- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@dkaegi wrote:

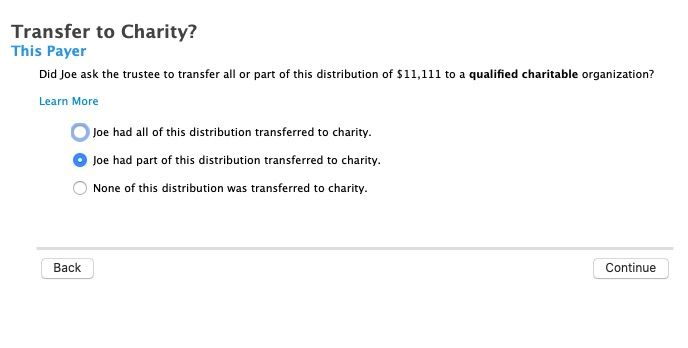

Your response works sometimes. If you receive a 1099 for an IRA distribution and all of it was for a QCD, then you will be fine. The question is asked and you say yes. If you get a 1099 that has a combination of regular and QCD distributions, however, there is a problem. With a yes/no question being asked, there does not seem to be a way to split your contributions. That is why I had to force mine into the form itself.

On the QCD screen check that part was transferred to charity then it will ask how much.

**Disclaimer: This post is for discussion purposes only and is NOT tax advice. The author takes no responsibility for the accuracy of any information in this post.**

March 27, 2022

8:02 AM