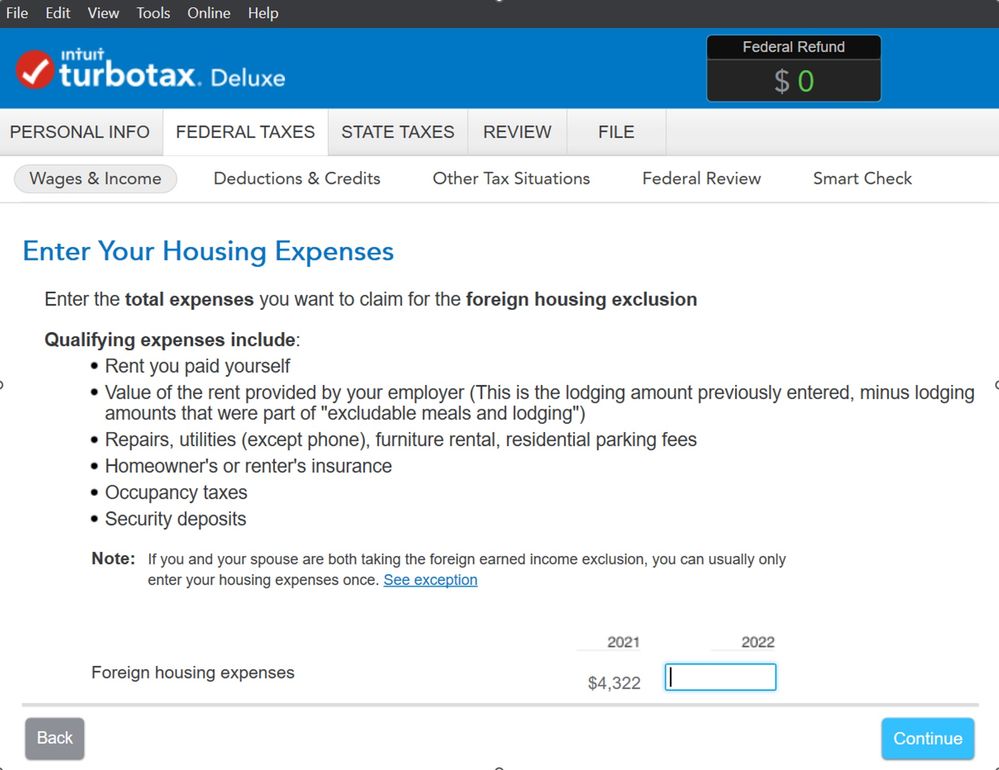

I have a question for this TurboTax page in the screenshot. [NOTE: I asked this already but I have NOT gotten a full answer that I know to be right yet.]

For the first part of the 2022 year, I had foreign employer-provided housing which I inputted the amount on a previous page that said the fair value of the housing.

For the second part of 2022, I received a HOUSING ALLOWANCE (CASH STIPEND) in lieu of housing. I inputted this on another page which showed money paid in cash for "Quarters" by the foreign employee.

For the Foreign housing expenses, do I only include the first part (value of the foreign employer-provided housing)? Or the combination of both the employer-provided housing market value AND the CASH provided in the housing allowance (cash stipend)? I didn't fully use the cash stipend directly towards rent and I don't want to itemize all of the other things on there (utilities, taxes, etc.).

For now, I just put the foreign employer-provided housing only ($2746.54). But, if I need to add the housing allowance (cash stipend $1,168.80) to it, I can.

Is it maybe even my choice since it's an exclusion? Thanks in advance! 😄

More detailed info:

Because the Foreign Earned Income Exclusion already brings my taxes to $0, doing this additional Foreign Housing Exclusion seems like it's not needed but TurboTax asks me anyway. I did it last year but last year I only had employer-provided housing so it was simple: I just put in the same number when it asked me how much the employer-provided housing fair market value was and then also on this page (in my screenshot) for the Foreign Housing Exclusion.

But, this year, at the beginning of the year, I had the same type of employer-provided housing (free house no rent needed to be paid) and so I marked all the forms the same way I did last year when it asked me. The fair market value of the employer-provided housing is $2746.54.

On top of that fair market value, I moved out of housing and moved in with my girlfriend (now my wife). So, I got extra CASH in my paycheck instead every month as a housing allowance/housing stipend. The amount I received for that was $1,168.80. I also had to input this on another page when it asked me how much I was given in CASH for housing.

So, my question was, do I just put in the $2746.54 since that is what the question says "Value of the rent provided by your employer". It says that is "the amount you entered previously" when it asked me the fair market value... So, I though maybe it's just the $2746.54 since the extra $1,168.80 was CASH and it doesn't mention the CASH payments on that screen (it just says rent you paid for yourself, utilities, etc. and I don't wanna itemize all that out). So, I'm not sure how to do it. Is it $2746.54? Or $2746.54 + $1,168.80? Or, it doesn't really matter? Please let me know.

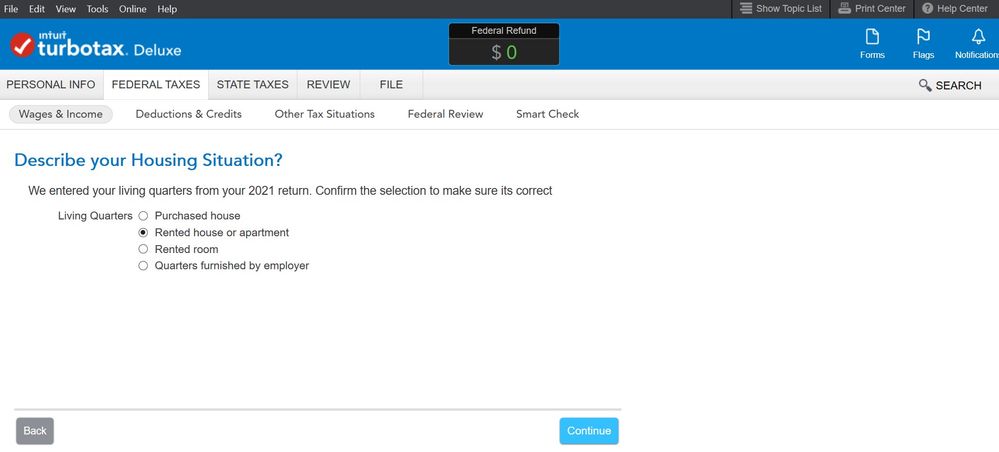

Edit: I will add my other question (https://ttlc.intuit.com/community/taxes/discussion/foreign-earned-income-exclusion-help-advice-pleas...) to this one in case someone knows and sees it: Quick secondary question: Since I lived at BOTH employer-provided housing (at the beginning of year for 7 months) and then moved to an unrelated apartment with an extra cash stipend from the employer (for the last 5 months of the year). How do I answer this question? I was going to pick "rented house or apartment" as that was the condition at the end of the tax year. Does this matter? I technically was at employer-provided housing for longer, but at the end of the year, I was at an unrelated house getting the stipend. As you can see, I inputted values for BOTH employer-provided housing (lodging) AND for cash stipends for housing allowance (quarters) on previous pages.

Thanks,

Shane