- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Schedule 8812

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812

For our joint return, we had to enter $0 in 8812, 12 B 2 (spouse) ; B 1 (taxpayer) was already $0.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812

Thanks everyone. I went back and input 0. It indeed worked. Problems solved.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812

We do not have children nor have claimed any children linked to the Child Care Credit, yet Schedule 8812 always returns after deleted the Tax Form, "Save", "Close" TurboTax downloaded Mac version and reboot computer. Despite that, Schedule 8812 reappears.

Something is not working correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812

@tomq7 wrote:

We do not have children nor have claimed any children linked to the Child Care Credit, yet Schedule 8812 always returns after deleted the Tax Form, "Save", "Close" TurboTax downloaded Mac version and reboot computer. Despite that, Schedule 8812 reappears.

Something is not working correctly.

If the TurboTax program is asking for an entry on a Schedule 8812 field, then just enter a 0 (zero) and continue. Do not run Smart Check again after entering the 0's on the 8812.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812

If you read earlier posts on this subject, you will have your answer. The instructions fixed this issue for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812

Sorry to report but have followed your directions and when placing a 0 in the Schedule 8812 box, the screen does not change, demanding and amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812

@tomq7 wrote:

Sorry to report but have followed your directions and when placing a 0 in the Schedule 8812 box, the screen does not change, demanding and amount.

Contact TurboTax support for assistance with this issue.

Use this website to contact TurboTax support during business hours - https://support.turbotax.intuit.com/contact/

Or -

Support can also be reached by messaging them on these pages https://www.facebook.com/turbotax/ and https://twitter.com/TeamTurboTax

Or -

Use this phone number and select TurboTax - 1-800-4-INTUIT (1-800-446-8848)

Or -

On every TurboTax web page, including this one, scroll down to the bottom of the page and click on Contact Us

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812

TurboTax needs to look at its program! I first replied wrongly that I had not received the Covid Relief payment, so TurboTax increased my federal refund amout by $2800! I fixed finally found/retraced to the question about the covid relief corrected it to "yes" received. Turbotax dropped the added $2800 federal refund but now insists I correct entries in the Child Credit Schedule 8812 (but I have no child credit! Won't let me finish taxes unless I correct 8812! I followed Turbotax suggestions to delete 8812 but it keeps coming back!

I am convinced Turbotax has a program error that conflates the covid stimulous with 8812 child credit!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812

I solved it!!!!!! Go back to Deductions. When you get to the screen that first cites the $1,400 (filing for Single) or $2,800 (filing for Married Couples) ... Click NO, Continue. The next screen asks if you received a March Stimulus payment ... Click YES, Continue. You are now done.

The hangup for me was this form so deleting Schedule 8812 does nothing other than aggravate people.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812

I tried to delete on my downloaded turbotax but it doesn't list Schedule 8812

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812

I accidentally entered the wrong number of children and the TurboTax app will not let me edit it. Where do I go to change or modify that, I can only get the dollar amount recieved for the CTC as something I can edit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812

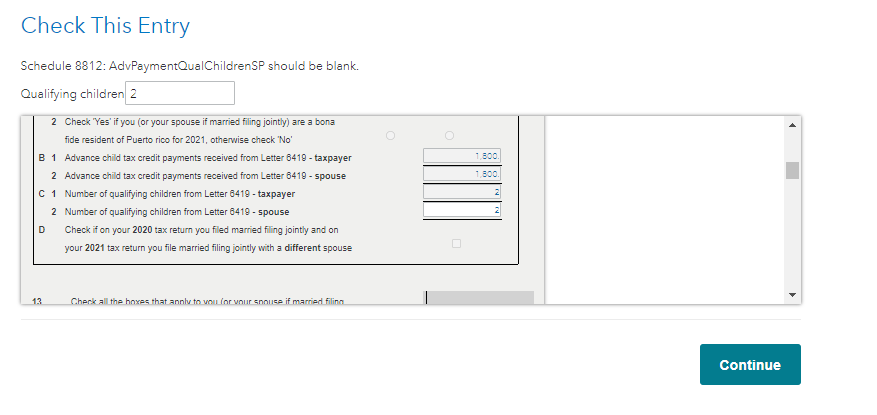

To change the number of children in TurboTax for the Child Tax Care Credit, please follow the instructions below:

- Open the return.

- Click on Federal Review on the top of the page.

- On the page Let's take care of these details now, click Review.

- On the following screens, you will be able to verify the amount and the number of qualifying children. I have attached a screenshot below for additional review.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812

Just enter "0". I got the same error in the same situation, putting in zero made it go away. The error-checking function is not discriminating enough.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812

Just enter 0 (zero), it's ok.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule 8812

@DawnC wrote:

Are you sure it is the Form 8812 that keeps reappearing or is it possible, it is Form 2441 - Dependent Care Credit? If you are taking the Dependent Care Credit, do not delete it, but if you started that section erroneously and attempt to delete the form, it will return if the section if half completed.

Dawn, the same error happened to me last night. I claim no dependents and have no other related forms. However, Turbotax Desktop created a schedule 8812 and populated it with my income and other information and calculated a zero benefit, but it still insisted on asking me the question during the error check. I suspect that this is such an important issue, and because there will be some people who got the advance payments but don't claim a dependent this year, that the program must ask everyone.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

wwthomp

Level 2

tunerthe1

New Member

daniel-minkler

New Member

RunnerBKK

New Member

miranda-ku-paly

New Member