- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Hi, I am a Costco member and I saw that I can get a discount on Turbotax with that. How can I do that, if I can do that, since I've done everything online already? Tnx.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, I am a Costco member and I saw that I can get a discount on Turbotax with that. How can I do that, if I can do that, since I've done everything online already? Tnx.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, I am a Costco member and I saw that I can get a discount on Turbotax with that. How can I do that, if I can do that, since I've done everything online already? Tnx.

Unfortunately, the Costco discount on TurboTax products applies to purchases of the CD/Download version at a Costco location or through their website.

If you haven't paid your online fees yet, you can clear the return, and purchase the CD/Download from Costco.

You would need to install the program on your computer (1 state return preparation is free), and re-enter all your tax information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, I am a Costco member and I saw that I can get a discount on Turbotax with that. How can I do that, if I can do that, since I've done everything online already? Tnx.

Unfortunately, the Costco discount on TurboTax products applies to purchases of the CD/Download version at a Costco location or through their website.

If you haven't paid your online fees yet, you can clear the return, and purchase the CD/Download from Costco.

You would need to install the program on your computer (1 state return preparation is free), and re-enter all your tax information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, I am a Costco member and I saw that I can get a discount on Turbotax with that. How can I do that, if I can do that, since I've done everything online already? Tnx.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, I am a Costco member and I saw that I can get a discount on Turbotax with that. How can I do that, if I can do that, since I've done everything online already? Tnx.

.…....TTX will not do that...and if they did, no stores would bother stocking it themselves.

Cancel your Advantage choice for next year....and then buy at the store in January every year instead.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, I am a Costco member and I saw that I can get a discount on Turbotax with that. How can I do that, if I can do that, since I've done everything online already? Tnx.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, I am a Costco member and I saw that I can get a discount on Turbotax with that. How can I do that, if I can do that, since I've done everything online already? Tnx.

I bought the "TurboTax Deluxe Federal & State 2019 PC (E-Delivery)" from Costco at $49.99. This was supposed to include Fed + 1 state tax filing. I registered the software with the code provided from Costco/Turbo Tax.

I downloaded the software and started with the filing. In the process, the software then asked me to pay:

1. TURBOTAX STATE RETURN CA TAX YEAR 2019 E-FILE $24.99

2. TURBOTAX NJ TAX YEAR 2019 WIN DOWNLOAD $44.99

3. TURBOTAX STATE RETURN CA TAX YEAR 2019 E-FILE $24.99

4. TURBOTAX STATE RETURN NJ TAX YEAR 2019 E-FILE $24.99

Since I partly stayed in NJ and other half in CA, I should have paid only $24.99 additional.

But till now, I have been charged these in addition, I dont understand why!

This is additional: TURBOTAX NJ TAX YEAR 2019 WIN DOWNLOAD $44.99

This is additional: TURBOTAX STATE RETURN CA TAX YEAR 2019 E-FILE $24.99

This is additional: TURBOTAX STATE RETURN CA TAX YEAR 2019 E-FILE $24.99

This is additional: TURBOTAX STATE RETURN CA TAX YEAR 2019 E-FILE $24.99

Who can help me with this issue!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, I am a Costco member and I saw that I can get a discount on Turbotax with that. How can I do that, if I can do that, since I've done everything online already? Tnx.

@abhi_ji_t wrote:

I bought the "TurboTax Deluxe Federal & State 2019 PC (E-Delivery)" from Costco at $49.99. This was supposed to include Fed + 1 state tax filing.

You misunderstood. The free state is the one state *software* that allows you to print and mail as many state tax returns that you want. E-filing state has ALWAYS been extra.

If you had two states then you must purchase the software for the 2nd state.

Did you e-file more than one CA state return? You would be charged for each e-file. If you only e-filed one CA return then contact customer service for a refund of the additional CA charges.

There is no single published number because it changes contently depending on the nature of the call and agent availability. Following the link below will either give a current number for you to call or take your number for a callback.

(Note that phone support is for paying customers only. There is no phone support for Free Customers.)

Here is a TurboTax FAQ for contacting customer support.

https://ttlc.intuit.com/questions/1899263-what-is-the-turbotax-phone-number

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, I am a Costco member and I saw that I can get a discount on Turbotax with that. How can I do that, if I can do that, since I've done everything online already? Tnx.

Did you purchase desktop software with state software included? They sell Deluxe both with and without state software--so you have to be careful which one you choose. And even if it does have the state software download included, that is for preparing the state. If you need an additional software program for a second state, it costs an additional fee of $44.99 for the second state program. There is an extra fee to e-file the state each time you e-file a state return, which you can do up to five times. You can avoid the $24.99 state e-file fee if you print and mail the state instead of e-filing it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, I am a Costco member and I saw that I can get a discount on Turbotax with that. How can I do that, if I can do that, since I've done everything online already? Tnx.

how do i import last years info onto my costco version

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, I am a Costco member and I saw that I can get a discount on Turbotax with that. How can I do that, if I can do that, since I've done everything online already? Tnx.

How to transfer last year’s return? https://ttlc.intuit.com/questions/1900883

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, I am a Costco member and I saw that I can get a discount on Turbotax with that. How can I do that, if I can do that, since I've done everything online already? Tnx.

@rich m Did you also use the Desktop program last year or the Online version?

If you used the online version last year and need to transfer your info to this year's Desktop version there are 2 ways depending on what you have.

1. If you saved the actual .tax2019 file (not just the pdf file) to your computer before online was shut down in Oct. then start a new return and the very first thing you do is Transfer from .tax file. You can only transfer at the very beginning.

2. If you didn't save the .tax file to your computer or lost it, there is a way to do it by starting a 2020 return in the Online version, transfer to that and then continue in the desktop version. You won't have to pay for Online. See this…..

Here's how to transfer last year's return to Windows…..

How to transfer into Turbo Tax for Mac

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, I am a Costco member and I saw that I can get a discount on Turbotax with that. How can I do that, if I can do that, since I've done everything online already? Tnx.

This WAS VERY Annoying. Your product DOES NOT WORK with OSX!! How can the leading tax software provider not work with MAC? Furthermore, you do not make it easy to transfer the license to the online version. I purchased through Costco with email delivery for a Windows download. There were no options or indications at purchase. Even if there were, Intuit should make it easy to apply the license key to the online version. All I (and millions of others) want to do is license your product. How, after all these years, have you not solved this issue? I am going to post this complaint all over the internet if I don’t get quick remediation or a refund!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, I am a Costco member and I saw that I can get a discount on Turbotax with that. How can I do that, if I can do that, since I've done everything online already? Tnx.

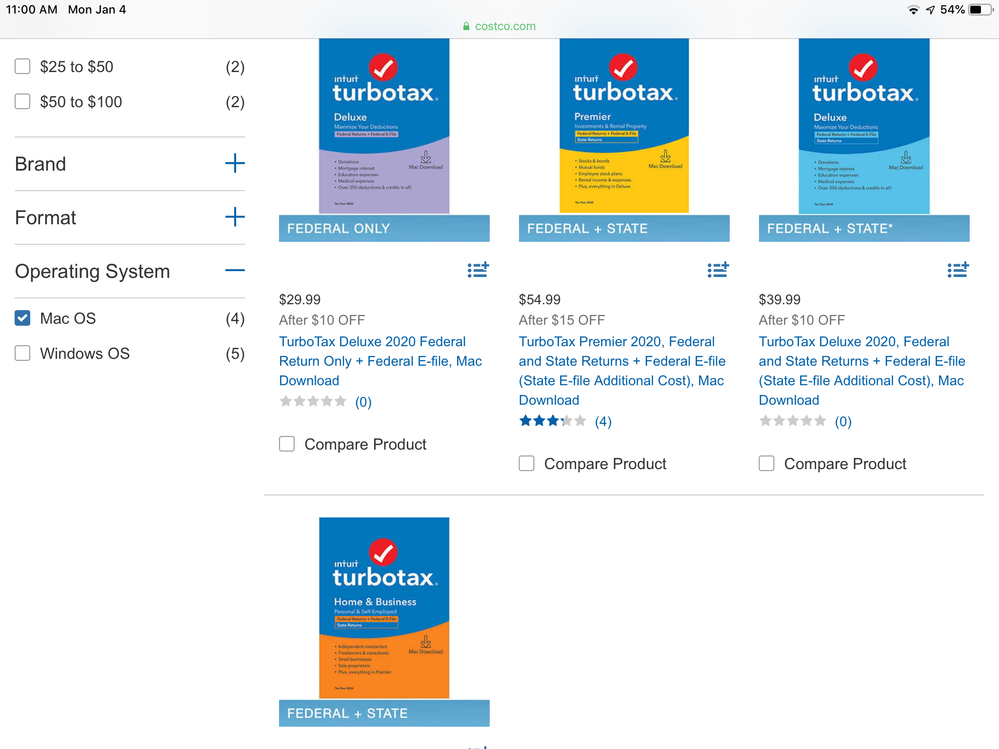

Costco sells 4 Mac versions. Ask Costco if you can switch and get the Mac version assuming your Mac will support it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, I am a Costco member and I saw that I can get a discount on Turbotax with that. How can I do that, if I can do that, since I've done everything online already? Tnx.

TurboTax works just fine with Mac OSX. It is running right now on my MacBook and has worked for many years.

You do have to have a Mac running OSX 10.14 or later however, that is a requirement of the Apple developer tools (not a TurboTax requirement) that do not support older then 10.14.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi, I am a Costco member and I saw that I can get a discount on Turbotax with that. How can I do that, if I can do that, since I've done everything online already? Tnx.

Been trying to get in using installturbotax.com

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

poetwoman1

New Member

Marlonj

New Member

smc89

New Member

patmag

Level 3

skr

New Member