- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Tax law changes

- :

- i could't e-file because i had zero 1040 income only 1099-nec income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

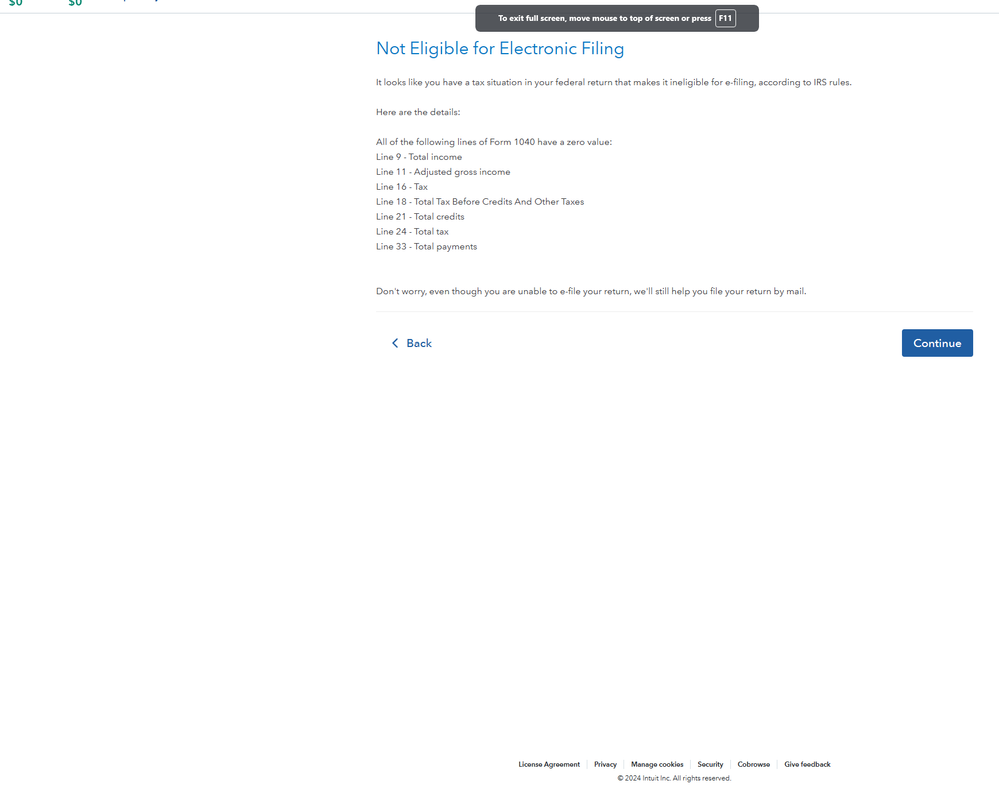

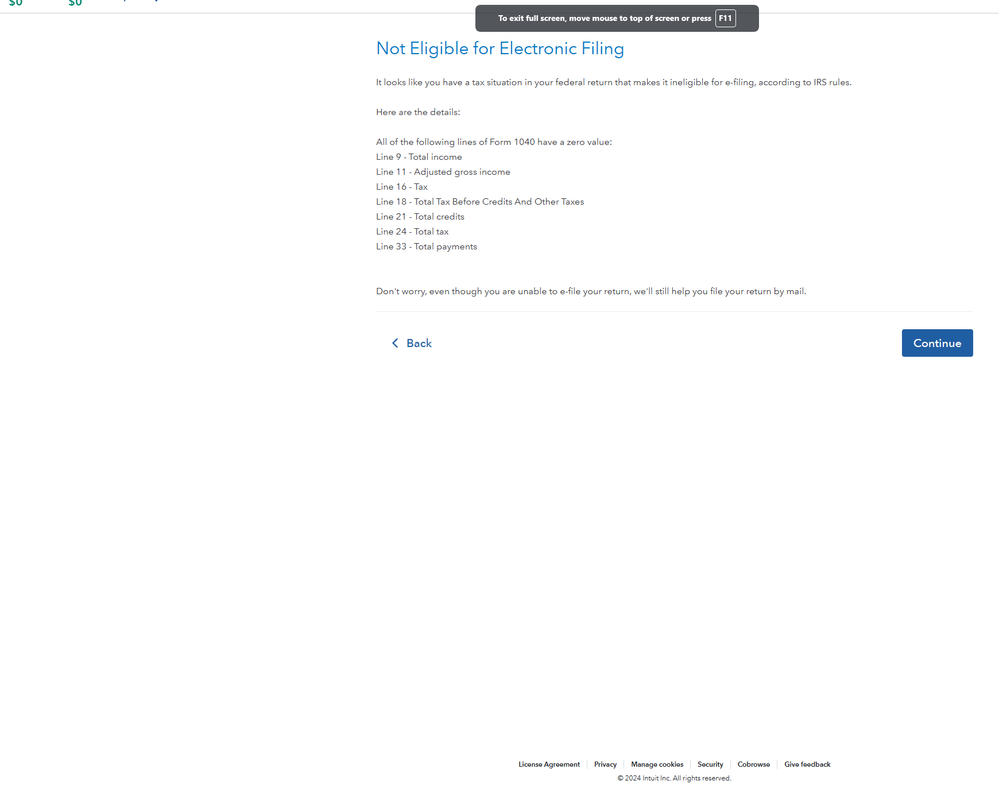

i could't e-file because i had zero 1040 income only 1099-nec income

this information was news to me, but it did prevent me from e-filing according to tubotax. I've been searching for clarification and am empty-handed respectfully. the edition is premium but I can't seem to locate the option to tag my post as such.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

i could't e-file because i had zero 1040 income only 1099-nec income

You can efile without a W2 and only 1099 income. Where are you stuck? Do you need help filling out 1099NEC for self employment?

You can enter Self Employment Income into Online Deluxe but if you have any expenses you will have to upgrade to Premium version. Or use any of the Desktop CD/Download programs.

How to enter income from Self Employment

https://ttlc.intuit.com/community/self-employed/help/how-do-i-report-income-from-self-employment/00/...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

i could't e-file because i had zero 1040 income only 1099-nec income

You can e-file with a 1099NEC. Not sure why you think otherwise. But you are posting your question from online Deluxe. If you have self-employment income you need to prepare a Schedule C for your business expenses. Deluxe cannot prepare a Schedule C. You need online Premium or any version of the CD/download to prepare a Schedule C.

You have self-employment income for which you will pay self-employment tax for Social Security and Medicare. You will need to use online Premium software or any version of the CD/download so that you can prepare a Schedule C for your business expenses.

https://ttlc.intuit.com/questions/2926899-how-does-my-side-job-affect-my-taxes

https://ttlc.intuit.com/community/self-employed/help/what-is-the-self-employment-tax/00/25922

https://ttlc.intuit.com/questions/2902389-why-am-i-paying-self-employment-tax

https://ttlc.intuit.com/questions/1901340-where-do-i-enter-schedule-c

https://ttlc.intuit.com/questions/3398950-what-self-employed-expenses-can-i-deduct

https://blog.turbotax.intuit.com/self-employed/self-employed-tax-deductions-

calculator-2021-2022-50907/

https://ttlc.intuit.com/questions/1901110-do-i-need-to-make-estimated-tax-payments-to-the-irs

https://turbotax.intuit.com/tax-tools/calculators/self-employed/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

i could't e-file because i had zero 1040 income only 1099-nec income

opps, i used the premium not deluxe ..then this happened a tax expert told me it was because zeros on a w-2 weren't being accepted by the irs

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

i could't e-file because i had zero 1040 income only 1099-nec income

sorry, i used turobotax premium

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

i could't e-file because i had zero 1040 income only 1099-nec income

i used premium my mistake

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

i could't e-file because i had zero 1040 income only 1099-nec income

The W-2 is the form an employer sends to an employee to document wages. The 1040 is the tax return that you file with the IRS.

I think you are confusing "W-2" with "1040", a frequent issue with taxpayers.

Your issue on e-file is that you have no taxable income on your 1040 - see lines 9 and 11 on your screenshot above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

i could't e-file because i had zero 1040 income only 1099-nec income

So did you enter the 1099NEC income? It should be be taxable. How much was it for? A 1099NEC is self employment income. You need to file it on Schedule C and pay self employment tax on it. You should have amounts on some of those lines.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Lukas1994

Level 2

jigga27

New Member

branmill799

New Member

anonymouse1

Level 5

in Education

ripepi

New Member