- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Foreign address in W-2 and "we are missing your state and zip code"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign address in W-2 and "we are missing your state and zip code"

At first I thought I could not use TurboTax because I'm a foreigner from Mexico who worked temporarily in the US with a TN visa, however, after trying to file through Sprintax and entering the dates I've been in the US under different Visas, I'm told I'm considered a resident for taxes purposes due to the amount of days I was in the US in the previous years as a tourist on top of the days I was there working.

My issue now is that TurboTax SAYS I can file from a foreign address, but it won't let me move on past a certain point if I've entered a foreign mailing address, even tho I've done it in the right spot in the dropdown menu. It will pop up a "we are missing your state and zip code" message. (I'm using a dummy phone number as well because I do not have a US based phone number, it was the only way it let me move on from that spot as well)

I was advised by TurboTax through twitter to enter a US mailing address if I had access to one, even tho I am stating that as of december 2019 my residence is and has been outside the US.

When I do this, TurboTax allows me to move forward, but I'm wondering: Is it an issue that my mailing address in TurboTax is in the US, while my address in the W-2 form is in mexico?

I'm getting conflicting information from TurboTax, on twitter they told me that it would be better if the W-2 has a US address, but on the phone and on my first round of asking on twitter they said it was okay and it wouldn't affect me at all, This is my first time doing this and I want to get it right, so any help would be really appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign address in W-2 and "we are missing your state and zip code"

Don't know who you talked to at TurboTax. But it's obvious that either they are wrong, or one of you completely mis-understood the other.

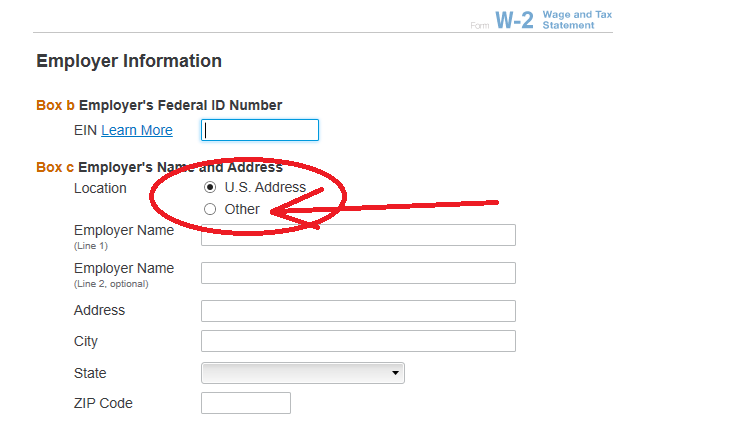

Enter your W-2 as printed, and don't go changing stuff or using made-up addresses. You can enter a foreign address *IF* you select the "other" option. Take a look at the attached screenshot. I've circled in red what you need to change.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign address in W-2 and "we are missing your state and zip code"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign address in W-2 and "we are missing your state and zip code"

Hey Carl, thanks a lot for replying!

That's not the kind of screen I see, I uploaded my W-2 directly from my employer, when I'm filling the the personal information section in turbotax I'm just asked about my state of residence (whether it's foreign, which I pick and then it doesn't ask me any further details) and then my mailing address, whether it's in the US or Foreign and such, and to enter it.

When I enter my actual foreign address, it doesn't let me move forward and throws me the "we are missing your state and zip" even tho they're right there, let me know if you need screenshots.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign address in W-2 and "we are missing your state and zip code"

by the way the foreign address in the W-2 is NOT my employer's, but my own.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign address in W-2 and "we are missing your state and zip code"

The address on the W-2 screen is for the employer's address, which you said is a U.S. address, so that should be no problem.

To indicate that you (the taxpayer) have a foreign address, please follow these steps:

- Click My Info in the black bar on the left side of your screen.

- In the Mailing Address section, click Edit on the right.

- On the next screen, select Foreign Country in the Type of mailing address box and complete entering your address.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign address in W-2 and "we are missing your state and zip code"

@Irene2805 Hello Irene, thanks a lot for replying!

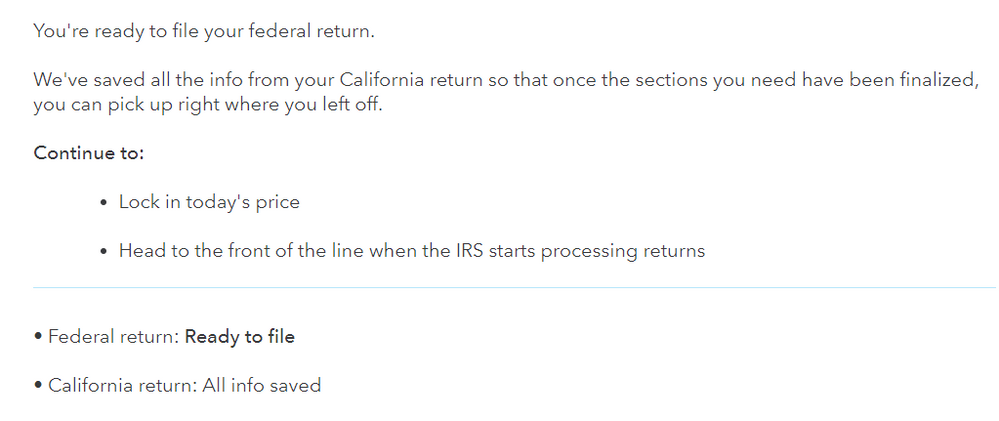

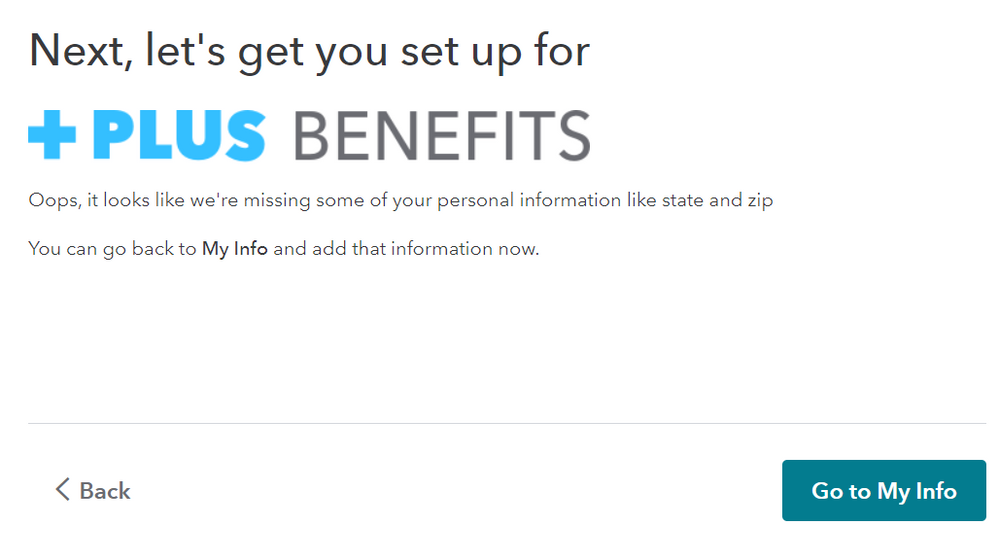

Those were the steps I followed to enter my own foreign address, however, when the foreign address is set, when I get to the point of getting ready to file my taxes, turbotax gives me the "oops we are missing some of your information" error, and indicates that it's missing the zipcode and the state, which is not true, as I type in both when setting my foreign address.

If I swap my mailing address fr a US-based mailing address, this error doesn't appear, and it lets me move forward. I haven't filed my taxes yet because I'm waiting for a couple of california forms to be made available, what can I do to be able to file them with my foreign address? I saw something about maybe choosing the "pay with my tax return" option generating the bug, but I'm not sure what steps to take to change that.

If that can be changed, would it be a problem with my taxes to indicate that I live outside the US, but to use a US based mailing address? it's an address I can still receive mail at (But I'd prefer to set my foreign mailing address instead).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign address in W-2 and "we are missing your state and zip code"

You may have a problem with the Mexican State and postal code. If those are correct and they match, the error should go away.

Please see the attached TurboTax website: How do I enter a foreign address in TurboTax? For further information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign address in W-2 and "we are missing your state and zip code"

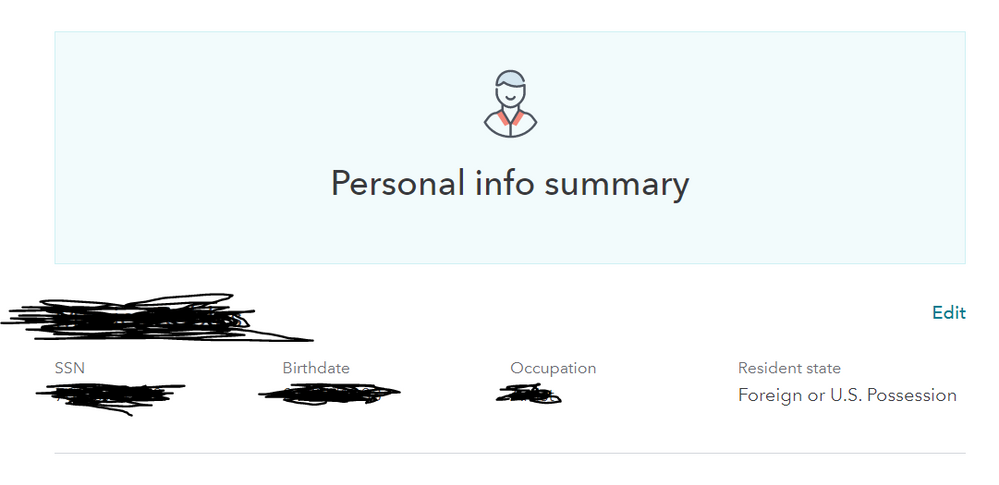

@RobertG Thank you for replying, I followed the instructions you mentioned to the letter, but this is what happens:

1. My mexican state and postal code are correct.

2. I entered the foreign address as instructed (I am set as "Foreign", and my Country is correct in the mailing address.

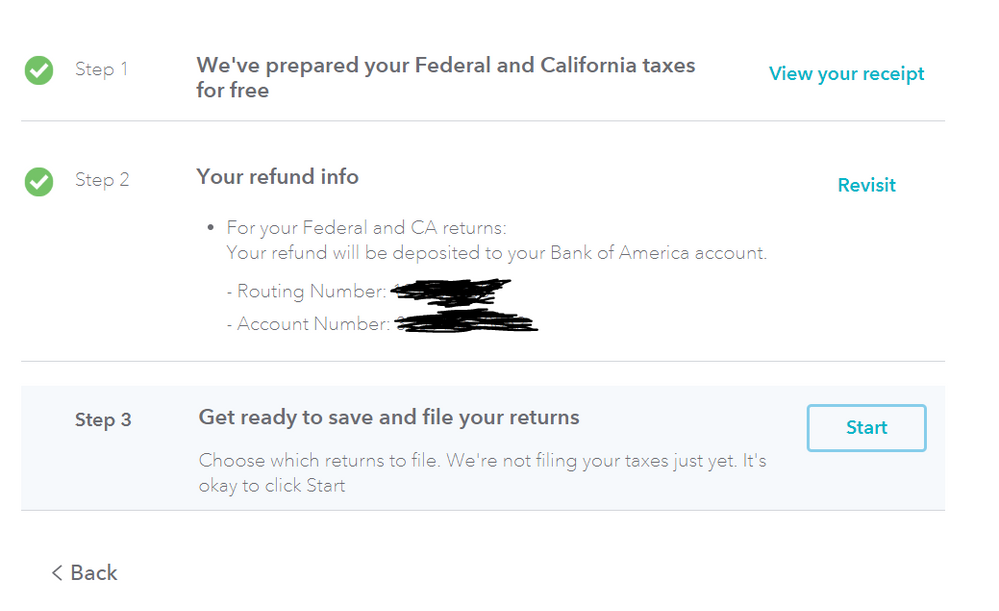

3. When I keep moving forward, right after clicking "get ready to save and file your return" (which I'm doing just to see if there is no error) I once again get the "oops, it looks like we're missing some of your info like state and zip" error, and it only gives me the option to go back to my info.

I've seen some similar problems in the forums and this might be relevant:

I'm using the free turbotax edition, and initially set it to be "paid for" with my own tax return, is this a problem when filing from a foreign address and how can I change my payment method if so? I saw you have to pay with a U.S credit card, and I only have a U.S debit card, since I'm using the free edition I don't see why it would be a problem to have it "pay" with my return, which is being routed to a U.S bank account.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign address in W-2 and "we are missing your state and zip code"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign address in W-2 and "we are missing your state and zip code"

You can pay for TurboTax with a US Debit card, as long as it is Visa, MasterCard, American Express, and Discover cards with a U.S. billing address.

The screenshots you posted are redacted so that the address is blacked out.

I suggest that you use TurboTax Live Tax Advice to get this resolved. A TurboTax agent will be able to see your screen and help you resolve the error message. Contacting an agent may require an upgrade to TurboTax Live.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign address in W-2 and "we are missing your state and zip code"

Hi @monrob,

Did you ever get this resolved with Turbotax? I'm experiencing the same issue/error with my foreign address and can't seem to find any info or person with Turbotax that gives a helpful answer.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign address in W-2 and "we are missing your state and zip code"

If you are trying to pay for TurboTax or e-filing, you must have a US address and US credit card.

If you have entered a foreign address in the MY INFO section then here is the workaround ...

1) go back to the MY INFO section and change the address to the same one the US credit card is registered to

2) complete the FILE tab long enough to pay the TT fees

3) return to the address section of the MY INFO tab and put the actual foreign address back

4) complete the FILE tab again all the way until you can transmit the return.

You can change you address in the MY INFO section on the left hand side of your screen in the black area. Click on Edit next to your address.

You may have to mail your return instead of e-filing.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign address in W-2 and "we are missing your state and zip code"

@TCARLSON333 I did, but I paid for the turbotax version that lets you have live assistance and then I had to be transferred to a tax expert on their end, since it seems like it's a complicated issue and you have to check a lot of information to make sure it stops displaying that error, so I'd advise you to get live assistance then request the tax expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign address in W-2 and "we are missing your state and zip code"

@TCARLSON333 I spent a good deal of time with a TurboTax rep dealing with the same problem e-filing 2019 US tax return from Canada.

We paid the e-filing with a US credit card (accepted) but TurboTax said that "state and zip code" were missing.

It seems, with the help from the rep, that the BILLING ADDRESS must match the MAILING ADDRESS.

The rep and I changed the MAILING ADDRESS to reflect the BILLING ADDRESS (US address) and went through the process of filing. Once we "signed the return," the rep had me go in to "My Info" and change the MAILING ADDRESS to my current Canadian address.

This end around worked and my current Canadian address showed on my 2019 US tax return.

@TurboTax - please correct e-filing using a foreign residence and allow US citizens to pay using a Canadian credit card (MasterCard). I am considering using H&R Block to file my 2020 US tax return. It took me 15 hours searching the message boards and talking with TurboTax reps to "cobble" an end-around resolution. Completely unacceptable for a simple, no-return tax filing.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

wmsgeorge

New Member

user17654899575

New Member

lil_dreamer13

New Member

geordiefoley

New Member

sherrimsmith67

New Member