- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Can I file federal and state separately?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I file federal and state separately?

I'm having the same problem -- can't get Turbotax to incorporate the federal return that was accepted electronically by the IRS. When prompted to file the state alone, I'm prompted to click a back button does no more than send me into a loop without being able to add the already transmitted federal return. Turbotax has failed, at least when dealing with my state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I file federal and state separately?

Please see this Turbo Tax FAQ for more information.

Why am I not able to e-file my state return after filing my Federal return?

Can't e-file state after federal

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I file federal and state separately?

Hello, @SForrestLO

I paid for TT online for federal & state filing but I would like to file for federal now and save state for later but the software is not giving me any options to delete state or to save it for later, do you know when this will be fixed?

Thank you,

Teresa M.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I file federal and state separately?

File Federal now and skip state for later

https://ttlc.intuit.com/community/state-taxes/help/can-i-file-my-federal-taxes-now-and-skip-my-state...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I file federal and state separately?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I file federal and state separately?

@teresamorgan0301969 wrote:

Hello, @VolvoGirl

I have tried to do this and no luck, but thank you.

Teresa M.

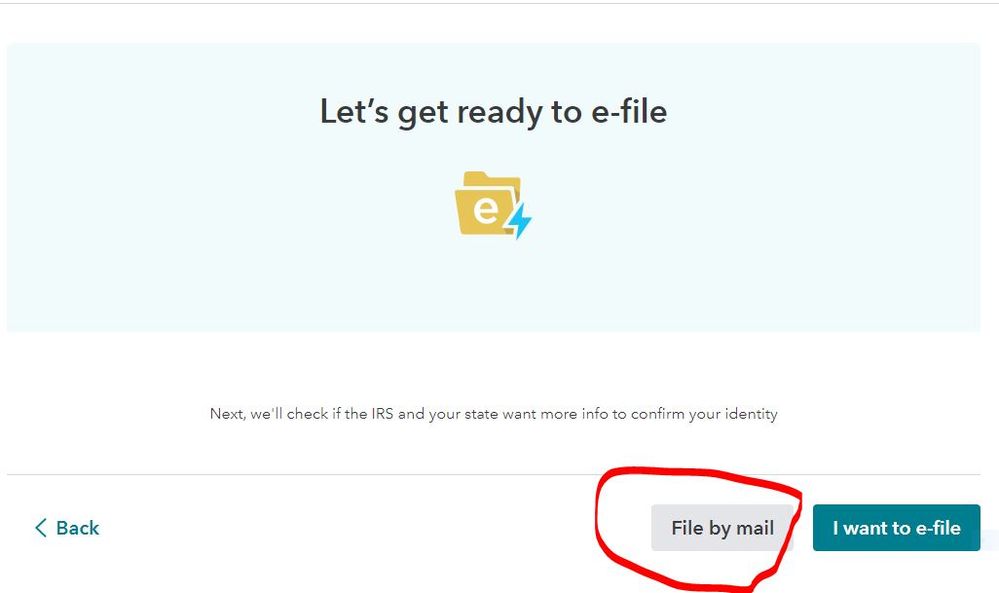

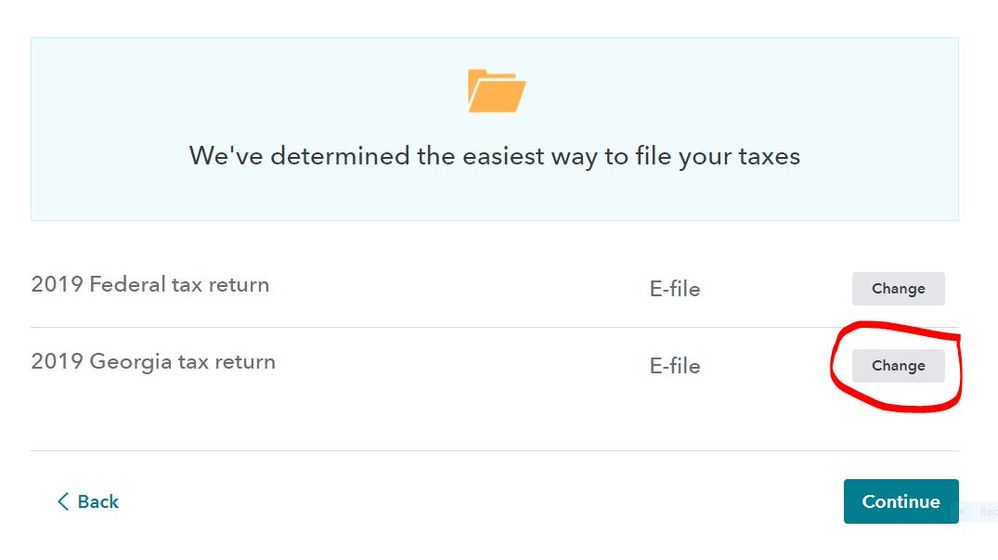

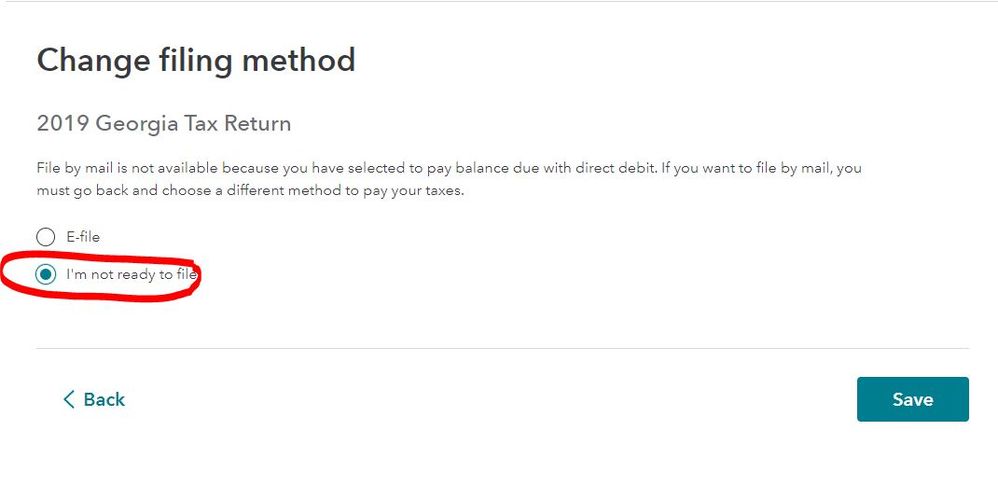

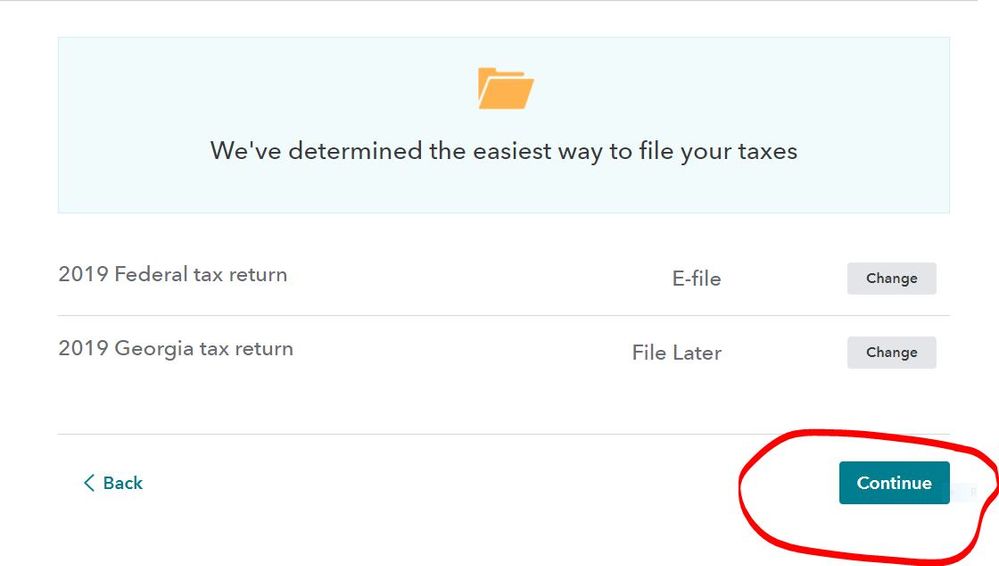

Assuming that you are using the TurboTax online editions, you can change how the state return is filed in the File section of the program on Step 3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I file federal and state separately?

So the only way to bring up the Change Filing Method option is to select File by mail? That's pretty confusing, dontcha think? I used the 2020 IRS Free File version to complete both Federal and State. I wanted to transmit Federal today, but wait a few weeks to transmit State (in case the new American Rescue Plan tax waiver trickles down to the states). So of course I chose "I want to e-file"; in the Free File version Step 3 even says "Get ready to save and file. Choose which returns to file. We're not filing your taxes just yet." But it never gives you that option. It immediately jumps to "Let's take one last look at the returns you're filing", then "TRANSMIT RETURNS" on bottom right. Both returns. No option to File Later for State. Maybe this only happens in the Free File version, but it shouldn't make a difference. Just sayin'.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I file federal and state separately?

If you want to wait to file your state return at a later time, please follow the instructions here @MarycatPhoenix.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I file federal and state separately?

Hi there, I filed my federal taxes for free on the government's website. Can I use turbotax to file my state returns? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I file federal and state separately?

@juliabcohen Sorry---when you use TurboTax the information flows from the federal return to the state return. You cannot use TurboTax to prepare "stand alone" state returns.

Try going to your state's tax web site to see if you can use the site, or get the forms to prepare by hand. You will need information from your federal return to prepare state forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I file federal and state separately?

If you used one of the IRS FREE FILE options to file the federal return then return to that company to file the state return as well. If they don't offer state filing then you can check your state's website to see if you can file the return directly online on their web site.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I file federal and state separately?

I already e filed my federal forms. How do I now e file my state forms???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I file federal and state separately?

When your federal has been Accepted. How to file state after federal

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I file federal and state separately?

Please review this resource for steps on filing your state return after your federal @ToneBone99.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17638037803

New Member

Raph

Community Manager

in Events

Ryan_TX

New Member

mytax26

Level 2

user17537184588

New Member