- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- In the other part in my account, I put that I can be claimed by someone else. How do I know that once I file, it would say that I am a dependent?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In the other part in my account, I put that I can be claimed by someone else. How do I know that once I file, it would say that I am a dependent?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In the other part in my account, I put that I can be claimed by someone else. How do I know that once I file, it would say that I am a dependent?

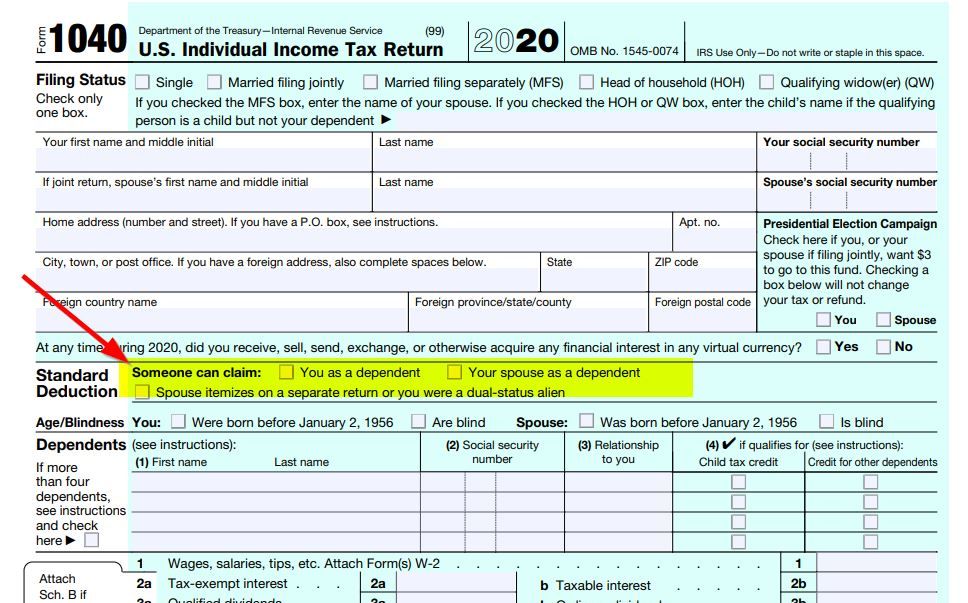

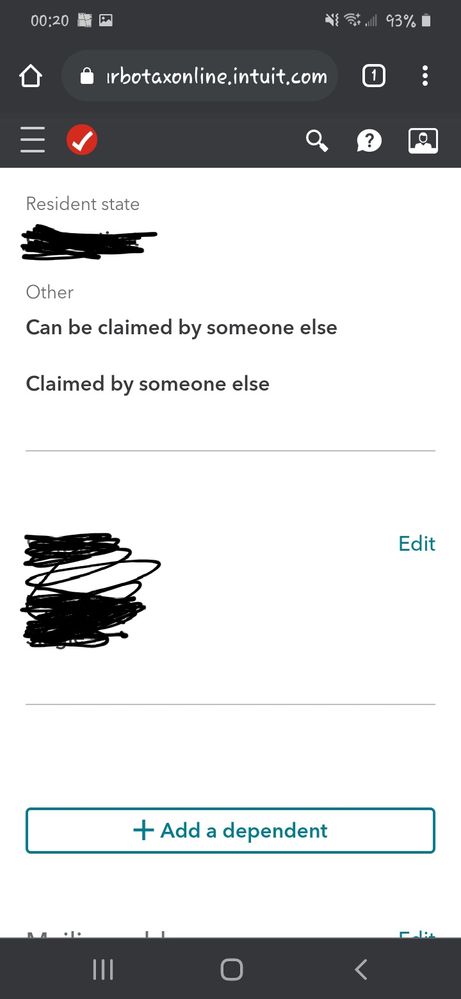

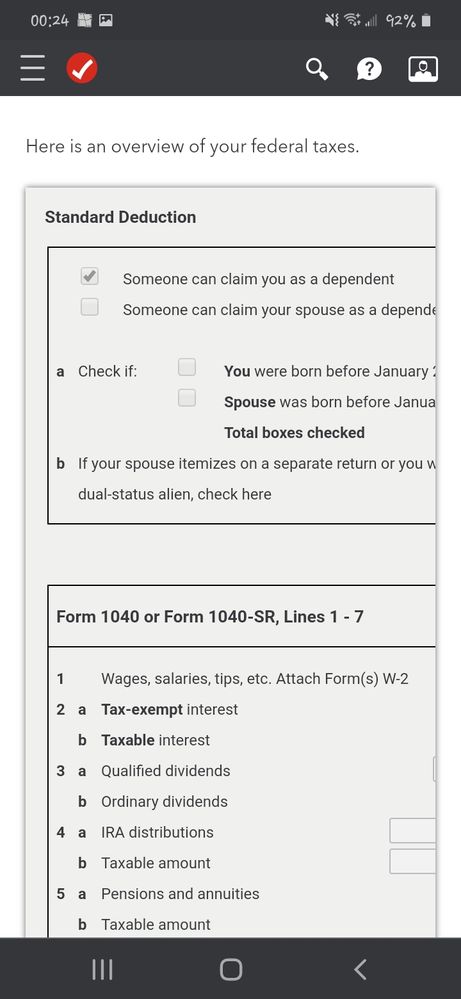

In My Info you are asked if you can be claimed as someone else's dependent. If you can be claimed as someone else's dependent then you answer YES to the question. Then if you are not sure what it shows on your Form 1040---look at it. Up near the top of the form it should have a check or an x in the box that shows if you can be claimed as someone's dependent. Look for the words "Standard Deduction"---then read to the right.

PREVIEW 1040

https://ttlc.intuit.com/questions/1901539-how-do-i-preview-my-turbotax-online-return-before-filing

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In the other part in my account, I put that I can be claimed by someone else. How do I know that once I file, it would say that I am a dependent?

Made a screen shot of the 1040 tax return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In the other part in my account, I put that I can be claimed by someone else. How do I know that once I file, it would say that I am a dependent?

So this means I being claimed as a dependent? I just want to clarify so that I don't make any mistakes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In the other part in my account, I put that I can be claimed by someone else. How do I know that once I file, it would say that I am a dependent?

Yes you have indicated that you can be claimed as someone else's dependent. That means you are NOT eligible to receive any stimulus checks, among other things.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In the other part in my account, I put that I can be claimed by someone else. How do I know that once I file, it would say that I am a dependent?

So does that mean I'm not allowed to file my taxes? Apologies for the many questions, I'm new to this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In the other part in my account, I put that I can be claimed by someone else. How do I know that once I file, it would say that I am a dependent?

CAN I FILE A RETURN IF I AM A DEPENDENT?

If you can be claimed as a dependent on someone else's return, you can still file your own return so that you can receive a refund of taxes withheld. (You will not get back anything for Social Security or Medicare withheld.) Be sure that on your own return you say that you can be claimed as a dependent on someone else’s return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In the other part in my account, I put that I can be claimed by someone else. How do I know that once I file, it would say that I am a dependent?

Yes you might still have to file your own return if you have income. You don't have to file if you only have W2 income under 12,400 but you can file to get back any withholding taken out in boxes 2 or 17. But you don't get boxes 4 or 6 back. If you got a 1099Misc or 1099NEC you have to file it as self employment income no matter how small the amount.

Filing requirements for a dependent

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kac42

Level 1

SB2013

Level 2

barbaramays333

New Member

kip16

Level 1

kip16

Level 1