- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

I have tried those steps for the online version three times without success. Any other ideas?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

Print it, white out the line and mail it is what I was told to do.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

@Johntrae You will not see any income for this distribution on this return because you already realized the income. You are only paying the proportional tax liability this year. You will see this amount in the total retirement distribution taxable amount on line 5b of your 1040.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

Please try these steps to fix the rejection issue (delete text on Line C):

- Login to your TurboTax Account

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Uncheck the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and click continue

- On the "Which disaster affected you in 2020?" screen I selected the blank entry and click "back"

- Then recheck the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and continue.

Another option is to delete "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and then go back to the retirement section and reenter the information:

- Open or continue your return in TurboTax.

- In the left menu, select "Tax Tools" and then "Tools".

- In the pop-up window Tool Center, select "Delete a form".

- Select "Delete" next to "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and follow the instructions.

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and enter your information. @jimsoltonner

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

Where is the **bleep** form? It's available on the IRS site but Intuit hasn't gotten around to linking it in to TurboTax? What are we paying for here - I want to file my return!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

This form is showing to be available within our Form Availability Table. If you are using the Download/Desktop version, you will need to make sure you have updated your software. To manually update for Windows, please see the Help Article here. For Mac, please see this Help Article.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

It may be "available" in your table but is not showing up in any updates and thus I remain unable to file my federal return over an issue I have no awareness of other than somewhere a box was checked and the program can't tell me where that might be. While I'll be happy to spend an hour or two trying to incorporate that "available" fund into my return, that's not what I paid for. Why isn't the program prompting me to solve this problem like others?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

@Mahkno99 Go through the Retirement section of the program for a Form 1099-R in Wages & Income. Answer the questions for a disaster distribution.

The Form 8915-F for 2022 was available on March 9. 2023 for both the online and desktop editions.

Using the desktop editions, click on Online and then Check for Updates.

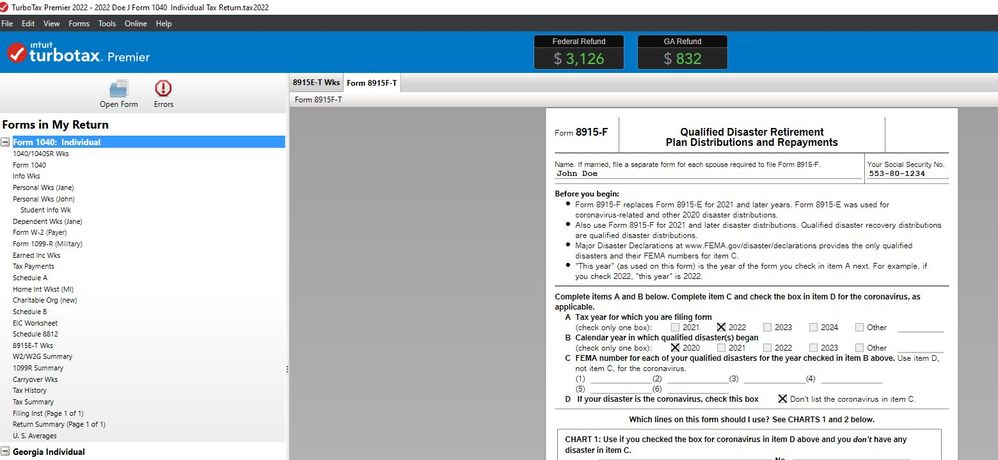

Screenshot for the Form 8915-F (2022) using TurboTax Premier for Windows with all updates.

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Amariew27

New Member

wordsforsale

Returning Member

007jacksonraymondg

New Member

Click

Level 5

businessisbusiness2019

New Member