- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

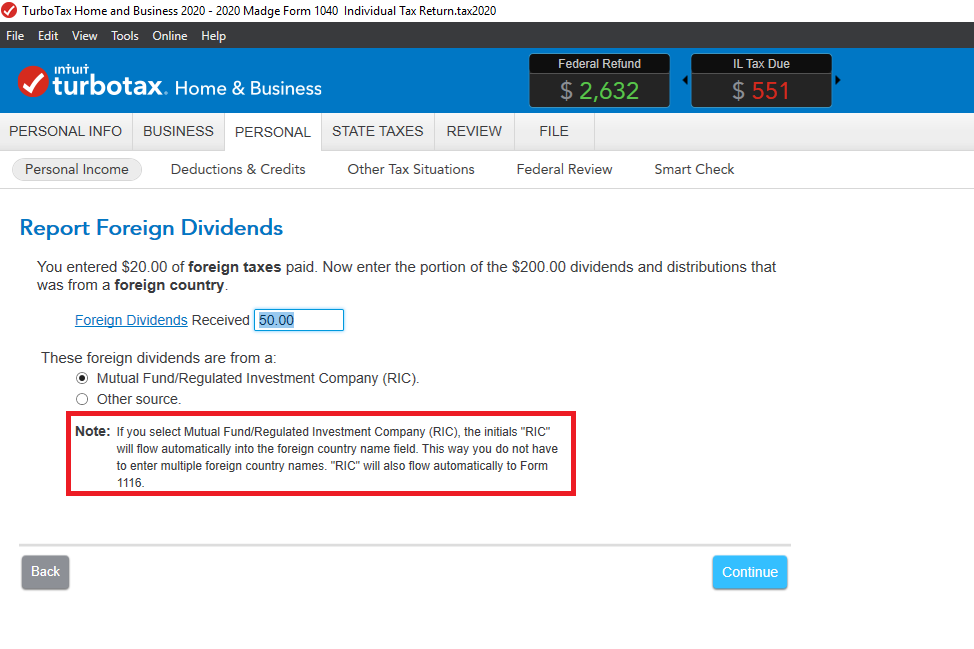

You need one Form 1116 for each type of income, so all Foreign Income/Foreign Tax Paid from 1099-DIV's will be added together on a single form with country designation 'RIC' (screenshot).

The Foreign Income/Tax Paid amounts flow into the Foreign Tax Credit section automatically when you choose 'RIC' as the country in your 1099-DIV entry.

All you need to do in the Foreign Tax Credit section is review and indicate 'Done'.

Click this link for more info on Form 1116.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 15, 2021

12:25 PM