- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

In TurboTax CD/Download, to enter the category summaries (long-term, short-term), please follow these steps:

- On the Income screen, in the Investment Income section click the Start/Update box next to Stocks, Mutual Funds, Bonds, Other

- On the screen asking Did you sell any investments in 2020? click the Yes box.

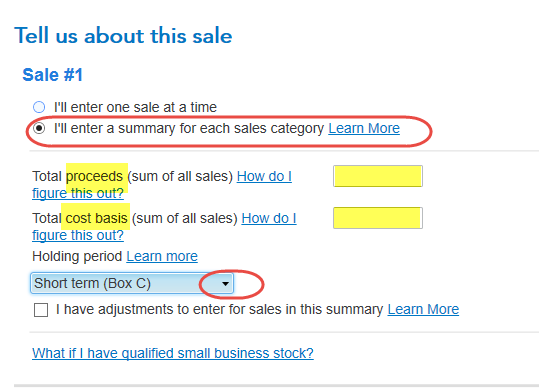

- On the screen Tell us about this sale, mark the radio button I'll enter a summary for each sales category

- Enter the total proceeds and total cost basis for that category.

- Select the holding period from the drop-down box. [See screenshot below.]

- On the screen, indicate whether you have another category of sales to enter and click Continue.

You will be able to e-file your return with the summary information.

Once your return has been accepted, print Form 8453 (a transmittal form), attach it to a copy of your cryptocurrency statement, and mail it in to the IRS at the address included on your filing instructions.

Yes, you have to report your cryptocurrency transactions even if you have losses. These are capital losses and can be applied to any gains you may have. Most cryptocurrency centers report transactions to the IRS, so the IRS may ask about them if you don't include the transactions on your return.

To summarize:

- Prepare your return with the summary statements;

- E-file your return; and

- Mail in your cryptocurrency statement.

April 8, 2021

8:30 AM