- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Why is turbotax suggesting that I take the standard deduction of 12,200 when my itemized deductions is much higher?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

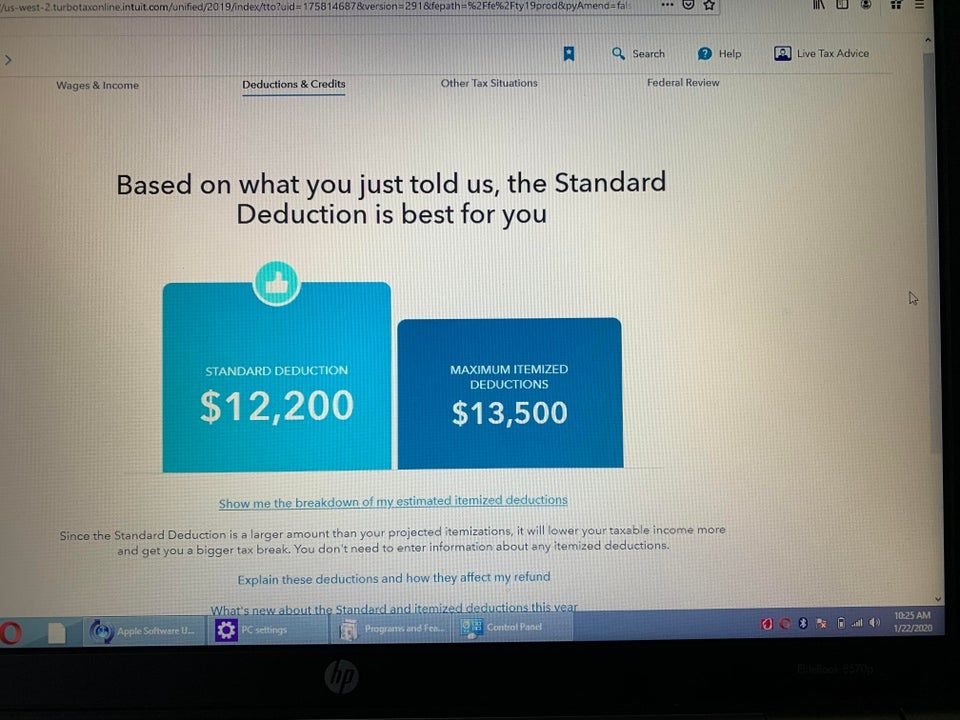

Why is turbotax suggesting that I take the standard deduction of 12,200 when my itemized deductions is much higher?

Ended up with over 16k in itemized deductions. But the issue is that based off of last years data itemized was expected to be better. Yet they still suggested standard.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is turbotax suggesting that I take the standard deduction of 12,200 when my itemized deductions is much higher?

can you post what expenses you have?

remember that state and local taxes (SALT) are limited to $10,000 so that is the limit that counts as itemized.

also, only the medical expenses that exceed 7.5% of your income count towards the itemized deduction limit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is turbotax suggesting that I take the standard deduction of 12,200 when my itemized deductions is much higher?

When I did itemized deductions, property taxes, interest on loan, car registration, and charitable donations it ended up being over 16k

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is turbotax suggesting that I take the standard deduction of 12,200 when my itemized deductions is much higher?

and that $16k is what Turbo Tax reported? or is that what you keyed in?

the property taxes plus you state income tax is limited to $10,000.

what loan? unless that is a house, it's not tax deductible.

are you sure you are listed as 'single' ($12,200) and not joint ($24,400)?

how much was each category?

home mortgage interest?

state taxes? (look at the W-2s)

property tax?

charitable contributions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is turbotax suggesting that I take the standard deduction of 12,200 when my itemized deductions is much higher?

in reply to your response

mort int 5277

fed tx 7163

prop tx 2998

char 710

car reg 144

it comes to 16292, so why am I told to go standard

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is turbotax suggesting that I take the standard deduction of 12,200 when my itemized deductions is much higher?

fed tx is not deductible - that is why ; you only have about $9200 in deductions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is turbotax suggesting that I take the standard deduction of 12,200 when my itemized deductions is much higher?

Federal tax? Fed tax is not an Itemized deduction. Just state taxes paid. Federal tax like withholding or estimated payments are subtracted off your tax liability at the end of your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is turbotax suggesting that I take the standard deduction of 12,200 when my itemized deductions is much higher?

previous years I have always been able to itemize and my numbers have not changed that much, so the tax laws must have changed dramatically, hense the rich get richer and the poor get poorer. So now the government gets to keep more of our overpayment of taxes, nice

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is turbotax suggesting that I take the standard deduction of 12,200 when my itemized deductions is much higher?

But starting in 2018 they about doubled the Standard Deduction so more people are taking the Standard Deduction now.

FAQ on 2018 changes

And see Deductions that have been suspended for 2018

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is turbotax suggesting that I take the standard deduction of 12,200 when my itemized deductions is much higher?

You need to check your actual deductions to compare to the Standard Deduction. Some of your deductions are now limited. And you were including federal taxes were are not a deduction.

If it's giving you the Standard Deduction and not showing you Schedule A you can check the actual amount of itemized deductions by using by going to

Tax Tools on left

Tools - Topic Search (top left box)

Type in itemized deductions, choosing. It should highlight that in the list, click on GO

Then Click on "Change my deduction". That will display the actual amount of itemized deductions vs. the standard deduction. (Be sure to uncheck "Change my deduction" after checking it so you do not lock in the wrong deduction.

How to change between the Standard Deduction and Itemized Deductions

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kh52

Level 2

TestEasyFirstName

New Member

realestatedude

Returning Member

user17544847578

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

juva

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill