- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Where in TT Desktop To Enter My New Zealand Wages?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TT Desktop To Enter My New Zealand Wages?

I have TT Desktop version and cannot figure out how to enter my New Zealand wages (foreign income) in this software! I know I need form 1116 for this but cannot get any help with where to enter this in when using TT. Can someone please guide me with this? I am really stuck. Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TT Desktop To Enter My New Zealand Wages?

To enter Foreign Earned Income -

Click on Federal Taxes (Personal using Home and Business)

Click on Wages and Income (Personal Income using Home and Business)

Click on I'll choose what I work on (if shown)

Scroll down to Less Common Income

On Foreign Earned Income and Exclusion, click on the start or update button

To enter Foreign taxes paid -

Click on Federal Taxes (Personal using Home and Business)

Click on Deductions and Credits

Click on I'll choose what I work on (if shown)

Scroll down to Estimates and Other Taxes Paid

On Foreign Taxes, click on the start or update button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TT Desktop To Enter My New Zealand Wages?

Thanks for your reply but I can't use the Form 2555 Income Exclusion since I didn't live in New Zealand enough days to use this form. I am using the Desktop Deluxe version and if I try to enter my New Zealand wages in the Wages and Income W-2 section I can't enter anything my EIN numbers. I am at a loss where to enter this to generate form 1116 (in Desktop you can see forms while working). I can't get help from Live Support since I'm not using the online version which I find stressful. Thanks for any help with this. I've already paid for this software so hate to give up!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TT Desktop To Enter My New Zealand Wages?

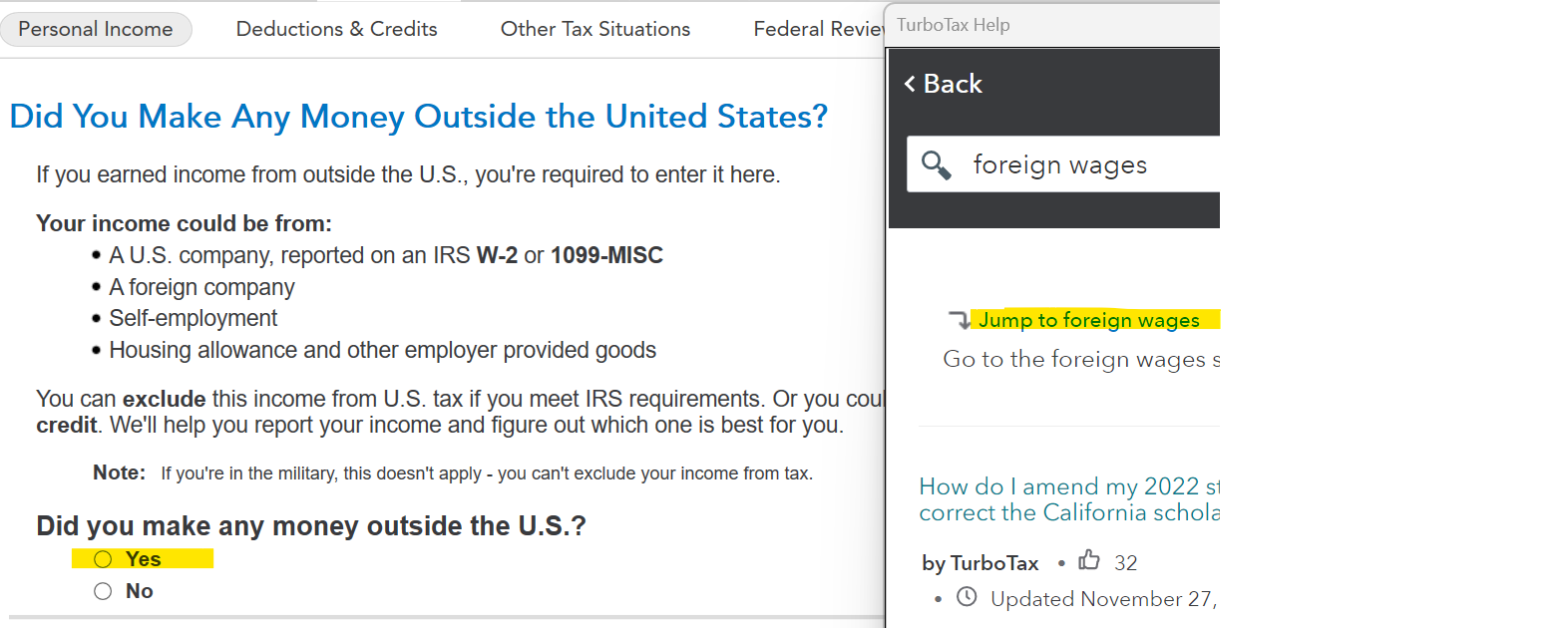

Don't enter your foreign wages in the w-2 section. Search for foreign wages and then use the Jump to foreign wages link. You will be asked if you made money outside the US - answer YES, a screen clip is below.

After you enter your foreign wages and taxes (you must have paid, accrued, or owe taxes on foreign income that is also subject to U.S. income tax), you can proceed to the Foreign Tax Credit section to complete Form 1116; the link has instructions.

Why is the FTC not showing up on Schedule 3?

One possibility is that you don't have any amounts on Form 1040, Line 15. This can happen if you're under the filing threshold or if you haven't finished entering all your income yet.

[Edited 03/09/2024 | 8:55 PM PST] for clarification @juinnder

[Edited 03/09/2024 | 8:55 PM PST] for clarification @juinnder

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TT Desktop To Enter My New Zealand Wages?

Unfortunately when I entered this foreign wages in the Desktop version it didn't generate form 1116 so sorry but that didn't work either! I am truly stuck on where to enter foreign wages into TT Desktop to generate form 1116 for general and then for passive income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in TT Desktop To Enter My New Zealand Wages?

@ juinnder wrote:Unfortunately when I entered this foreign wages in the Desktop version it didn't generate form 1116 so sorry but that didn't work either! I am truly stuck on where to enter foreign wages into TT Desktop to generate form 1116 for general and then for passive income.

Foreign wages are entered in the interview topic that @ DawnC discussed above, but as you've seen, that is not the topic that generates Form 1116. You can prepare Form 1116 (Foreign Tax Credit) in the desktop version. It's under the "Deductions & Credits" tab. So it's actually a 2-part process--first, entering the foreign wages in the Foreign Earned Income section, then going to the Foreign Tax Credit topic to generate the Form 1116.

It's not the entry of foreign wages that generates Form 1116. Form 1116 is generated when you go through the interview for the Foreign Tax Credit, which is a different interview. Have you gone through the Foreign Tax Credit section? Scroll up and see the second set of steps that @ DoninGA left you in his original comment to your question. Those are the steps to get to the Foreign Tax Credit interview that generates Form 1116.

Once you get past several screens in that Foreign Tax Credit interview it will ask you to select if you want to use a deduction or credit for foreign taxes paid. If you choose "take the credit", about 4 or so screens later it starts Form 1116, and the first question will say "Choose the income type." That's where you can choose passive, general, etc. See image below; click to enlarge:

.

.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

doubleO7

Level 4

TMM322

Level 1

user17552101674

New Member

anthonysalasr22

New Member

HNKDZ

Returning Member