- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thanks for the really detailed answer. I don't think I'll itemize out utilities and other fees as I'll owe $0 either way.

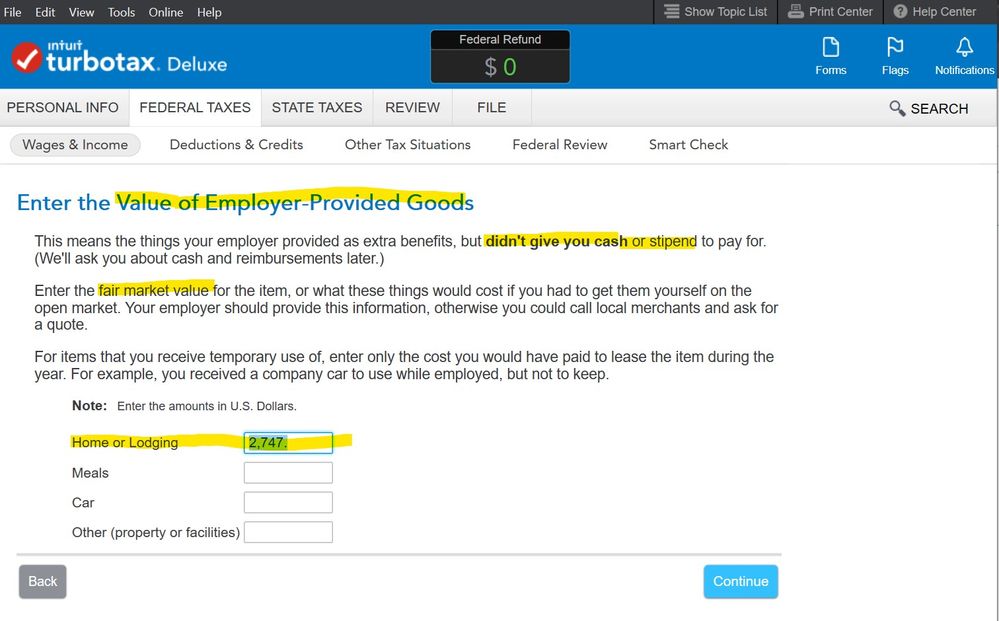

In your example, I would be putting both the employer-provided housing FMV + the later received housing stipend's value. I was just worried if the second part (stipend) is meant to be on this exclusion since TurboTax just says it as "Value of the rent provided by your employer (This is the lodging amount previously entered...)" Sometimes when I read it, it sounds like only the first part (FMV of employer provided housing) and sometimes it sounds like it could be both or it's very ambiguous.

And, I just went back through the guide and it shows the lodging amount that I just quoted on the "Enter the Value of Employer-Provided Goods" screen where "didn't give you cash or stipend" is bolded. And it says it will ask about cash stipends later (which it does on another screen). So, I'm wondering if it's just the FMV of the home/lodging provided by the employer and NOT the cash stipend that goes on that Foreign Housing Exclusion page (unless I directly paid rent myself). Of course, people are able to put in the other items on that list but I don't want to or need to since it's already a zeroed-out return due to the other Foreign Earned Income Exclusion.

What do you think @Opus 17 ? (Or anyone else)? Thanks in advance! 🙂