- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Possible bug in 2021 Turbotax Business for Deductions, Payments to independent contractors

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible bug in 2021 Turbotax Business for Deductions, Payments to independent contractors

I appear to have encountered a bug in 2021 Turbotax Business. It appears that in the Deductions area the software is subtracting the value entered for "Payments to independent contractors" from "Common business expenses". I previously last used the software in mid June without this issue. At first I thought that my .tax2021 file had somehow become corrupted, so I took the following steps:

1) Created a new return, imported information from 2020's return, updated business and partner information (it's a multi-member LLC), entered income information, started to enter deduction information. After I entered the "Payments to independent contractors" value, the "Common business expenses" value immediately became the negative of the "Payments to independent contractors" value.

2) I then uninstalled the software and reinstalled it, rebooted the PC, and started the software. It, of course, insisted on downloading and installing the latest updates. This completed successfully.

3) I then started the software and opened the previous 2021 tax files, the one from mid June and the one from today. They both continued to show this error.

4) I then created a new tax return completely from scratch. I did not import anything. The same error still happened. I have attached a screenshot of the Deductions page. It clearly shows the value for "Payments to independent contractors" with "Update" for its button and the negative value for "Common business expenses" with "Start" for its button.

This subtraction appears to carry through the software to the actual tax forms. When I view Form 1065, Line 20 does not include the "Outside services" value, Lines 21 and 22 are exactly off by this value as well. When I view Other Ded Wks, its Line 22, Outside services, does show the correct value and the Total shown in its Line 35 is correct.

Help! Have I actually encountered a bug or am I missing setting some new option or switch to get the software to include Payments to independent contractors? Without a fix to this issue, the only option I have at this point is to download the forms from the IRS website and manually fill them in. As I am sure you know, this return is due on September 15, so time, as they say, is of the essence. BTW, the PC is running Windows 11 and is up-to-date per updates from Microsoft.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible bug in 2021 Turbotax Business for Deductions, Payments to independent contractors

This is not a bug ... where/how the expenses are entered in the interview & shown on the summary screen and where/how they are reported on the form 1065 are simply in different places. Switch to the FORMS mode and look at the 1065 ...are all the amounts listed on the form and overflow worksheets?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible bug in 2021 Turbotax Business for Deductions, Payments to independent contractors

Thank you for the response.

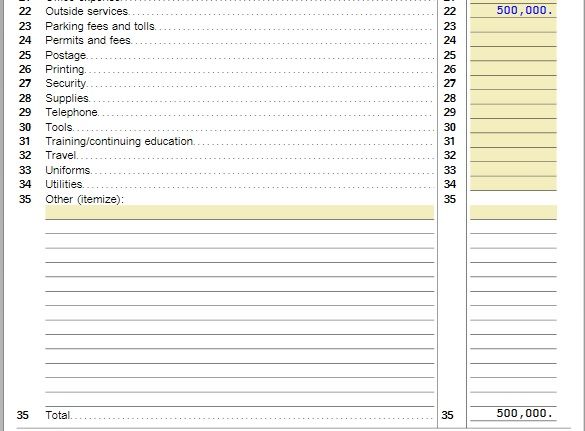

As I stated in the next to last paragraph of my original post, I did switch to the FORMS mode and viewed the 1065. Line 20 does not include the value for Outside services, Lines 21 and 22 are also off by exactly the value that was entered for Payments to independent contractors. The Other Deductions Worksheet viewed in FORMS mode does include the value entered for Payments to independent contractors on its Line 22 which is labeled as "Outside services". Line 35 of this worksheet does show the correct total.

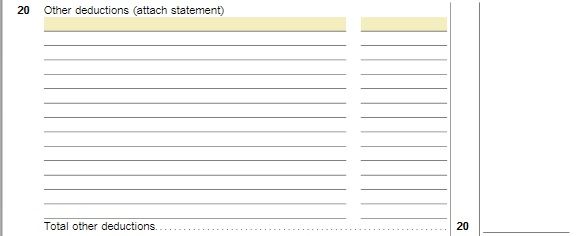

Here is a snippet of Form 1065 showing its Line 20 which shows no value.

Here is a snippet of the Other Deductions Worksheet showing Lines 22 (Outside services) through 35 (Total) showing the $500,000 value.

Something weird is going on. The 500,000 from Line 35 of the Other Deductions Worksheet should be showing up on Line 20 of Form 1065 and it is not. I'm happy to provide more screenshots if that will help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible bug in 2021 Turbotax Business for Deductions, Payments to independent contractors

I am having the same problem and can't figure out the solution.

This is so frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible bug in 2021 Turbotax Business for Deductions, Payments to independent contractors

Contact support on Monday .... to help get you connected to the right person, please click the link below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible bug in 2021 Turbotax Business for Deductions, Payments to independent contractors

Thanks for your response, I just manually added on line 19, and it worked, just won't transfer to the next year's interview screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible bug in 2021 Turbotax Business for Deductions, Payments to independent contractors

Well. it seems that someone in the engineering group may have noticed this thread. I just went back into Turbotax Business 2021 (desktop edition). It loaded an update. There was no specific indication as to the purpose of the update or what issue(s) it is meant to address.

Being curious, I tried entering a value for Payments to independent contractors, and the original issue appears to have been resolved. LOGANESIAN, please retry your situation and post your results.

However, this appears to be a case of "one step forward and one step back". For some reason, my balance sheets are now not correct. These were definitely correct before. When I view Form 1065 p4-5 in FORMS mode, there are no longer any values on Line 9a of Schedule L Balance Sheets per Books. Line 9b for columns (a) and (b), Beginning of tax year, are also blank. Other fields in this form appear to be correct other than the fields that are calculated based on Lines 9a and 9b. I definitely did not touch anything to do with assets or the balance sheets. The individual entries for my assets appear to still be correct. More help please.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible bug in 2021 Turbotax Business for Deductions, Payments to independent contractors

Thanks for the update.

I just added description on the line Other Expenses, and it became part of the total Business deductions. Everything is in balance, and I don't want to change anything. After filing will look into it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dalibella

Level 3

Vivieneab

New Member

IndependentContractor

New Member

teewilly1962

New Member

jwicklin

Level 1