- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: When I enter multiple foreign countries for foreign tax credit, TT then only allows me to ent...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter multiple foreign countries for foreign tax credit, TT then only allows me to enter income for one country, not all. Am I missing something?

The remaining balance in B5 is over $600 than it should be. Recheck all the entries for mistakes.

With regard to box b1; (qualified dividends), it appears you didn't do the subtractions as I don't see any indication on the spreadsheet that it was done.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter multiple foreign countries for foreign tax credit, TT then only allows me to enter income for one country, not all. Am I missing something?

I didn't see how to determine what portion of the foreign dividends are qualified in order to change 1b.

How's this for a new strategy? As the 1116 forms are created, I will manually double-check the figures and change the 2 original 1099 1a numbers back to the original amount to get past the error check. As long as the amounts are correct, there shouldn't be a problem. I also changed the 1116 forms where both 1099's hit the same country to have supporting lines reflecting each of the 1099 amounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter multiple foreign countries for foreign tax credit, TT then only allows me to enter income for one country, not all. Am I missing something?

The foreign qualified dividends should be within the broker's supplemental info.

With regard to the 1a's: it is important that the total of all 1a's must be exactly the same as the original amount in schedule B, line 6.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter multiple foreign countries for foreign tax credit, TT then only allows me to enter income for one country, not all. Am I missing something?

Sorry for the late reply. Had to migrate to a new desktop. 1099B is correct

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter multiple foreign countries for foreign tax credit, TT then only allows me to enter income for one country, not all. Am I missing something?

Redid the spreadsheet, everything AOK. One thing is TTAX automatically included another country that did not have any foreign tax. Thanks for all your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter multiple foreign countries for foreign tax credit, TT then only allows me to enter income for one country, not all. Am I missing something?

Love the jumping the hoops and data massaging and potentially messing up the return/calculations, required by a problem that goes unfixed for last how many years

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter multiple foreign countries for foreign tax credit, TT then only allows me to enter income for one country, not all. Am I missing something?

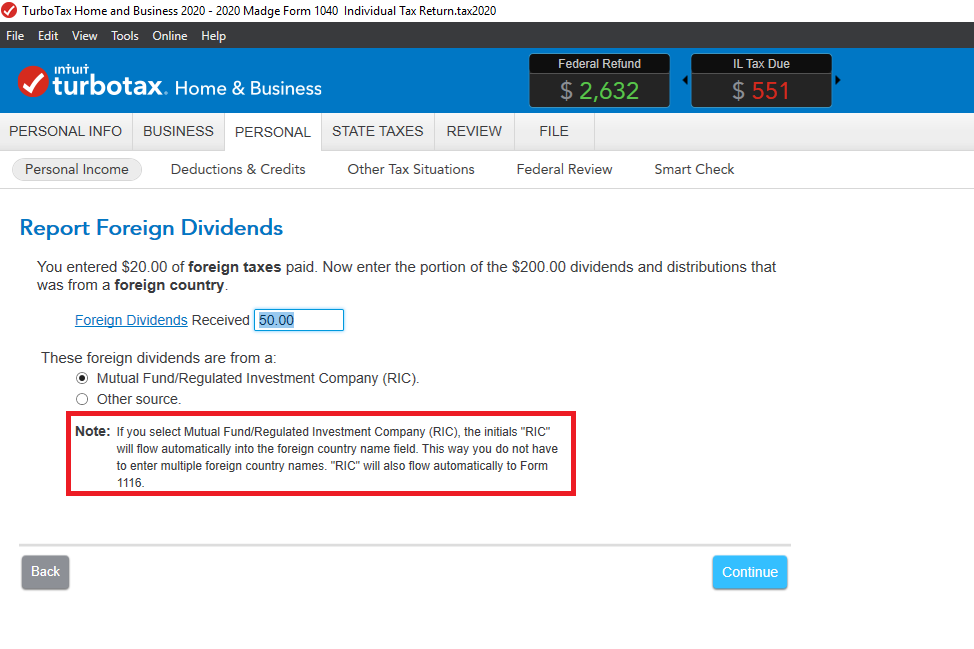

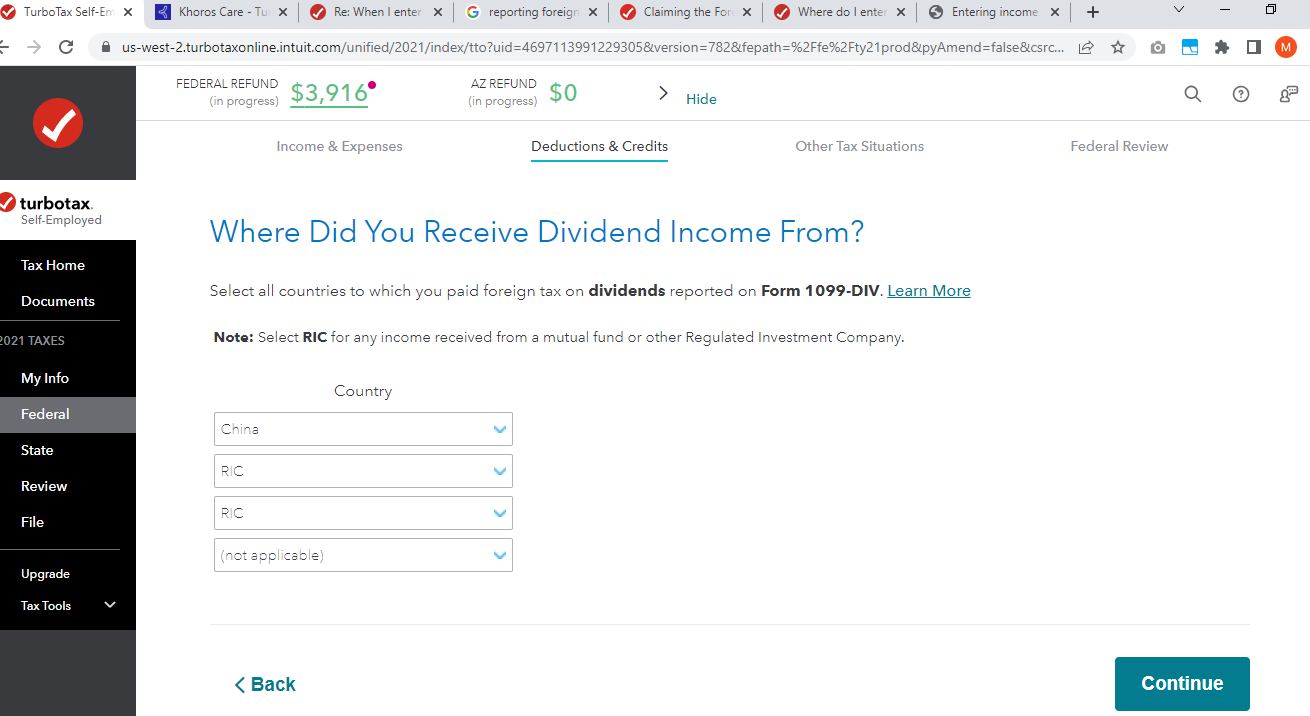

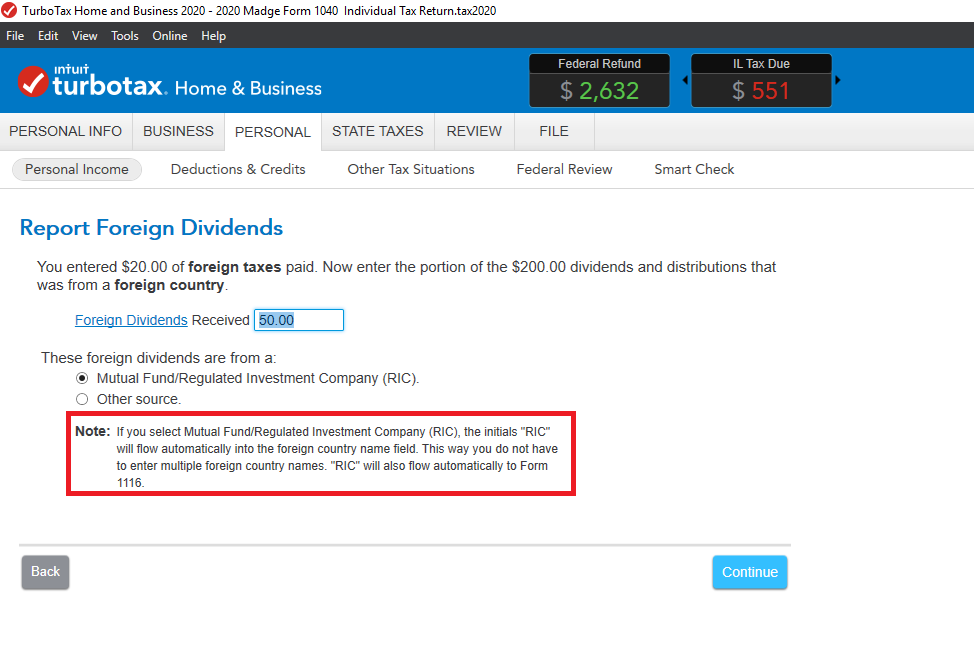

You need one Form 1116 for each type of income, so all Foreign Income/Foreign Tax Paid from 1099-DIV's will be added together on a single form with country designation 'RIC' (screenshot).

The Foreign Income/Tax Paid amounts flow into the Foreign Tax Credit section automatically when you choose 'RIC' as the country in your 1099-DIV entry.

All you need to do in the Foreign Tax Credit section is review and indicate 'Done'.

Click this link for more info on Form 1116.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter multiple foreign countries for foreign tax credit, TT then only allows me to enter income for one country, not all. Am I missing something?

What is ordinary income on line 9 of Form 1116 and its source

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter multiple foreign countries for foreign tax credit, TT then only allows me to enter income for one country, not all. Am I missing something?

If you are reporting Foreign Income and Foreign Tax from a 1099-DIV, use 'RIC' as one country for the total amount of Foreign Dividend/Tax when entering the 1099-DIV (screenshot).

This transfers to Form 1116 for you.

If you have different types of Foreign Income from different countries (earned income, rental, etc.), you need a separate Form 1116 for each category of income.

Line 9 on Form 1116 would show the total amount of Foreign Tax Paid on this type of income.

Click this link for more info on Form 1116.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter multiple foreign countries for foreign tax credit, TT then only allows me to enter income for one country, not all. Am I missing something?

This doesn't help if it isn't from an RIC. If I directly own foreign stocks from multiple countries in one brokerage account, then calling them all RIC ("Registered Investment Company") is a lie. RIC is only meant for mutual fund or ETF holdings, not for individually-held stocks.

This is such a ridiculous shortcoming of Turbotax. To ask us to lie to the IRS, and make up dummy 1099's that don't match our real 1099's, and that we calculate from spreadsheets to overcome a huge software bug in their system is ridiculous.

It's not like Turbotax doesn't generate billions of dollars each year that they could use to hire developers to fix this problem. They are just too cheap to spend their CEO's bonus money to help their customers solve these kinds of problems.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter multiple foreign countries for foreign tax credit, TT then only allows me to enter income for one country, not all. Am I missing something?

@MarilynG1 wrote:If you are reporting Foreign Income and Foreign Tax from a 1099-DIV, use 'RIC' as one country for the total amount of Foreign Dividend/Tax when entering the 1099-DIV (screenshot).

This transfers to Form 1116 for you.

Are you indicating that after it transfers to 1116, one needs to revise 1116 (after transfer) from RIC to appropriate value required? (In case you are referring to entering RIC -wrong entry just to get it transferred to 1116).

- If that works for multiple 1116s then maybe its a good workaround to use.

- If that's (changing RIC later on 1116) not what you were implying , system should just allow handling multiple 1116 across multiple countries across multiple 1099-Div / brokers. (Just a M:M relationship not that complex)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter multiple foreign countries for foreign tax credit, TT then only allows me to enter income for one country, not all. Am I missing something?

I have 2 tax reporting statements from my broker. Among the 2, there are 2 funds (RIC correct?) and 7 foreign country tax paid, China is on both of the statements, other countries are separate on one or either of the statements.

| Account 1 Tax | Account 2 Tax | TOTAL TAX | Account 1 Income | Account 2 Income | TOTAL INCOME | |

| SWITZERLAND | 342.63 | 342.63 | 978.94 | 978.94 | ||

| GERMANY | 220.84 | 220.84 | 837.32 | 837.32 | ||

| CHINA | 93.01 | 24.60 | 117.61 | 442.89 | 117.11 | 560.00 |

| DENMARK | 112.89 | 112.89 | 414.48 | 414.48 | ||

| VANGUARD RIC | 23.93 | 23.93 | 835.24 | 835.24 | ||

| AM SMALL CAP RIC | 12.31 | 12.31 | 12.31 | 12.31 | ||

| NORWAY | 6.00 | 6.00 | 24.00 | 24.00 | ||

| MEXICO | 4.99 | 4.99 | 51.18 | 51.18 | ||

| FRANCE | 0.02 | 0.02 | 0.07 | 0.07 | ||

| 841.22 | 3713.54 |

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter multiple foreign countries for foreign tax credit, TT then only allows me to enter income for one country, not all. Am I missing something?

If you are entering dividends/foreign tax from a particular country, when you are in the Foreign Tax Credit section, the interview wants to match each dividend previously entered (with foreign tax) with a Country and an income amount.

The dividend entries are displayed and you are asked to indicate the country and amount of dividend income. You will be able to choose the country from a dropdown list in the Foreign Tax Credit section.

Up to three countries can be included on one Form 1116 for each type of income. If you have more than three countries, additional form 1116's are created.

It looks like you have Foreign Tax from two funds reported as country RIC, and one from China (if Account 2 Tax is Foreign Tax).

@mnothstein

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter multiple foreign countries for foreign tax credit, TT then only allows me to enter income for one country, not all. Am I missing something?

Both accounts have foreign tax. 1116 help indicates having the largest first and then decreasing.

Despite multiple attempts to accomplish that I could not.

Perhaps someone should model this in TTAX to see how impossible it is to create all the 1116 forms from the interviews. All the information is in the spreadsheet I pasted.

2 tax reporting statements, 7 countries, 1 of which appears on both statements, 2 rics.

I certainly couldn't.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I enter multiple foreign countries for foreign tax credit, TT then only allows me to enter income for one country, not all. Am I missing something?

I am using 2024 TT. I followed this and it seemed to work but at the Federal Review it complained the amount (foreign source) should not be greater that in amount reported in the form 1099 DIV. I paid the most taxes to one country but got the most income from another. Should I have altered the 1099 from the payer to match the largest income or taxes?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

shuli05131999

New Member

flyday2022

Level 2

israelloera00

New Member

anth_edwards

New Member

pchicke

Returning Member