- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

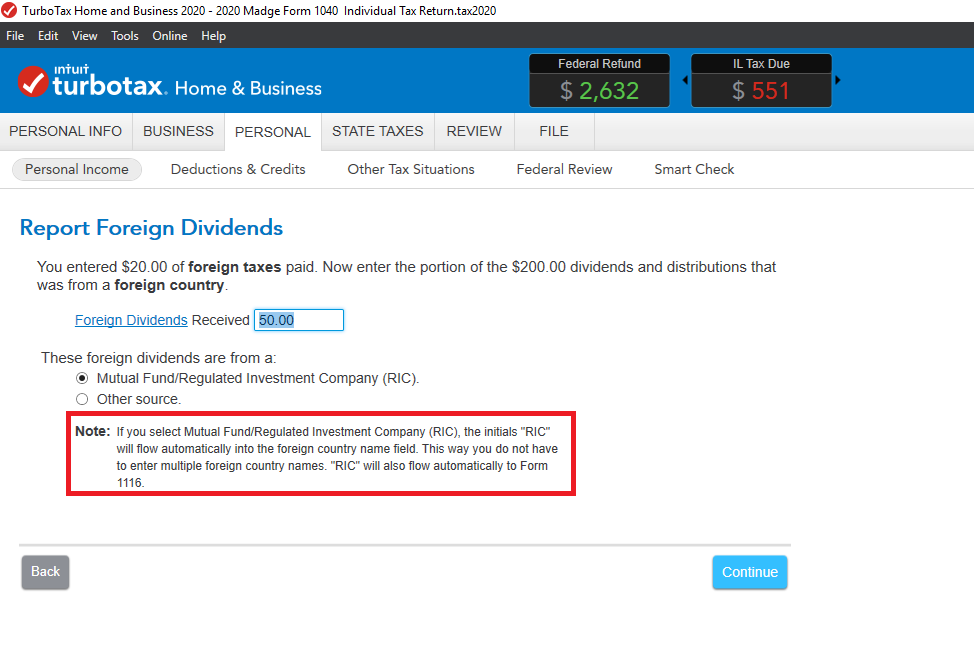

If you are reporting Foreign Income and Foreign Tax from a 1099-DIV, use 'RIC' as one country for the total amount of Foreign Dividend/Tax when entering the 1099-DIV (screenshot).

This transfers to Form 1116 for you.

If you have different types of Foreign Income from different countries (earned income, rental, etc.), you need a separate Form 1116 for each category of income.

Line 9 on Form 1116 would show the total amount of Foreign Tax Paid on this type of income.

Click this link for more info on Form 1116.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 5, 2021

1:14 PM