- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to enter cryptocurrency on the downloaded version???

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

How come TurboTax put everything in 1 big csv file?? I have more than 5000 transactions, what should I do? I see that some providers you mentioned charge like$199 for calculating these transactions.

if I do it manually on TurboTax, I can only put 50 transactions. There’s no free cryptocurrency earnings and losses reporting software?? With large transactions more than 5000 what do I do? It’s very frustrating. I don’t wanna pay $199 for these services.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

If you have over 50 transactions and want to add the others without using CSV's from a partner, you will need to summarize the entries for your Form 8949. You can aggregate all the Short Term and Long Term Transactions and then mail in your statement that supports the summary entries.

Here is an FAQ that discusses the particulars of how to aggregate and summarize the info on the 8949:

How to Report Large Amounts of Transactions Per@AlexanderS08

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

How do I do that? Can you show me an example? What’s the loss and gains on form 1099B for crypto? I think you meant write down the numbers on form 8949 from 1099B? There’s security totals and Totals on 1099b what’s the final number??

also, do I have to file crypto even if I don’t have any gains? I have losses. What if I don’t report?

You mean send the form to the IRS? File electronically on TurboTax and mail in form 8949 to the IRS???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

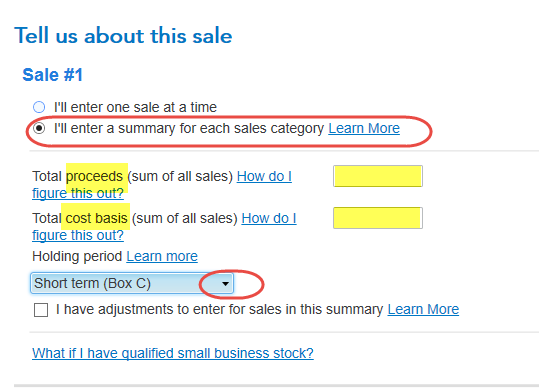

In TurboTax CD/Download, to enter the category summaries (long-term, short-term), please follow these steps:

- On the Income screen, in the Investment Income section click the Start/Update box next to Stocks, Mutual Funds, Bonds, Other

- On the screen asking Did you sell any investments in 2020? click the Yes box.

- On the screen Tell us about this sale, mark the radio button I'll enter a summary for each sales category

- Enter the total proceeds and total cost basis for that category.

- Select the holding period from the drop-down box. [See screenshot below.]

- On the screen, indicate whether you have another category of sales to enter and click Continue.

You will be able to e-file your return with the summary information.

Once your return has been accepted, print Form 8453 (a transmittal form), attach it to a copy of your cryptocurrency statement, and mail it in to the IRS at the address included on your filing instructions.

Yes, you have to report your cryptocurrency transactions even if you have losses. These are capital losses and can be applied to any gains you may have. Most cryptocurrency centers report transactions to the IRS, so the IRS may ask about them if you don't include the transactions on your return.

To summarize:

- Prepare your return with the summary statements;

- E-file your return; and

- Mail in your cryptocurrency statement.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

Your response does not work with the Premier Desktop version. There is no category for "All Income" and there is no "Show More" capability.

Stan Rom

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

Yes, you are correct. Show More is only seen when using TurboTax Online.

Please see other responses in this thread that specifically address entering details in the TurboTax CD/Download.

To get to the Stocks, Mutual Funds, Bonds, Other section for reporting your 2020 transactions, another way to get there is to follow these steps:

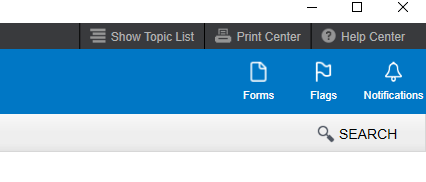

- Click on the Search/magnifying glass in the top right corner.

- Enter investment sales.

- Select the Jump to link in the search results.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

Does not work for Desktop Premier Version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

@sromanow wrote:

Does not work for Desktop Premier Version.

Go to the investment section and then follow the instructions provided in the this thread for entering the crypto currency sales.

To enter an investment sale other than from a brokerage account (1099-B), follow the steps below.

- Click on Federal Taxes (Personal using Home and Business)

- Click on Wages and Income (Personal Income using Home and Business)

- Click on I'll choose what I work on (if shown)

- Under Investment Income

- On Stocks, Mutual Funds, Bonds, Other, click the start or update button

On the next screen click on Yes

On the next screen click on No

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

I have checked this using the Premier Desktop and was able to jump to the right section. @DoninGA also has provided good steps to return to the correct input area.

Keep in mind that only TurboTax Online has a dedicated section for Cryptocurrency. TurboTax CD/Download filers enter their details in the same section as their other investment sales.

Please follow the instructions listed above for getting the .CSV file uploaded to report your cryptocurrency transactions.

Please see the screenshots for a series of steps to get to the right section to report investment activity.

First go to the top right corner of your program and click on the magnifying glass/SEARCH.

There will be a pop-up window appear. Enter investment sales in the search box.

Click the jump to link listed:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

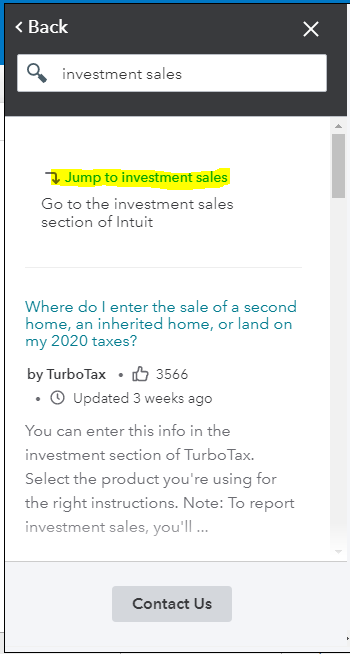

I read every post in this thread and it was still very confusing on how to enter my cryptocurrency sales. I also didn't want to send in additional forms via mail once I e-filed. I tried quite a few different Crypto tax programs that Intuit recommended but Koinly was the only one that computed everything properly.

After you sign up for Koinly and connect it to your exchanges/wallets and pay for your tax year, it gives you the option to download a "TXF" file that you can directly import into your return. Boom and you are done. Koinly costs $50 per tax year but you can use my referral code if you want and then its only $30. https://koinly.io/?via=5AB92D7D

Here are the pictures to where you import the file in the Offline CD Based software

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

It depends. You may have received a 1099B for the transactions but not necessarily. Cryptocurrency transactions are entered like stock transactions when you report them. To enter these:

- In TurboTax, open your tax return

- Click on Federal in the left-hand column, then on Wages & Income on top of the screen

- Scroll down to All Income, locate the section Investment Income and click on Show more

- Click Start next to Stocks, Mutual Funds, Bonds, Other

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

I used the Cd for Turbo Tax 2020 and when I came to the question about cryptocurrency I answered yes. There is nowhere after that to enter any info about my sale. Where do I put that? Is it an investment, income, capital gain? I listed it where it says stocks, etc, is that ok?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

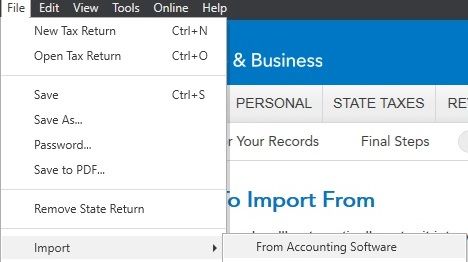

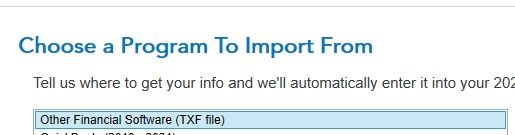

@dtroccola To enter cryptocurrency in TurboTax CD\Download:

- Manual Entries. You can type in the transactions yourself the screens which are set up for stock transactions.

- Summaries. You can enter summaries and send copies of your exchange reports to the IRS.

- Import TXF file. You can import your transactions if they are in a TXF file format.

- Choose File in the upper-left corner of CD\Download

- Select Import > From Accounting Software (Windows) or Import > From TXF Files (Mac)

- Browse Files and Import Now

Our Community Tax Experts have come up with two workarounds.

Workaround 1 from awesome Tax Expert @KathrynG3:

- Click on Forms in the upper right to switch to Forms mode.

- Click Open Form in the left column.

- You’ll see a pop up titled Search or Browse the list of available forms.

- Type cryptocurrency.

- Select Cryptocurrency Wks and click Open Form.

- Enter your transactions in “Part II: Manually Entered Cryptocurrency Transaction Information.”

Workaround 2 from awesome Tax Expert @DawnC:

- Start a free tax return in TurboTax Premier Online. It’s free because you will not finish and pay online. You’ll just use this to prepare your crypto.

- Enter (import) your crypto currency information in the Crypto section.

- Save the tax data file to your computer. See: How do I switch from TurboTax Online to the TurboTax software?

- Open the tax file in TurboTax CD\download and complete your return

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

This was true with the 2020 return, but on the 2021 return it gives you a message "The stocks and crypto section will be ready soon".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter cryptocurrency on the downloaded version???

You just need to wait until that section is functional ... probably around the end of January ... in plenty of time for the 1099-B forms are issued mid February.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17678439925

New Member

paul

New Member

ricw23

Level 2

CP01

Level 3

larry25

New Member