- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

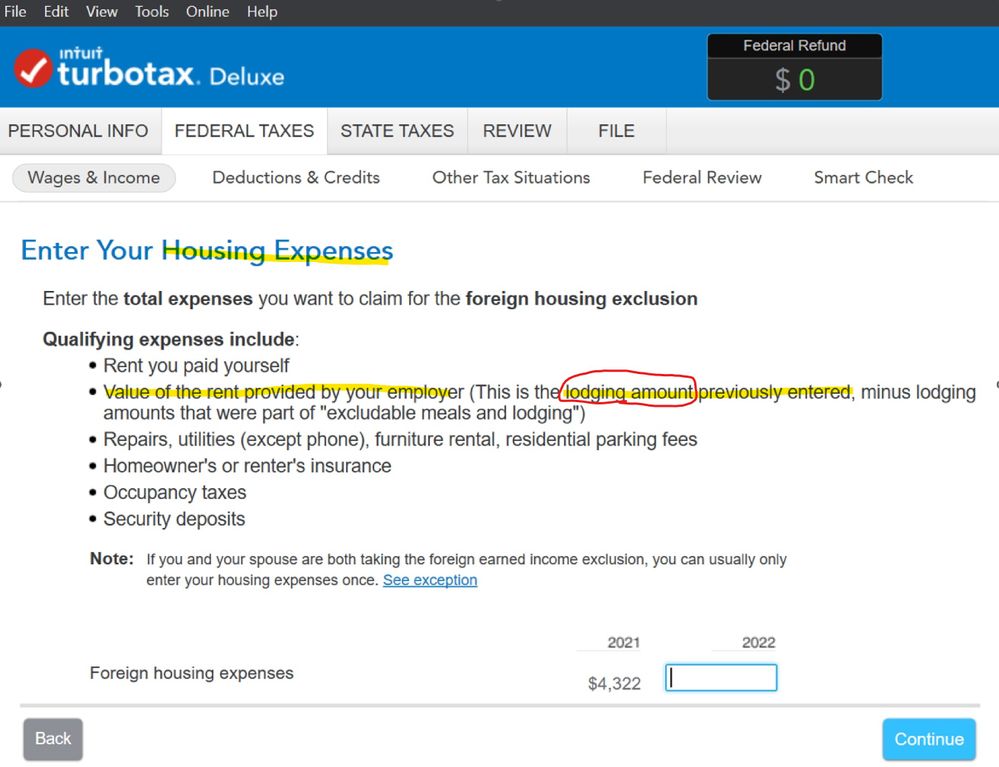

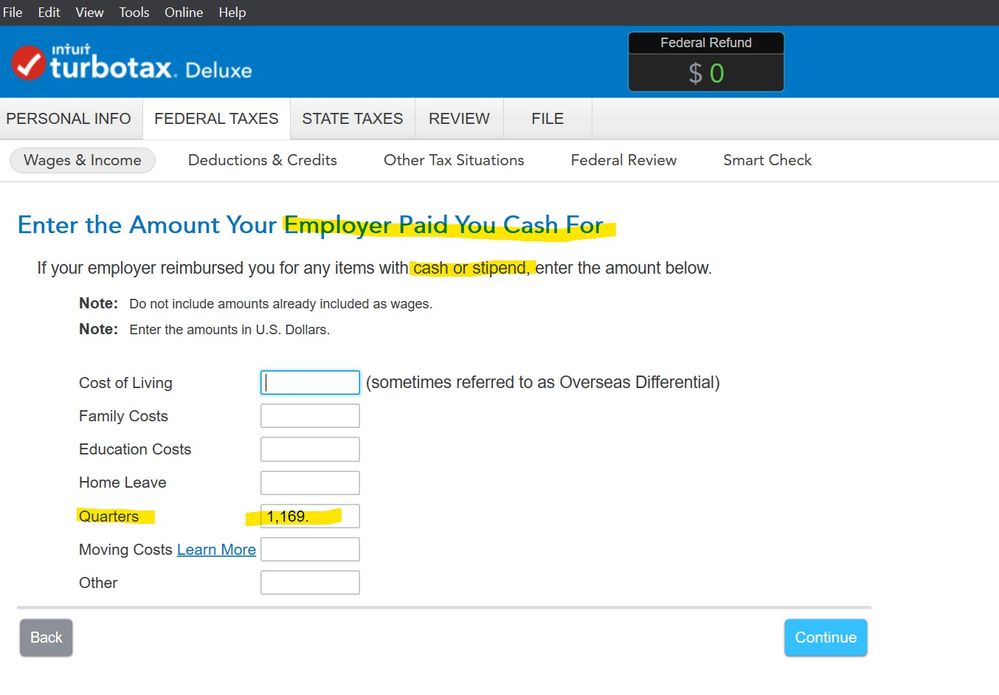

@pk , I'm truly sorry. You helped a lot! TurboTax's wording on this page (below) is what threw me off. Long story short, I was living with my gf (now wife) and we don't really have to pay rent here (we have a low-interest loan on a large deposit that's in this house and that's about it). So, I don't think I can include the housing cash stipend since it was basically just given since I moved out of the employer housing and paid in my paycheck without me really using it for rent. I just basically looked at it as a raise (and reported it properly on screenshot 3.)

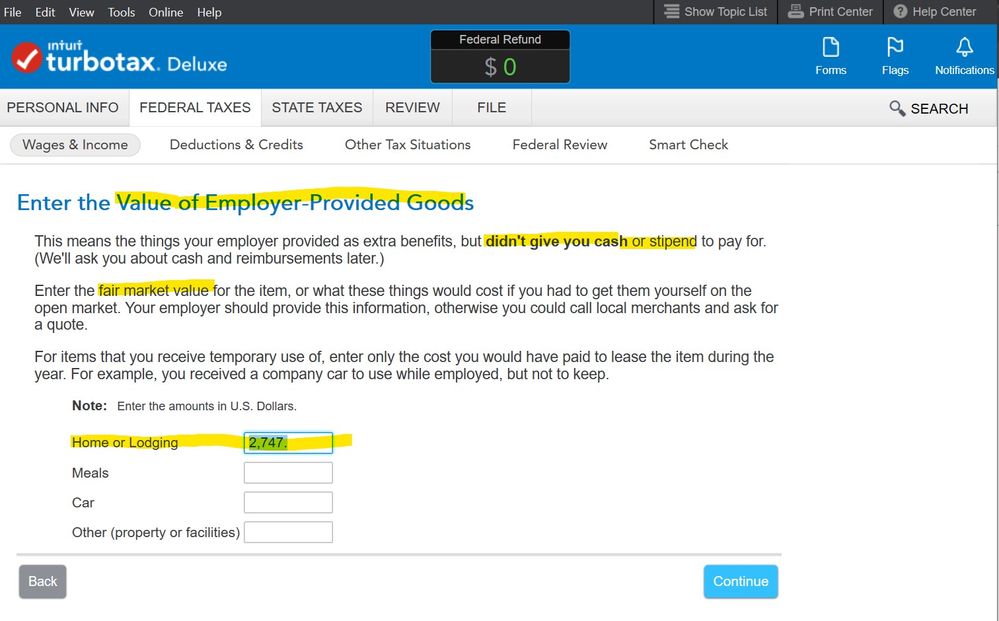

These are the screenshots and the wording throwing me off: "Value of the rent provided by your employer (This is the lodging amount previously entered...)"

That lodging comment in screenshot 1 is referring to screenshot 2's lodging value. Screenshot 1 has the wording that is referring to screenshot 2. But it is NOT referring to the cash stipend in screenshot 3.

Thank you so much @pk and everyone else too @Rick19744 and also @Opus 17 (who gave example of clergy tax credit which may be similar).