- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

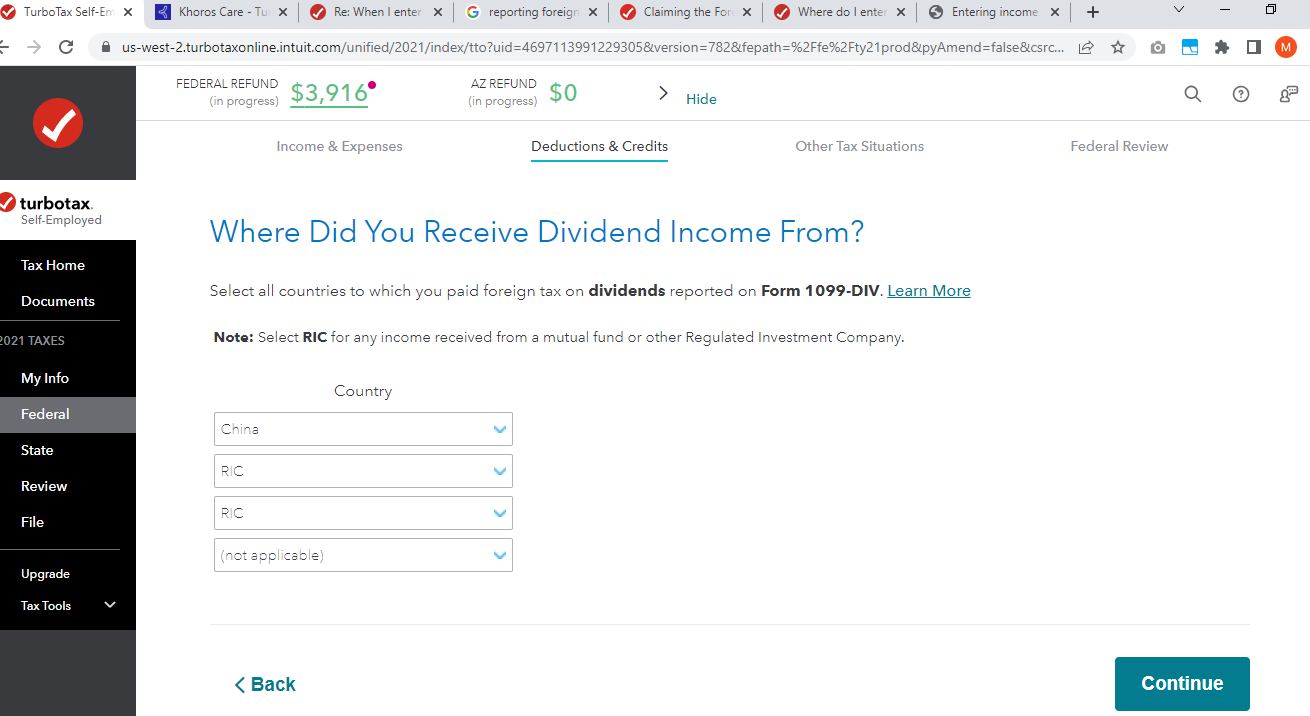

If you are entering dividends/foreign tax from a particular country, when you are in the Foreign Tax Credit section, the interview wants to match each dividend previously entered (with foreign tax) with a Country and an income amount.

The dividend entries are displayed and you are asked to indicate the country and amount of dividend income. You will be able to choose the country from a dropdown list in the Foreign Tax Credit section.

Up to three countries can be included on one Form 1116 for each type of income. If you have more than three countries, additional form 1116's are created.

It looks like you have Foreign Tax from two funds reported as country RIC, and one from China (if Account 2 Tax is Foreign Tax).

@mnothstein

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 12, 2022

12:21 PM