- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

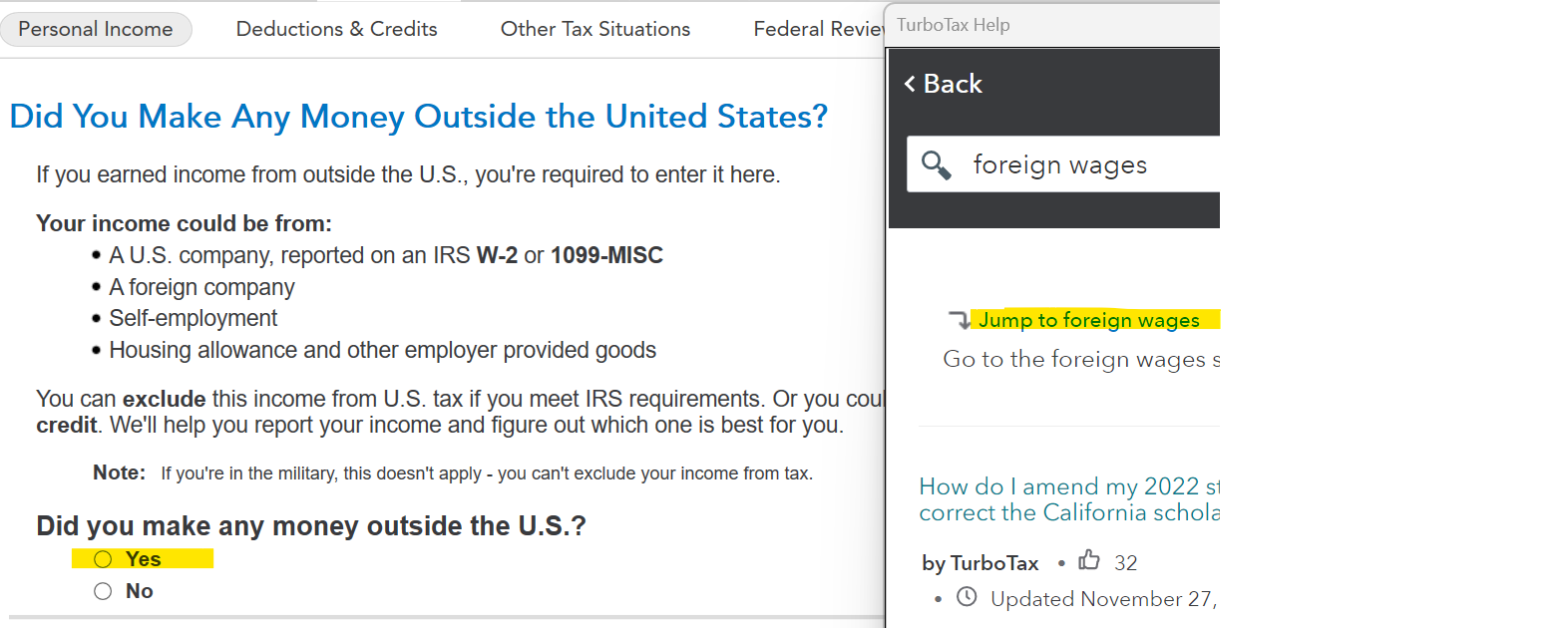

Don't enter your foreign wages in the w-2 section. Search for foreign wages and then use the Jump to foreign wages link. You will be asked if you made money outside the US - answer YES, a screen clip is below.

After you enter your foreign wages and taxes (you must have paid, accrued, or owe taxes on foreign income that is also subject to U.S. income tax), you can proceed to the Foreign Tax Credit section to complete Form 1116; the link has instructions.

Why is the FTC not showing up on Schedule 3?

One possibility is that you don't have any amounts on Form 1040, Line 15. This can happen if you're under the filing threshold or if you haven't finished entering all your income yet.

[Edited 03/09/2024 | 8:55 PM PST] for clarification @juinnder

[Edited 03/09/2024 | 8:55 PM PST] for clarification @juinnder

**Mark the post that answers your question by clicking on "Mark as Best Answer"