- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Qualified Charitable Distribution

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Distribution

@stclair wrote:

when will this be fixed?

My guess is in the 2021 software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Distribution

I am 75 yrs old, donated $3500 to charities, processed the donations thru a broker from my ira account and identified them in my turbo tax filing. I only received credit for $300. i took standard deduction. Why didn't i get credit for the full $3500 ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Distribution

It should have reduced the taxable amount of your 1099R on line 4b. You should not enter it again under Deductions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Distribution

I did one this year and last year and its not popping up from mt 2019 TurboTax/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Distribution

How do I reflect a QCD on the 1099-R entries? I indicated that $40,000.00 of $89,107.89 was paid directly to a charitable organization, but the full $89,107.89 still showed up as taxable income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Distribution

If you are looking at a summary screen or review screen those show the full amount as income and lump a lot of stuff together. You need to check the actual 1040 form and make sure it's right.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Distribution

What is your birthday? I guess we have to consider the possibility that the issue in tax year 2020 has returned for 2021. If so, please see the workaround described by dmertz above (if you can see it):

"

For those with a birthdate between July 1, 1949 and June 30, 1950, 2020 TurboTax presently (now version R15.1) has a bug the prevents it from asking the necessary question regard transfer of the distribution to charity. As a workaround for this, with the CD/download version you can provide the QCD-amount information on the 1099-R in forms mode or in any version of TurboTax you can temporarily change your birthdate in TurboTax to something before July 1, 1949, edit the 1099-R form in TurboTax and answer the question asking how much was transferred to charity, then change your birthdate back in TurboTax back to your actual birthdate.

"

Of course, you would need to update this workaround by 1 year.

Otherwise, come back and tell us.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Distribution

How do I enter the QCD amount from my IRA into Turbo Tax Premier?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Distribution

I am 79. How do I enter the QCD amount from my IRA in Turbo Tax Premier?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Distribution

The only way I was able to do it was enter it into the schedule manually. I could not find a question in the easy step process that allowed me to do it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Distribution

The only way I was able to do it was manually enter into the appropriate form. There was no easy step question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Distribution

To report a qualified charitable distribution on your Form 1040 tax return, you'll use the 1099-R (even though there's no indication that it was a QCD). Enter the info as a 1099-R and you'll be asked in one of the follow-up questions if it was a Qualified Charitable Distribution.

TurboTax includes the full amount of the distribution reported on your Form 1099-R on line 4a (IRA Distributions) of your Form 1040. The taxable amount reported on Line 4b will be the total distribution less the QCD amount and will have "QCD" entered next to it.

Some Rules

- You don't have to itemize to make a QCD and you cannot claim a charitable contribution deduction for any QCD not included in your income.

- QCDs are limited to the amount that would otherwise be taxed as ordinary income. This excludes non-deductible contributions. If your IRA includes nondeductible contributions, the distribution is first considered to be paid out of otherwise taxable income.

- A distribution made directly to the IRA owner, who then gives it to a charity, doesn't qualify as a QCD.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Distribution

Your response works sometimes. If you receive a 1099 for an IRA distribution and all of it was for a QCD, then you will be fine. The question is asked and you say yes. If you get a 1099 that has a combination of regular and QCD distributions, however, there is a problem. With a yes/no question being asked, there does not seem to be a way to split your contributions. That is why I had to force mine into the form itself.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Distribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Qualified Charitable Distribution

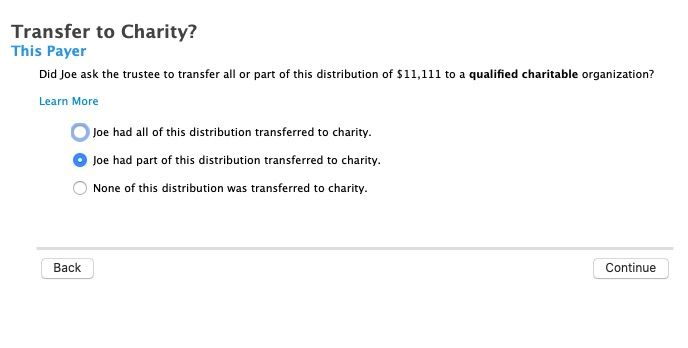

@dkaegi wrote:

Your response works sometimes. If you receive a 1099 for an IRA distribution and all of it was for a QCD, then you will be fine. The question is asked and you say yes. If you get a 1099 that has a combination of regular and QCD distributions, however, there is a problem. With a yes/no question being asked, there does not seem to be a way to split your contributions. That is why I had to force mine into the form itself.

On the QCD screen check that part was transferred to charity then it will ask how much.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

vindelicato

New Member

suemark1

New Member

dozersophie174

New Member

holliedavis

New Member

gurneyd8442

New Member